OrganOx, the Oxford-based medtech company behind pioneering liver perfusion technology that has transformed transplant outcomes worldwide, has been acquired in a deal valued at approximately $1.5 billion. The transaction also delivered BGF’s biggest return to date, generating £175 million in proceeds, a 10x money multiple on its original investment, and an IRR of around 69 per cent.

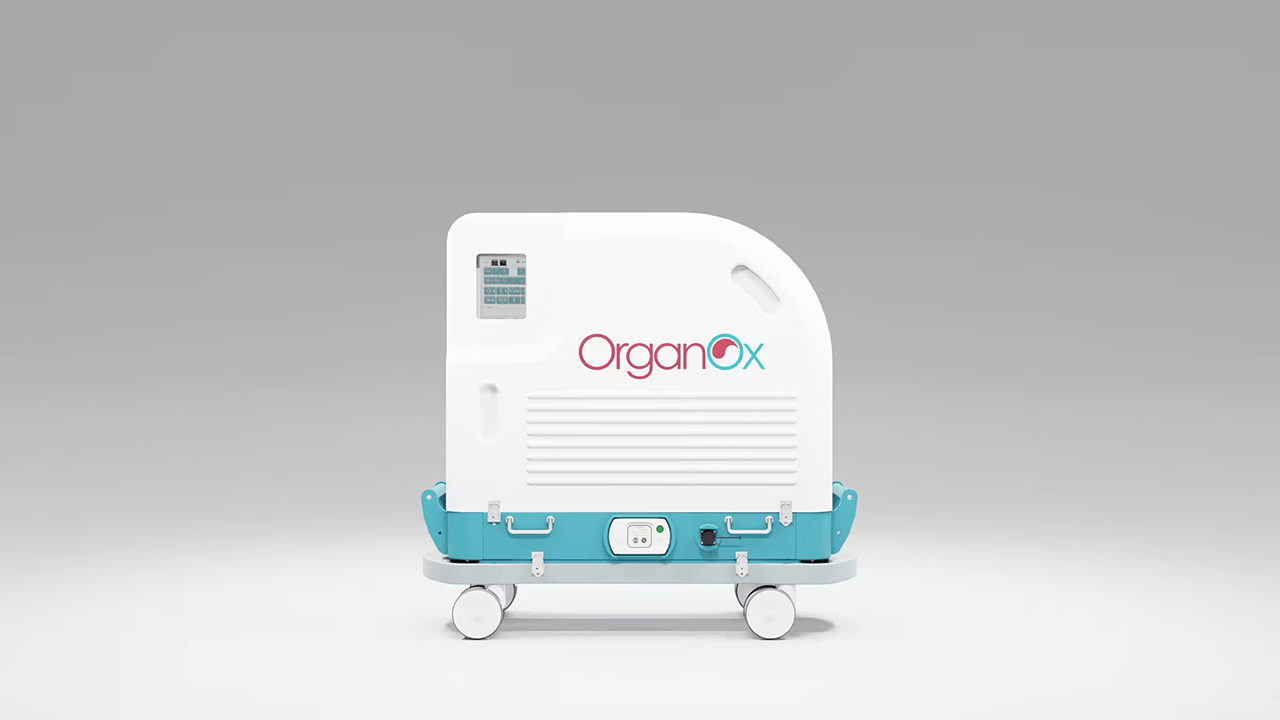

Founded out of the University of Oxford, OrganOx developed the world’s first fully automated device for liver preservation, metra, which enables donor livers to be maintained in a functioning state outside the human body for up to 24 hours. The technology, used in more than 6,000 liver transplants to date, has significantly increased the number of viable organs available for transplant and improved patient outcomes.

With BGF’s support, OrganOx has scaled into a world-leading medtech company. Following its acquisition, it will continue to operate from Oxford as a standalone division of global healthcare group Terumo Corporation.

Tim Rea, co-head of early stage investing at BGF and a member of the OrganOx board since 2019, said:

OrganOx has transformed liver transplantation and built a world-class position in medtech. In a sector where institutional capital is constrained, this exit highlights the importance and potential of patient growth capital, and a willingness to back innovation before it is de-risked — something many investors find difficult to do in this still nascent market.

BGF was built to deploy capital into underserved parts of the investment market. In early stage medtech, we have gone further by deliberately backing companies with significant hardware and manufacturing complexity. Our capital and commercial expertise made us ideally placed to take on this challenge and OrganOx is a powerful example of why that strategy matters.

BGF first invested in OrganOx in 2019 and has provided seven rounds of investment, including a £20 million commitment earlier this year. BGF participated in each of the funding rounds following its initial investment and is the company’s largest shareholder.

Other early backers of the company included Longwall Ventures and Oxford Investment Consultants. In its later growth stages, the company secured backing from Lauxera Capital Partners (US/FR), HealthQuest (US), and additional supporters.

Oern R. Stuge, MD, MBA, and Executive Chairman of OrganOx, said:

Today’s announced transaction is expected to expand the adoption of our transplantation technology platform by leveraging Terumo’s global infrastructure to benefit more patients around the globe.

Thank you to BGF who have shown conviction and support as an investor and board member since their first investment. Their capital and leadership have enabled the value creation inherent in today’s announced $1.5bn transaction.

Andy Gregory, CEO of BGF, said that achieving a ten-figure valuation marks one of the UK’s largest medtech exits. He highlighted the OrganOx team’s remarkable achievement and stressed that the success is all the more significant because it directly benefits patient outcomes:

By combining early and growth-stage investing across multiple sectors, BGF has created the right blend to deliver strong, sustainable and repeatable returns. Our ambition now is for more capital to flow into the UK’s most promising companies — whether through co-investments with international, specialist investors, or domestic sources.

Would you like to write the first comment?

Login to post comments