Embat, a Madrid-based fintech specialising in corporate treasury management, has secured $16 million in a Series A funding round that will drive continued international expansion plans.

The Series A is led by historic backers of Trade Republic, Klarna, iZettle and Pleo, Creandum, alongside the participation of existing investors Samaipata, 4Founders and Venture Friends. Adding further credence to Embat’s offer, angel investors in the company’s latest funding round include former Commerzbank CEO Martin Blessing.

"Having the support of such a prestigious international fund as Creandum aligns with our aspiration to grow in major European markets. Their experience supporting top-tier fintechs gives us great confidence to continue our exponential growth.” — Antonio Berga, co-founder of Embat

Co-founded by former JP Morgan executives Antonio Berga and Carlos Serrano, along with former Fintonic and Wonnai CTO, Embat self-bills as a service “created by financial experts, for financial experts.”

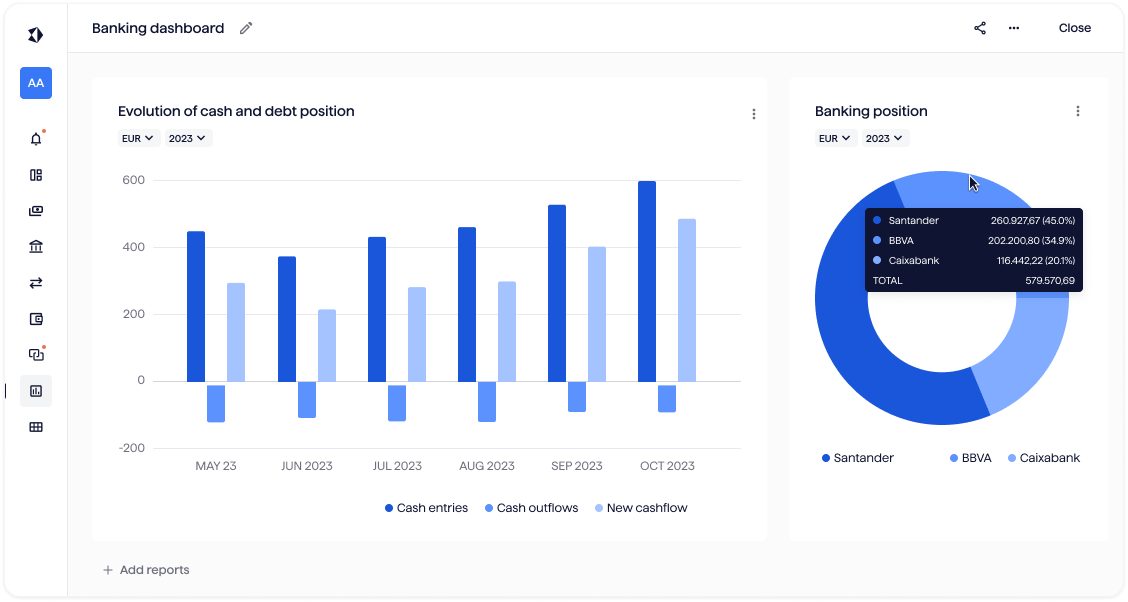

With a range of services on tap including banking connectivity, treasury processes, payment automation and automated accounting and reconciliation, Embat claims that it can save financial teams up to 75 per cent of time dedicated to these tasks, while concurrently providing global visibility of cash and facilitating automatic monitoring of treasury forecasts.

Throughout 2023 the startup reports the handling of more than 3 million bank transactions, representing over $20 billion in value, serving over 150 clients including Playtomic, Cabify, Wallapop and Fever. In so much, Embat says it’s seen a turnover multiplier of 4x last year alone.

Late last year Embat announced a partnership that sees the startup now leveraging the power of Google Cloud’s Vertex AI platform, a move that’s proving to help financial teams further reduce errors in accounting and save up to 10 hours per week.

Embat CTO Tomás Gil shared:

“We are very proud of our platform's positive impact on our clients. Besides, the trust of such an experienced investor increases our motivation to keep leading innovation in the corporate treasury sector.”

On the investment, Creandum general partner Peter Specht commented:

“Real-time and efficient treasury management is among the top three pain points of mid-market CFOs. Legacy players often cost more than €100,000 to set up and take six months to implement. Embat’s novel approach allows companies to set up an end-to-end treasury system in a matter of weeks and for a fraction of the cost.

“The company’s impressive growth in this segment reflects how mission-critical real-time cash management is to the CFO office.

“In 10 years every company above a certain size will use a next-gen treasury tool and we’re thrilled to back this team in making this a reality across the globe.”

Lead image: The Embat team.

Would you like to write the first comment?

Login to post comments