While all venture capital has taken a severe hit since central bank interest rates started to rise in 2022, investments in alternative proteins have been particularly affected.

“Alternative proteins” is a catch-all term for any proteins that are alternative to traditional animal-based products, meaning meat, fish, eggs, and dairy. To the average consumer, this currently means plant-based meat and dairy alternatives, but the alternative protein field also includes insects and microbial proteins and more futuristic concepts like lab-grown meat and precision fermentation.

The common denominator is that these solutions offer a way of producing protein without animals and an opportunity to significantly cut back on CO² emissions, deforestation, biodiversity loss, and other environmental impacts associated with animal farming. The food system is responsible for more than a quarter of humanity’s CO² emissions, and the lion’s share of that is caused by animal farming.

It has been estimated that a dollar invested in alternative proteins can help reduce CO² emissions 11 times more than an equivalent investment into electric cars. The fundamental drivers toward an alternative protein future are clear, and in addition to environmental benefits, consumers want healthier options that don’t violate animal welfare.

Entering the winter of alternative proteins

The stock market remained bullish on alternative proteins long into 2021, but VC investments and valuations have since taken a serious nosedive. Beyond Meat’s stock now trades at less than 3 percent of its 2019 peak value. It’s a similar story all around. Oatly, the Swedish pioneer of oat-based alternative dairy has seen its share price plunge 98 percent from its listing price in 2021.

What is going on?

During the frothy years before 2022, growth in sales was extremely rapid (often triple-digit YoY), and investors looked for revenue growth above all else. Then, the meat substitute companies were suddenly hit by a double whammy.

First, companies’ sales growth slowed and even went into reverse in some cases. This was fueled by, among other things, reaching a limit of easily reachable vegetarian/flexitarian customers, stagnant disposable incomes among consumers, and competing companies entering the fray and eating into the first movers’ market share.

Second, interest rates took off in 2022. This has meant that profits in the here and now were suddenly more important to investors than some distant future revenue on the back of loss-fueled growth today.

The companies quickly entered a spiral where they needed to try and reach profitability by any means, even as their revenues were shrinking in the face of competition. Investors, ever prone to herd behavior, concluded it was time to move on from “unprofitable” alternative proteins. But if the fundamental drivers for alternative proteins are so crystal clear, why are companies unable to make money?

From an uphill battle to a level playing field

For a consumer to change purchasing habits, you will have to burn through piles of cash on a huge marketing drive. For a rapid organic transition to happen, the product should be better and/or more affordable than the existing alternative – and there are already compelling products, like the Beyond Burger patties. If the product is not the main problem, it must be the price — especially today, with high inflation and rising living costs for consumers.

Each cow needs about 15 kilograms of feed to yield 1 kilogram of beef. You also need a lot of infrastructure and labor to grow the cattle, slaughter the animals, and get the meat to market. How on Earth can it cost more than twice as much to get the plant proteins directly from the field to the supermarket?

According to the American Institute for Economic Research, US federal subsidies alone drop the price of meat from $30 to $5 per pound. Research from Stanford University indicated that between 2014 and 2020, conventional meat and dairy producers raked in 900 and 1200 times the subsidies that were allocated to alternative products in the US and Europe, respectively.

In Europe, direct subsidies accounted for more than 50 percent of cattle producers’ incomes. The study also exposed the extent of lobbying from these industries, pushing legislation aiming to hold back alternatives potentially disruptive to their businesses by, e.g., banning alternatives from using terms like “milk” and “cheese” in their products and forcing on them labels like “imitate.”

This borrows heavily from the playbook of Big Tobacco and Big Oil lobbies in decades past.

Where do we go from here?

While we expect government subsidies to be directed more fairly toward alternative proteins, investors and startups will have to lick their wounds, hone their products, and get ready for the next climb on the alternative protein roller coaster, which is sure to come.

Consumers’ willingness to be meat-free is growing, and large suppliers in all food, feed, and beverage industries are looking for solutions to make their whole supply chain more sustainable. So it’s just a matter of time before we’ll mostly have proteins on our dinner tables that are not derived from animals.

Startups and investors on the alternative protein roller coaster, expect many more ups and downs before a final breakthrough!

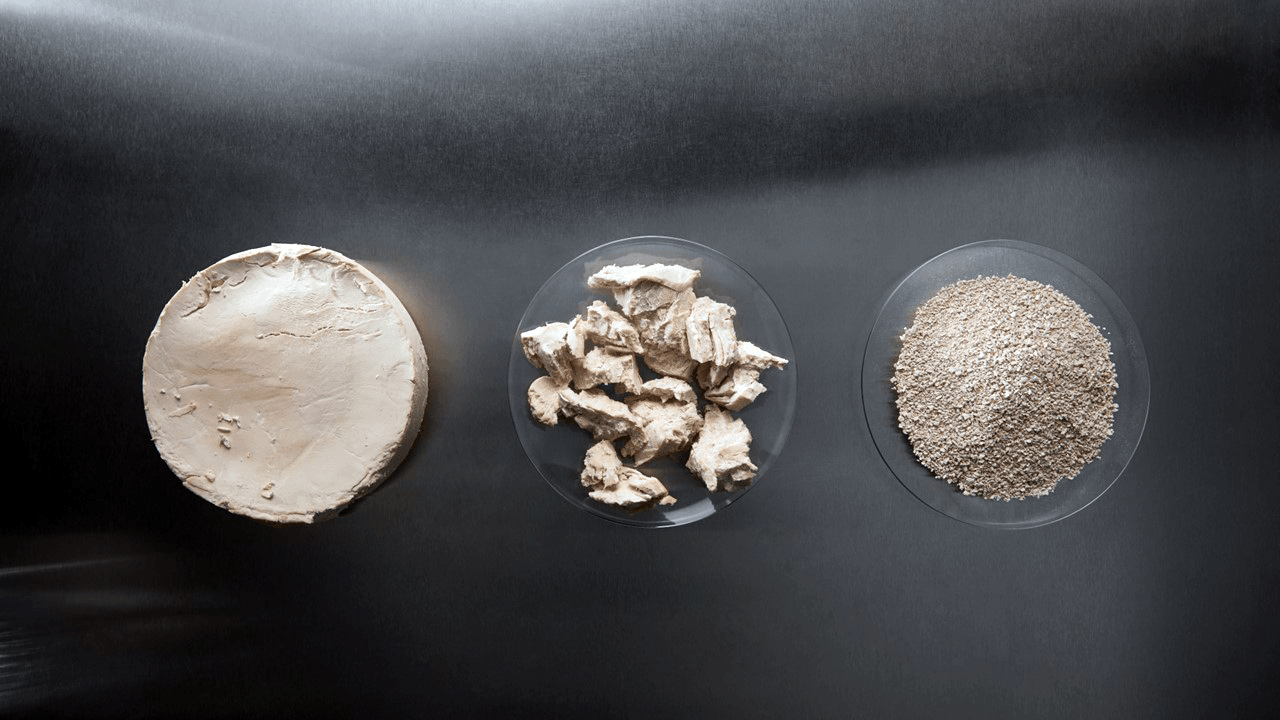

Lead image via eniferBio.

Would you like to write the first comment?

Login to post comments