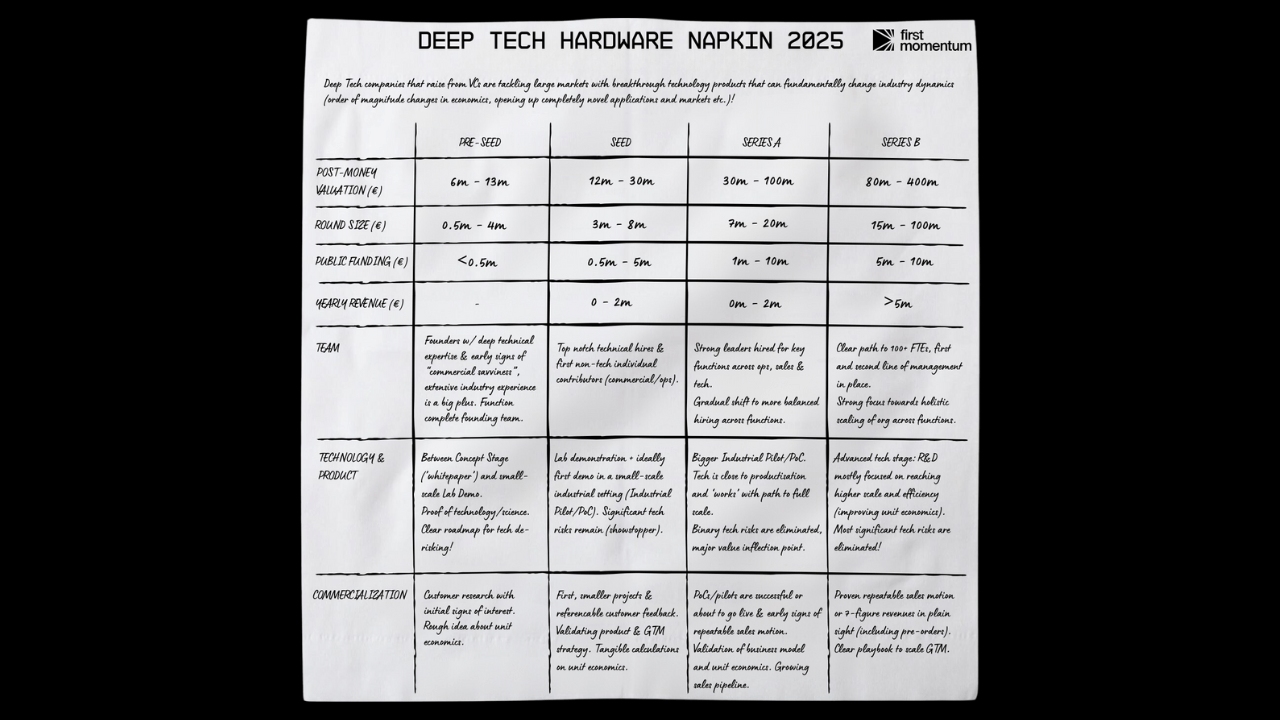

Today First Momentum Ventures released its second DeeptechHardware Napkin. Inspired by Point Nine Capital's influential SaaS Funding Napkin, it offers compact insights into the fundraising dynamics of deeptech hardware startups.

I spoke to Dr Maximilian Ochs, VC at First Momentum Ventures and one of the report’s authors, to find out more.

This year’s version includes data from 2024 and 2025, tracking the changes over the last two years.

First Momentum Ventures gathered over 100 anonymised survey responses from around 20 European deeptech venture capital firms. Each entry represents a specific funding round successfully raised by a hardware-first startup, rather than a generalised industry average.

The dataset captures critical investment-time details, including:

- Round size and valuation;

- Public funding received;

- Team composition (e.g. academic vs commercial backgrounds);

- Commercial traction;

- Technical maturity;

Only European startups at Pre-Seed to Series B stage were included, with funding rounds limited to 2024 and 2025, excluding bridge rounds and extensions; the focus was on hardware-first startups such as those in semiconductors, photonics, and robotics, while biotech startups were deliberately excluded.

Key findings on a napkin:

Revenue is not a key metric for early-stage investors

This year, the data included only one Pre-Seed company with revenue (around €500,000 to €2 million). It revealed that startups are less technically mature compared to 2022/23, and investors appear to have more appetite for higher tech risk.

The number of Pre-Seed companies with industrial pilots dropped from 40 per cent to 20 per cent while 80 per cent of startups were in concept or lab demo stage.

Throughout Series A, less than 40 per cent of deeptech hardware companies are still testing lab demonstrators.

According to Ochs, “While most early-stage startups are in the lab demonstration phase and still years away from commercialisation, this is not just an early-stage issue. Only 30 per cent of the Series B companies included had revenue!

Investors are paying more for companies with less validated technology

Investors seem to have more appetite for tech risk. Especially if this comes with less market risk (let’s say if you can solve the tech, you more or less unlock a massive market).

"Early-stage venture is very competitive, you have lots of funds that want to do deeptech and few very good startups, so one way to compete is to invest earlier than competitors. 90 per cent of Pre-Seed deeptech founders hold PhDs — but commercial experience still lags," shared Ochs.

PhDs dominate over deeptech serial entrepreneurs

Further, 2024 report emphasised the dominance of PhDs and industry veterans in founding teams.

At the Pre-Seed stage, 90 per cent of founders hold a PhD — up from 80 per cent in 2022/23 — while fewer than 40 per cent have relevant industry experience, though that’s an increase from just 27 per cent last year.

Ochs highlights that the strongest teams combine deep research expertise with hands-on industry experience.

Having a commercial co-founder is not yet the norm for deeptech companies. At Pre-Seed, almost 75 per cent are pure tech teams. Instead, most companies across all stages have very technical CEOs. But the general trend remains: Deeptech startups are often founded by very academic first-time founders, but do not yet have many serial entrepreneurs in deeptech.

Ochs asserts that

“We do not yet have a community of serial deeptech founders (as in the US), just because there are not that many successful deeptech hardware startups in Europe.”

Technical tractor prioritised over commercial traction

The data reveals that commercial traction is not unimportant, but technical traction is very important at early stages.

According to Ochs:

“We see many Series A and B companies without significant revenue, but if they hit major tech milestones that help them build a dominant position in the future, investors are still keen to invest.”

While concept-stage startups can attract millions in funding, I was curious if, with 2024-2025 investors, they will they become more disciplined about matching funding size with technical readiness level or product maturity?

Ochs asserts:

“We still have many concept-stage companies at pre-seed, but 60 per cent of companies at pre-seed have a lab demo, so are slightly more tech advanced. The physics needs to be checked out for every investor. “

Don’t rely on public funding as part of your fundraising goal

The last year has seen slight upticks in public funding, but Ochs generally advises founders not to rely on public funding when raising from VCs.

He shared:

“Let‘s say a company needs €4 million to reach relevant milestones but wants to only raise €2 million from VCs and the rest from grants.

We have seen it over and over again, grants are delayed or applications are not accepted (for whatever reason), and then the private round has to be larger.”

He would always recommend planning fundraising independently of grants.

“That said, grants are often essential to accelerate progress, especially in cases where public support is critical, such as building a fusion company.”

Involve customers early in your development

A key takeaway from Ochs, which he shares with many deeptech founders, is that given the CAPEX and long innovation cycles, it's crucial for deeptech startups to work with customers as soon as possible.

“I like cases that chase early customer traction (also to validate tech) on the way to a big vision (that might be still far away).”

Overall, the report data saw a notable increase in Series B deals, signaling that the ecosystem is beginning to mature. At the same time, there was continued interest in less mature technologies, highlighting a sustained appetite for early-stage innovation.

In addition to advising founders to plan fundraising separately from grants, Ochs encourages ambitious teams to raise substantial rounds to accelerate their progress.

“Don’t be afraid to raise what you need to reach your milestones.”

Would you like to write the first comment?

Login to post comments