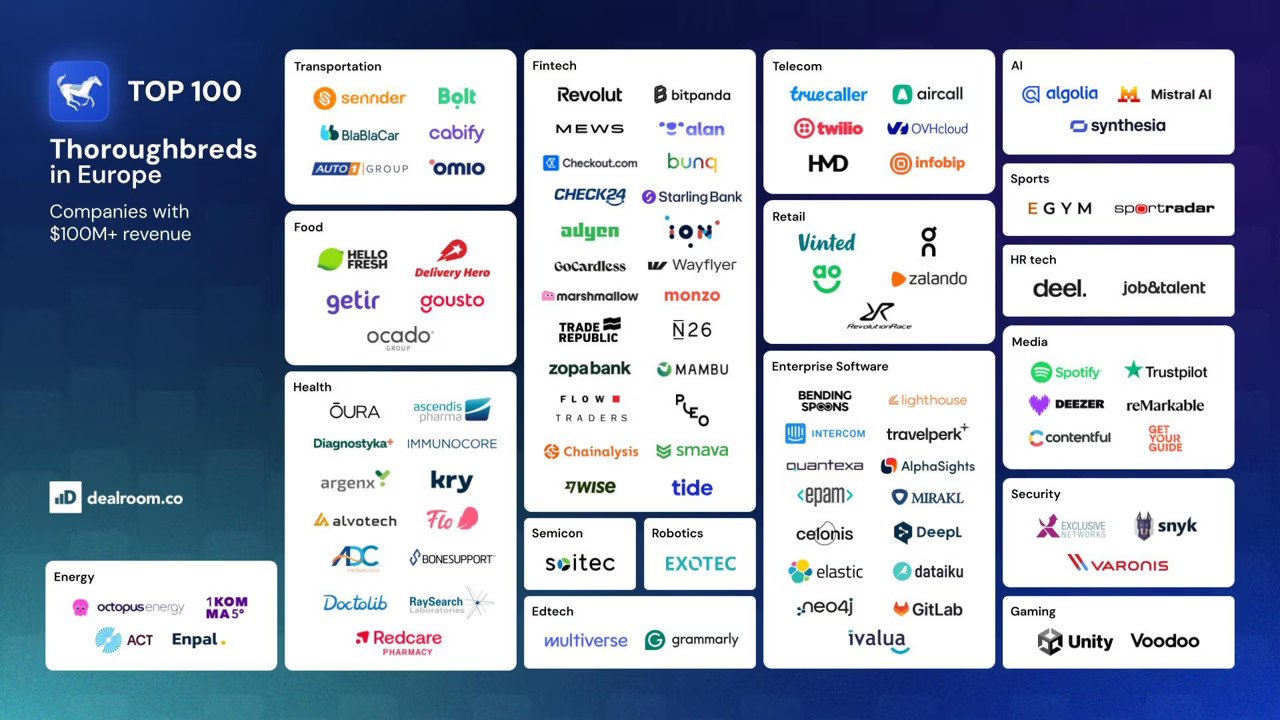

Today, VC data provider Dealroom released its inaugural Thoroughbreds 100 report, a list of the 100 most promising tech scaleups in EMEA, with revenues of $100 million+.

This ranking shows the tech companies with the most momentum, growth and team strength.

The ranking now includes Thoroughbreds ($100 million+ revenues) and Colts ($25–100 million revenues) alongside Unicorns.

The Thoroughbreds 100 EMEA represent the companies with the most momentum in 2025, out of over 700 Thoroughbreds across EMEA, with 38 created in the last two years alone. Thoroughbreds now account for 27 per cent of EMEA’s $5.6 trillion tech ecosystem.

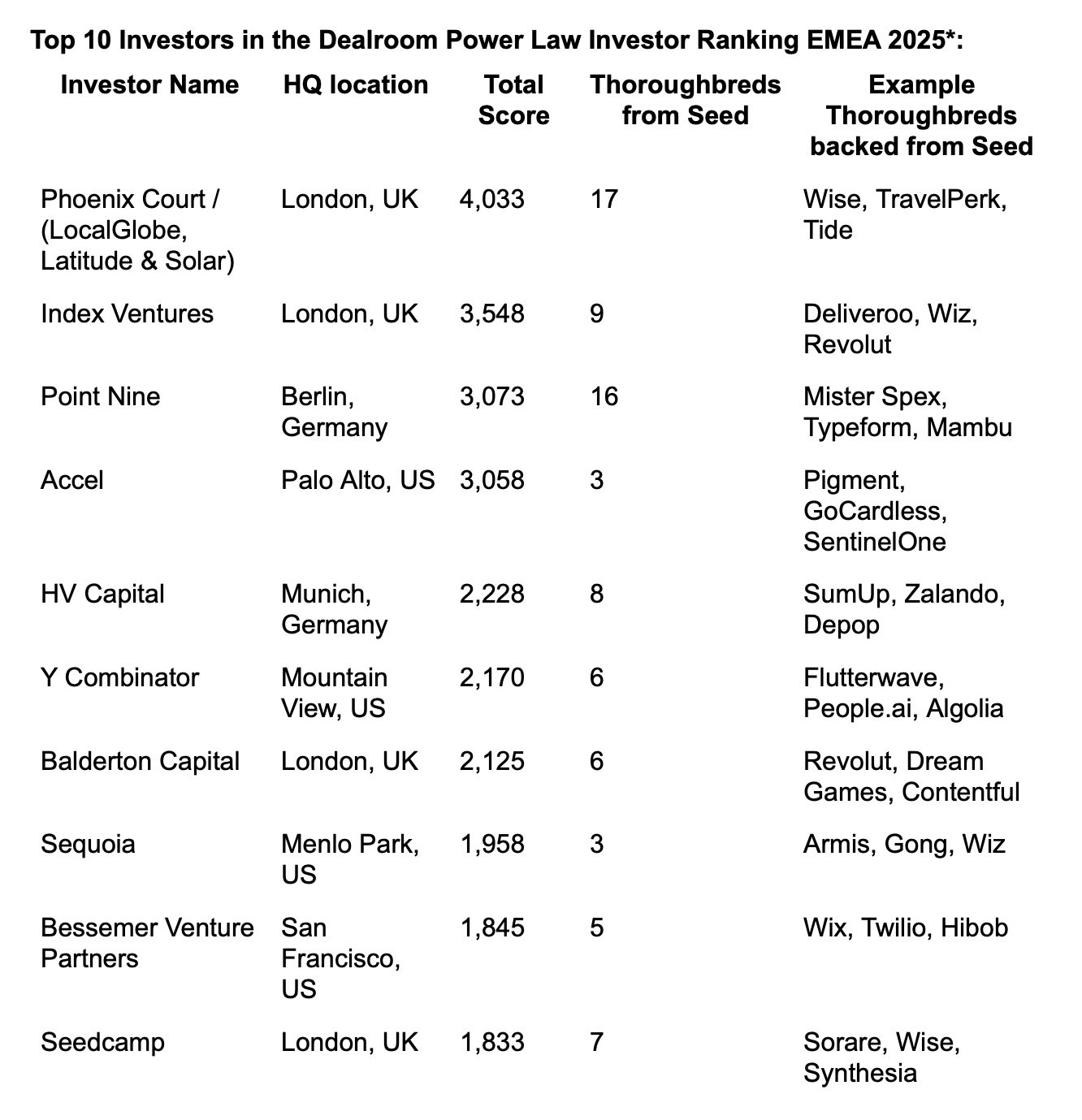

Europe underrepresented: only Phoenix Court and Index Ventures among the global Top 20

Investors are ranked by the number of high-growth companies in their portfolios, with additional weight for those backing them earliest at Seed and Series A, when data is scarce and risk is highest.

Significantly, Phoenix Court, Index Ventures, and Point Nine are the only European funds in the global top 20, led by Y Combinator and Sequoia.

Phoenix Court is recognised as the region’s #1 investor in Thoroughbreds, Colts, and Unicorns for consistently backing high-revenue tech companies from Seed stage and in the top 0.01 per cent of funds globally.

Index Ventures secured second overall, while Point Nine, the Germany-based Seed investor, achieved third position.

As investor focus shifts from speculative valuations to proven performance, this new measure of success reflects a wider shift across fast-growth tech companies towards sustainable growth and financial discipline.

Driving economic prosperity

As more companies stay private for longer, the focus is on driving economic prosperity through improved productivity, job creation, and tax contributions.

Thoroughbreds 100 EMEAs collectively generated $168 billion in combined revenue over the past year and provided 367,000 jobs across the region.The UK is the lead country for Thoroughbreds 100 (22), followed by Germany (17)

The top three sectors are:

- Fintech (30 companies) – including Revolut (UK), Wise (UK), and Trade Republic (Germany)

- Enterprise Software (25 companies) – including Mistral AI (France) and Bending Spoons (Italy)

- Health & Biotech (14 companies) – including Alan (France) and Flo Health (UK)

Europe’s $57 billion scaleup funding gap

Within EMEA, the report cites the importance of "New Palo Alto" region – an interconnected network of innovation ecosystems within a five-hour train ride of London (including London, Paris, Amsterdam and Brussels). It's the most productive region for Thoroughbreds in EMEA, home to over 250 Thoroughbreds and nearly 800 Colts, underlining its position as the world's second most productive innovation cluster, surpassed only by the Bay Area.

Seven of Europe's 10 most valuable tech companies founded after 1990 originated from this ecosystem, including Booking.com, ASML, Adyen, Arm, Revolut, Tide, Wise, and Monzo.

However, the EMEA region faces an estimated $57 billion scaleup funding gap according to Dealroom, compared to the Bay Area.

Unsurprisingly the report asserts that while Europe consistently nurtures innovative companies, long-term value creation could be significantly accelerated with a more plentiful supply of local capital at later growth stages. This represents a substantial, largely unaddressed investment opportunity for asset allocators and institutional investors, with nearly 2,000 venture-backed companies in EMEA now generating revenues of $25 million or more.

Yoram Wijngaarde, Founder and CEO of Dealroom, said:

“Venture has long been measured by promise, but performance comes from proof.

That’s why our 2025 ranking includes a focus on Thoroughbreds: companies generating $100 million+ in ARR, rooted in strong customer demand and lasting value. These aren’t speculative bets; they’re regional assets.

By prioritising tangible impact and sustainable growth, we offer unprecedented clarity for founders, LPs, and policymakers on where resilience lies and the investors that are truly bending the curve. Europe is no longer merely emerging; it is a demonstrable engine room for national, regional, and global champions."

According to Saul Klein, Co-founder and Executive Chair at Phoenix Court, venture capital has been gripped by unicorns for over a decade.

“But the real test of a company is not valuation, but fundamentals. The definition of success has changed.

Europe has the raw ingredients to create the companies that matter, and it's encouraging to see 38 new Thoroughbreds created in the past two years. The challenge is not building them, but scaling them.

What’s needed now in Europe is the long-term conviction at growth - so that the value created here stays here and compounds for the next generation.”

Would you like to write the first comment?

Login to post comments