It is "much, much harder” for a UK challenger bank to launch today than it was ten years ago, according to the founder of two of the most celebrated UK neobanks.

Anthony Thomson, co-founder of beleaguered Metro Bank and founder of Atom Bank, said there are opportunities for a new challenger bank to launch in the UK today but capital demands and the current funding landscape are significant deterrents.

Asked by Tech.eu if the winning and losing UK neobanks had already been determined, he said:

“I am not sure the winners and losers have been determined. What I think is that the more traditional banks have caught up.

“Ten years ago, the digital or mobile offerings of the big banks were just terrible. There was a real opportunity for the Monzos, the Metros, the Starlings, and the Atoms of the world to present a substantially differentiated proposition to consumers.

“I think a lot of that gap has narrowed because most, if not all, of the more traditional banks have got at least a workmanlike mobile app.

“Does that mean that there isn’t room for new players? I think there always is, but I think it will just be much, much harder today.

“The key challenge that any new bank entrant has is raising capital. Startup banks are disadvantaged by the amount of capital they have to hold compared with the traditional existing banks.

“Marry that with the fact that the VC world and private equity world are not as active as they were two years ago, it’s a tough time to raise money for new businesses and a neobank would be no exception.”

Thomson has recently launched the accelerator Archie, which plans to work with up to a dozen fintech startups based in the UK, Middle East, and Australia over the next two years, taking an equity stake instead of a fee in exchange for advice and hands-on support.

The venture kicked off with a launch event last month in Dubai.

Thomson said Archie was talking to around 12 startups in the Middle East and the UK, three of whom in the UK were at an “advanced" stage.

He said that given Archie’s model of equity in exchange for expertise, an ‘awful lot” of due diligence was involved in the process as it was a “big conviction play”.

In terms of what fintech areas the accelerator would be looking to invest in, he highlighted B2C and B2B2C, adding there was “still a lot of activity in payments” and also mentioned ESG as an area of interest.

Commenting further on the UK neobank sector, Thomson believes the asset-liability model (the route taken by Atom) trumps the “capital light” model, without lending, taken by the likes of Starling and Monzo as the best path to making money.

“If you are a bank I believe the path to prosperity lies in the asset-liability model,” he says, pointing out that Monzo has recognised this and is now building a lending business to power it to profitability.

Thomson stood down as chairman at Atom, which he founded in 2014 and which was granted UK banking licence in 2015, in 2018 but remains a shareholder.

On the regulator's approach to granting UK banking licences, he said:

"If they weren’t going to give you a licence they would tell you."

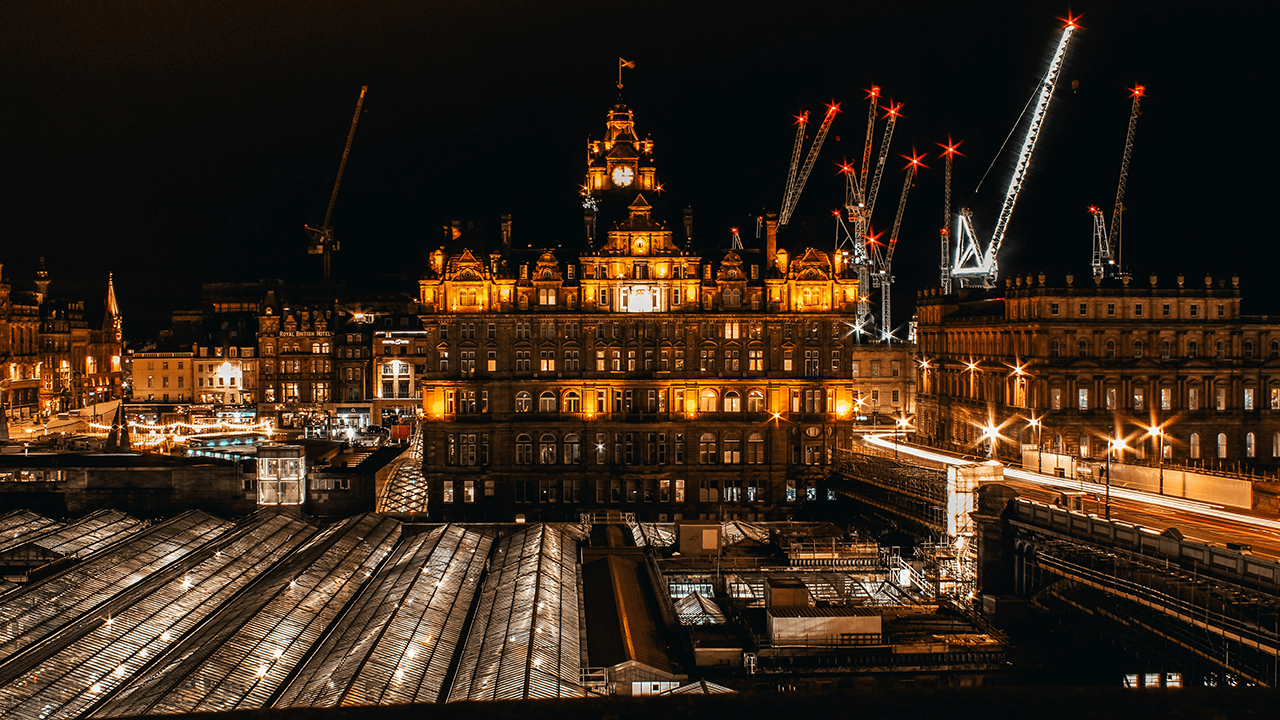

Lead image: Photo by David Barajas

Would you like to write the first comment?

Login to post comments