In the world of entrepreneurship, there are those who wait for change to happen and those who make it a reality. With the national debut of Slush Helsinki in Spain, Bilbao Slush’D 2025 has made it clear that the Basque Country belongs to the second group. With an ambitious vision, flawless execution, and the backing of the biggest global ecosystem players, Bilbao has positioned itself as a key hub for innovation and venture capital.

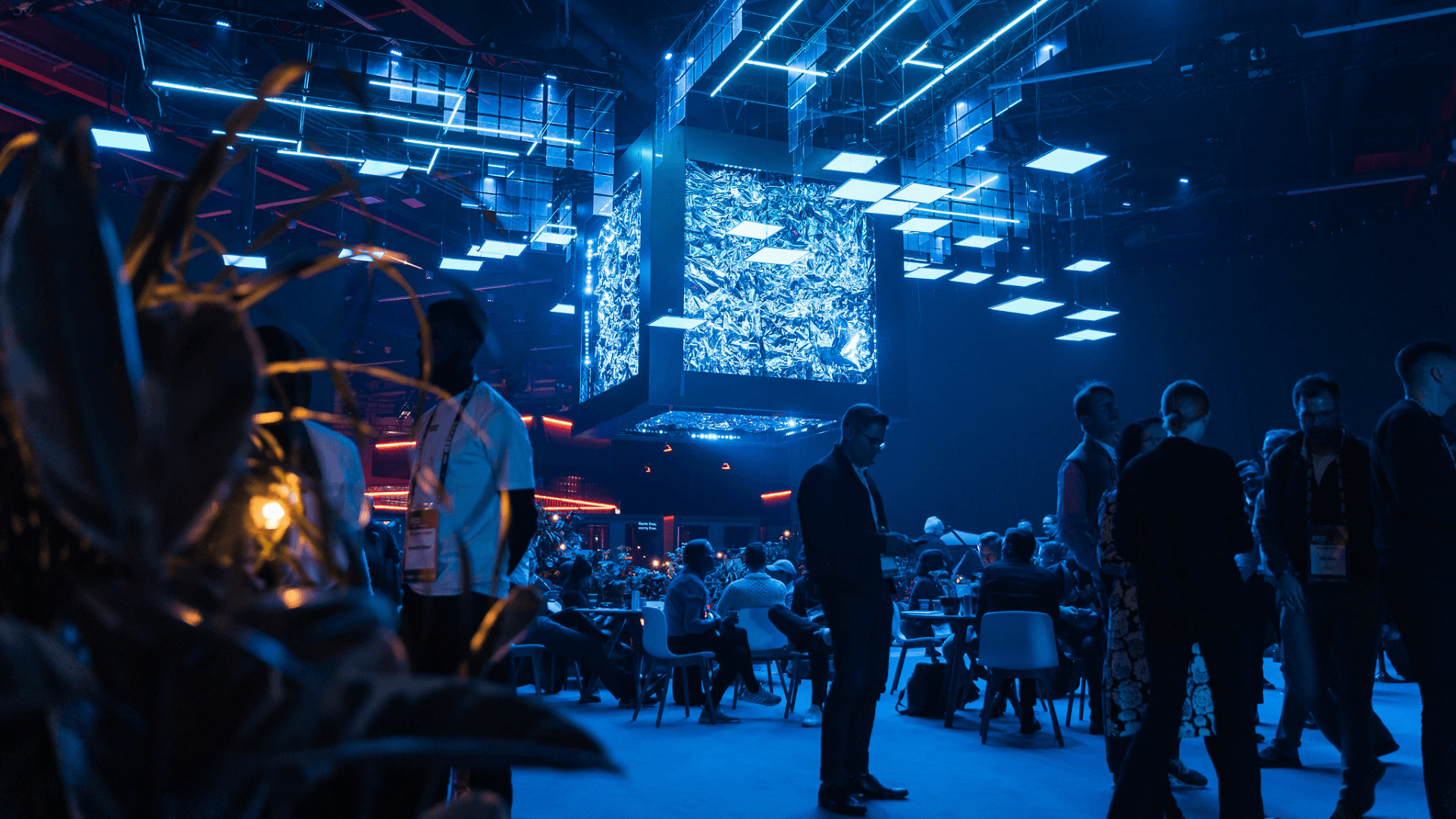

What took place at the Bilbao Exhibition Centre (BEC) was more than just an event. It was a turning point.

Bilbao: Where investors find the next unicorn

Being the first edition in Iberia and following a “north-to-north” ecosystem building strategy and with over 850 participants from 40 countries, including 95 speakers, 385 startup founders and managers, 250 international investors, and 185 corporates, Bilbao Slush’D 2025 was the perfect stage to connect the dynamism of Southern Europe with the pragmatism and strategy of the Nordic-Baltic hubs.

One number says it all: €8B in assets under management (AUM) concentrated in a single event. Money was not an issue—it was an opportunity. The presence of investment giants like BlackRock, Goldman Sachs, and McKinsey & Company, along with the Big Four (Deloitte, PwC, EY, and KPMG), confirmed what was already evident: Bilbao is on the radar of major global funds.

With 6 side-events, 2 days, 26 panels and 10 workshops, the 1st edition of Bilbao Slush’D proved that with conviction and the right ecosystem-building efforts, a city can transform into a global hub for innovation, attracting top investors, entrepreneurs, and thought leaders to shape the future of venture capital and startups. In total, over the course of two days, the event generated over 1,200 networking opportunities and 415 investor-founder meetings.

The event wasn’t just about established and upcoming names—it was also a stage for some of the most promising early-stage and growth-stage startups, including those backed by Y Combinator, Sigma Squared Society and featured in Poets & Quants as some of the most promising MBA-founded startups. These companies, spanning multiple industries from AI and fintech to sustainability and biotech, brought cutting-edge innovation and ambitious visions, attracting investors eager to bet on the next breakout success.

Beyond startups, Bilbao Slush’D 2025 also welcomed Kauffman Fellows, members of one of the most prestigious networks in venture capital, renowned for shaping the future of global investment and entrepreneurship. The event also attracted key national investor and angel networks, with BIGBAN Investors Spain and the Spanish Association of Business Angels (AEBAN) strengthening the bridge between startups and early-stage capital in Spain. Their presence ensured that emerging founders had direct access to business angels and syndicates looking to fuel the next wave of entrepreneurial success.

The event also highlighted the shifting landscape of venture capital, where new generations are demanding more openness, accessibility, and diversity in investment opportunities. This is why this edition featured Included VC, the prestigious venture capital Fellowship backed by a consortium of the very best in the VC industry that is focused on representation within the industry and opening doors to emerging talent. Among its representatives was Nikita Thakrar, co-founder & CEO and one of the most influential figures in venture capital.

baby vc was also present—a growing community of VCs, founders, and operators who share the mission of making the startup and investment ecosystem more accessible to the next generation of innovators. The message was clear: the future of venture capital is diverse, inclusive, and more accessible than ever.

The reverse pitch: When investors have to impress

Traditionally, entrepreneurs are the ones competing for investors’ attention. But at Bilbao Slush’D, the script was flipped.

For the first time, it was the investment funds that had to present their strategies and visions to startups in an unprecedented reverse pitch session. Venture capital is not just about money—it’s about strategic alliances, shared vision, and mutual growth.

Investment funds that participated in this dynamic included JME Ventures, Notion Capital, Tenity, Plug and Play, Kfund, Adara Ventures, Cometa VC, Lumo Labs, Cardumen Capital, Clipperton, Criteria Venture Tech, Perseo Ventures (Iberdrola), G+D Ventures, Trind VC, Acurio Ventures, Actyus, CVX Ventures, Ninepointfive, Moeve CVC, GoHub Ventures, BBVA Spark, Net Zero Ventures, Draper B1, Punch Capital, Seven Roots VC, and Inclimo Climate Tech Fund, among others.

The event also showcased scaleups such as Goparity, a fast-growing impact-driven investment platform, Red Points, one of Spain’s most promising scale-ups and recipient of the Future Unicorn Award 2023, and investment vehicles like Crowdcube, which is enabling thousands of investors to support startups across Europe. The event also welcomed the IESE Impact Fund from IESE Business School. This edition also hosted the prestigious PremiosEmprendeXXI by CaixaBank DayOne.

European VC and startup ecosystems: Facts & Insights

Europe’s venture capital and startup ecosystem is booming, with record investments and an increasing number of unicorns emerging from unexpected regions. In 2023 alone, European startups raised over €90B, proving the resilience of the ecosystem despite global economic uncertainty. Deep tech and AI startups are leading the way, with major funding rounds in areas like cybersecurity, climate tech, and fintech.

In Spain, according to Funds Society, private equity and venture capital funds saw their average TVPI (Total Value to Paid-In) grow from 1.5x to 1.6x in 2023, reflecting resilience in the face of market uncertainty. Meanwhile, research by Preqin shows that Nordic funds with strong focus on tech innovation boasted an average TVPI of 2.5x for top-quartile funds.

Among Europe’s startup hotspots, Estonia has the highest number of unicorns per capita in the world, producing companies like Wise, Bolt, and Pipedrive. Finland, home to Slush, has built a globally recognized startup ecosystem with strong government and corporate support. The Basque Country, meanwhile, is rapidly emerging as a top deep-tech and industrial innovation hub, leveraging its strong industrial heritage and focus on AI, green energy, and manufacturing.

One of the key themes was Nordic innovation, where leaders from Finland, Estonia, and Sweden shared insights into how tech-focused policies, public-private collaboration, and deep investment in R&D have turned the region into one of the world’s most competitive startup ecosystems. The Nordic model was particularly relevant in discussions around scaling born-global companies, an approach that emphasizes international expansion from day one.

Another crucial topic was AI in venture capital operations, highlighting how firms are leveraging machine learning for deal sourcing, portfolio monitoring, and due diligence automation. With AI transforming investment workflows, venture firms are increasingly integrating data-driven decision-making to optimize fund performance and startup success rates.

The rise of European impact investment was also a focal point, with discussions centered on current market dynamics, Nordic and Baltic best practices and the need for future-proof solutions. Investors emphasized the need for mission-driven startups that balance profitability with long-term sustainability, particularly as regulatory frameworks push toward ESG compliance and ethical innovation.

Ecosystem futures and the playbook for unicorn creation were explored through fireside chats with industry veterans who have built billion-dollar startups. The conversations provided a roadmap for founders looking to navigate the complexities of hypergrowth, attract global capital, and build category-defining companies.

Throughout the event, the most relevant industries and verticals were tackled in dedicated sessions, including biotech, femtech, health tech, foodtech, AI, deeptech, fintech, insurtech, SaaS, cleantech, and greentech.

Finland, Estonia & The Basque Country: Similarities in their innovation ecosystems

Despite their geographical differences, Finland, Estonia, and the Basque Country share remarkable similarities when it comes to entrepreneurship, innovation, and venture capital.

All three regions have strong industrial and engineering roots, making them natural hubs for deep-tech and industrial innovation. Finland’s expertise in telecommunications, Estonia’s leadership in digital infrastructure, and the Basque Country’s advanced manufacturing ecosystem all contribute to a shared culture of technological excellence.

Government-backed innovation has played a crucial role in their development. Each region has a strong commitment to research and development, with substantial public funding directed towards entrepreneurship and innovation. Initiatives such as Business Finland, Estonia’s e-Government strategy, and the Basque Country’s extensive R&D programs have fostered high-growth ecosystems that attract both local and international talent.

Their startup ecosystems are also built on tight-knit, highly collaborative networks, where startups, corporations, and investors work closely together. Unlike massive hubs like London or Berlin, these ecosystems thrive on trust and direct engagement, creating environments where early-stage companies can scale faster.

Another key similarity is their focus on education-driven talent pipelines which in the case of Bilbao was represented with the volunteers from Deusto Business School (University of Deusto). In the New Nordics, leading universities and research institutions like Aalto University, TalTech, Finnish Innovation Fund-Sitra, and VTT Finland play a crucial role in spinning off tech startups and providing a continuous stream of highly skilled engineers, product designers, and business leaders.

The event also saw participation from EIT Manufacturing, a key driver of industrial innovation in Europe, and Supernovas, an initiative fostering female entrepreneurship and investment. Their involvement underscored the increasing role of deep-tech, sustainability, and inclusivity in shaping the future of venture capital.

As strategic collaborators Bilbao Slush’D had Google for Startups, ICEX, ESTECH, Endeavor, the Embassy of Finland, Business Finland, Team Iberia, the Republic of Estonia through its e-Residency program, and Deloitte, who contributed to making it possible to build a strategic bridge between the Nordic-Baltic ecosystem and Southern Europe under the North-to-North strategy.

BBK Unicorn Night: Where the next generation of unicorns is born

Before the main event, six side-events including the BBK Unicorn Night brought together visionary founders, investors, and ecosystem leaders for an ice-breaking day of strategic networking and deal-making, all of which were amplified by collaborating with wavveup to amplify the networking and matchmaking capacity of the event. Unicorn Night, originally created at Hanken Business School in Finland and now backed by BBK and the Republic of Estonia, set the stage for Europe’s next wave of high-growth startups, unifying the distinct regional ecosystem of Spain in Bilbao.

Bilbao Slush’D brought some of the most influential figures in the global startup ecosystem, including Peter Vesterbacka, creator of Angry Birds and founder of Slush; Fiona Garvey, CEO of Softonic, who spoke about the future of software and the need for diversity; Agur Jõgi, CTO of Pipedrive, one of Estonia’s 10 unicorns, who explained how to build scalable products from the ground up; Itxaso del Palacio from Notion Capital, who shared insights on AI and venture capital; Laura Kankaala, Director of Threat Intelligence at F-Secure Corporation, one of the world’s leading cybersecurity experts; Nicolaj Højer Nielsen, co-founder and investor in Penneo and Sepior; Sari Rautio, the Ambassador of Finland in Spain; and Wouter Draijer, founder of SolarMente, bringing key perspectives on cleantech and sustainability.

Bilbao Slush’D has made it clear that innovation is not something to wait for—it’s something to build. Startups are not just looking for funding, they are seeking partners who share their vision. Investors, on the other hand, are not just looking for profitability, but for impact. And talent knows no borders, as Bilbao has demonstrated.

If you want to be at the center of global innovation, Bilbao Slush’D is the place to be. Here, innovation isn’t followed—it’s created. This event was sponsored by the Basque Government, through its business development agency SPRI Group, the Provincial Council of Bizkaia, BEAZ, and the Bilbao City Council.

Lead image: Janne Nuolioja

Would you like to write the first comment?

Login to post comments