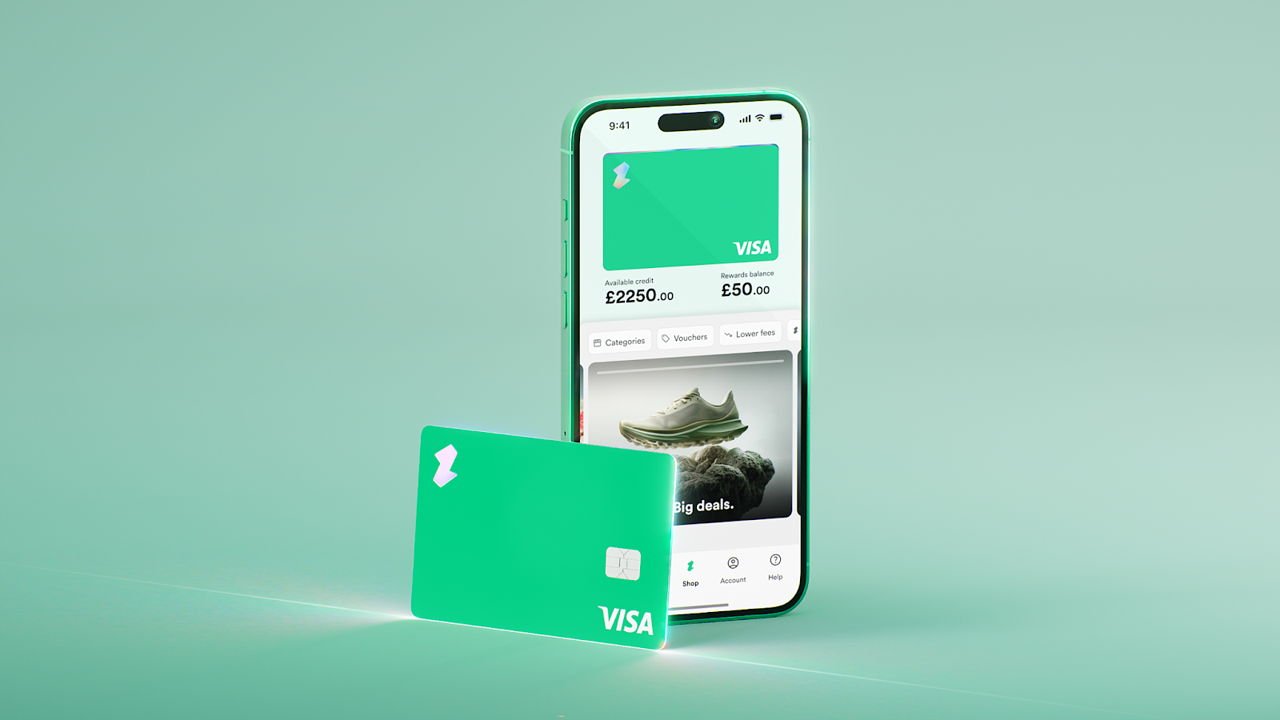

UK BNPL startup Zilch is launching its first physical card, after striking a deal with Visa, which is replacing Mastercard as its card network. The multi-year partnership between Zilch and Visa was announced today (Tuesday) at the Money 20/20 conference in Amsterdam.

It is unclear why Zilch is replacing Mastercard with Visa. Zilch says it will shift billions in annual transactions onto Visa’s global infrastructure. Mastercard has partnered with Zilch since its 2020 launch, with Zilch offering its BNPL services through a virtual Mastercard.

Zilch says the Visa physical card will give flexibility to its customers, particularly those who prefer the assurance of a tangible card. Zilch cardholders will be able to use it anywhere in the world Visa is accepted.

According to sources, the deal between Zilch, which has been touted as a London IPO prospect, and Visa is bigger than the one it had with MasterCard.

Zilch, which says it now has five million customers, says its deal with Visa will allow it to launch other new products.

Zilch CEO and co-founder, Philip Belamant, said: “Today’s announcement is about scaling reach, deepening utility, and setting the stage for the next era of Zilch.

"By partnering with Visa - a global leader in payments - we’ve plugged our AI-driven engine into a network that touches over 150 million merchants worldwide.

“This move will allow us to fully deploy our ad-enabled payments technology across both digital and physical retail, bringing measurable savings to consumers and margin efficiencies to merchants.”

Would you like to write the first comment?

Login to post comments