There is a significant number of researches dealing with gender inequalities in the tech sector. According to them, some progress and changes are notable. Thus, a 24 per cent capital increase in 2022 compared to 2021 was recorded within tech startups and scaleups in the UK with at least one woman co-founder.

Even with these improvements, there is the other, not-so-bright side, as some researches show that the volume of capital raised by all-men-owned VC funds between 2017-2023 (in the UK) is around ten times higher than the one raised by all-women-owned VC funds.

But, despite the challenging fundraising environment, especially in the last couple of years, there is some proof that female founders and female emerging fund managers in Europe have proved resilient.

Ahead of International Women’s Day and Women’s History Month, PitchBook released the inaugural “All In: Female Founders in the European VC Ecosystem” report in order to examine the challenges, successes, and representation of female founders and investors within the venture capital ecosystem. The report reveals that venture dealmaking significantly varies when broken down by founder gender. And, not so hard to guess, the data showed that female-founded companies collectively are receiving far less investment than male-founded companies.

VC deal activity

For the first time in 2021, female-founded companies collectively closed more than €10 billion in a year. When it comes to all-female-founded companies, they exceeded €1 billion only once, also in 2021. Just for comparison – in the case of all-male-founded companies in Europe, since 2015, they have collectively closed more than €10 billion each year.

These numbers show us that it will take some time before the inequalities „disappear “. But even knowing that, and looking from the other perspective (like a number of deals), it might be noticed that the female-funded companies are exhibiting momentum.

According to the report, in the past decade, the total number of deals grew more than twice as fast for female-founded teams than it did for all-male-founded teams. If we take this data into account, it is clear that it will contribute to reducing the founders' gender gap.

Although all-female-founded companies remain a comparatively small part of the European VC ecosystem, as stated in the report, the population has seen significant growth and consistency over the past several years with at least 400 deals closed each year since 2018.

The percentage of female founders in all European venture deals is a crucial indicator for understanding the context of deal activity. The data show that a record-high percentage of deal count (25.8 per cent) and deal value (20.5 per cent) were created by female founders in 2023. They saw the largest year-over-year increase since 2012 as their proportion of deal value increased by 33.7 per cent from 2022.

Decline in deal count but different trend in deal value within verticals

According to the report, the deal count for female-founded companies showed double-digit declines in 2023, within all verticals that were examined. On the contrary, deal value trends varied.

In 2023, female founders closed €8.1 billion within the broad tech vertical. Although this decline follows two years of the deal value of over €10 billion, it still represents the third-highest annual level on record.

One of the few verticals in which female-founded companies collected more capital, compared to previous years was cleantech, showing 10.9 per cent growth across slightly fewer deals.

Since 2020, female founders in biotech & pharma have closed more than €1 billion each year. The level of deal value was consistently high, following the pandemic-era surge.

Female angel investments

An important early catalyst for venture capital (VC) activity, angel investments in female-founded businesses have grown in tandem with venture activity as a whole. However, deal activity dropped in 2023, and showed the lowest amount of total deal value since 2018.

For almost a decade, there was a notable increase in the number of female angel investors in Europe but as investors became more cautious, overall, the number fell by almost one-half in 2023.

According to the report, female angel investors become more active participants in rounds for female founders. This led to establishing synergistic relationships with women on both sides of a transaction. As a result, female angel investors have participated in more than 25 per cent of all VC deals involving both a female founder and angel participation during the last three years.

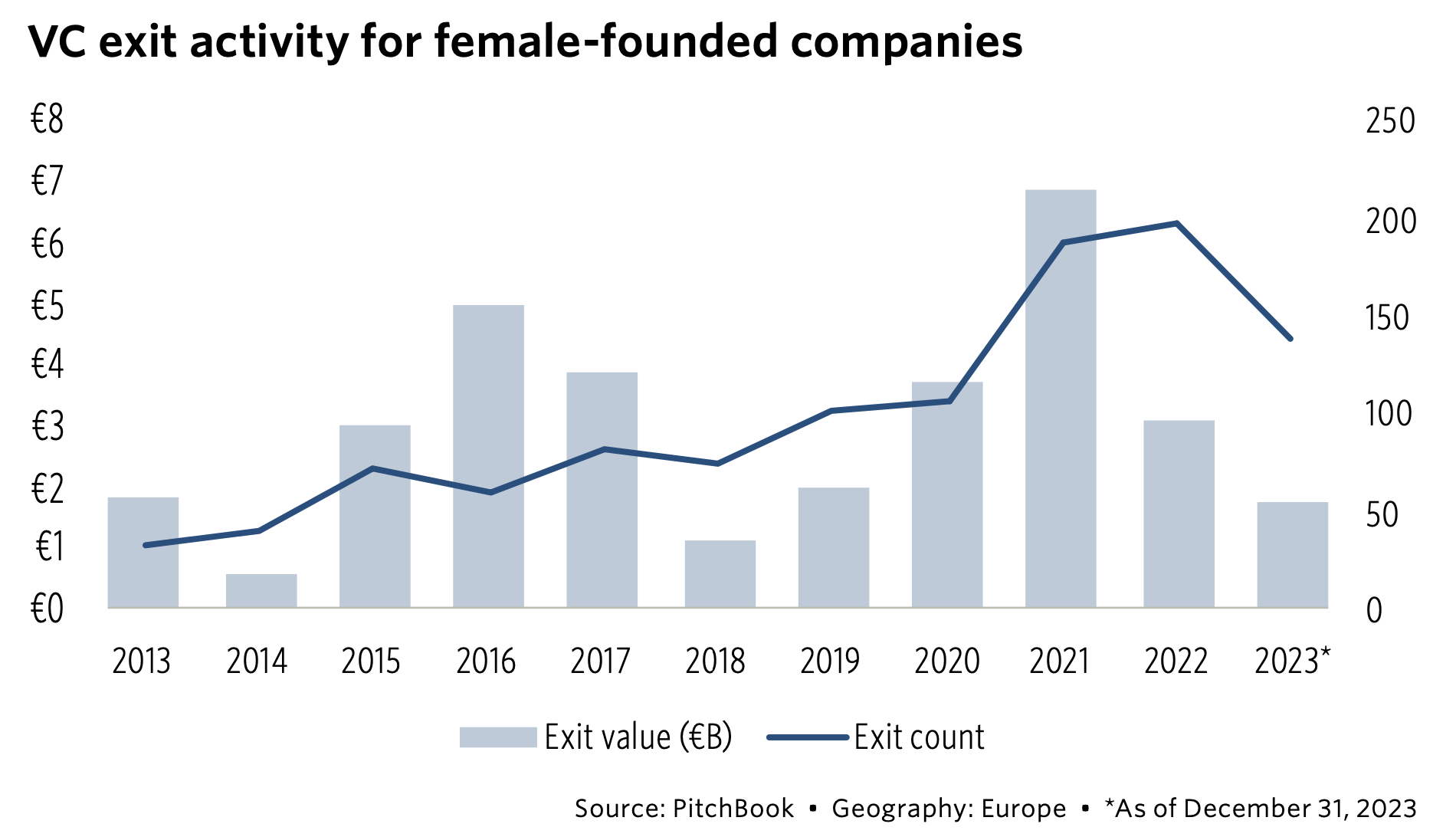

The exits

The European venture exit environment has been declining annually since 2021. Between 2019 and 2022, female founders created almost €2 billion in total exit value year. However, the 2023 figure came in just short of that amount along with a significant decline in the number of exiting companies.

Would you like to write the first comment?

Login to post comments