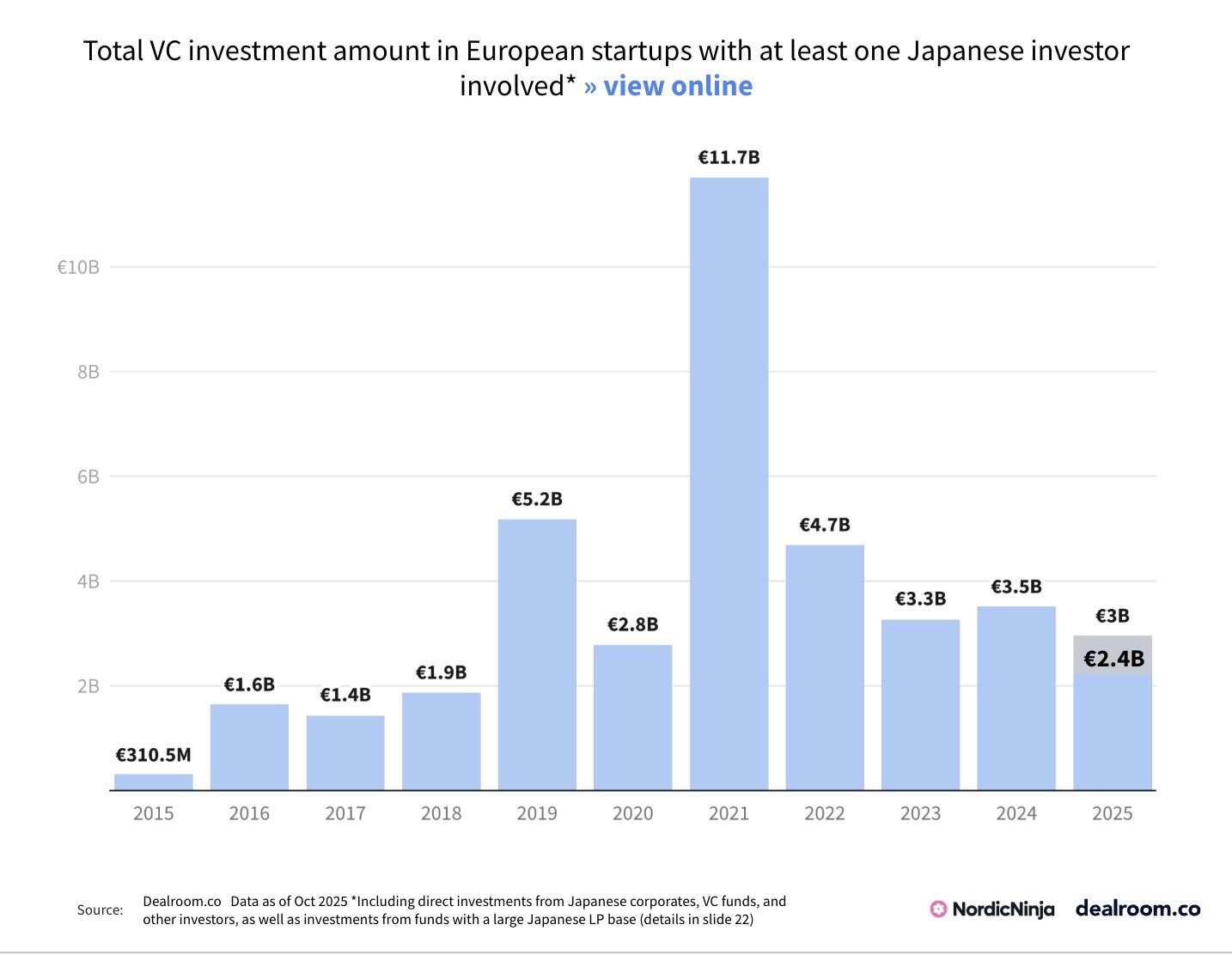

A new report by NordicNinja, Europe’s largest Japan-backed VC and backers of fast-growing tech companies including Bolt, Starship and Varjo, and Dealroom reveals that €33 billion of Japan-linked capital has flowed into Europe since 2019 as investors double down on the region’s deep tech advantage.

Further, investors are on track for a further €3B by the end of 2025.

The report shows that since the EU-Japan Economic Partnership Agreement (EPA) came into force six years ago, bilateral annual trade between the two regions has exceeded €200 billion.

Japanese capital in 6 per cent of all VC European investment

Japanese capital, whether direct or through a Japanese-backed fund, has participated in 6 per cent of all VC investment in Europe.

That includes €3.5 billion worth of deals in 2024 alone, with a further €2.4 billion deployed in the first ten months of 2025.

The UK’s gain

The UK has attracted the majority of this funding, accounting for €14.9 billion of the €31 billion total since 2019, including €2.5 billion of 2024’s volume. Germany follows with €4.8 billion from 2019, followed by France with € 3.4 billion.

Deeptech and AI startups the biggest winners

Of last year’s total, a record 70 per cent went to deep tech and AI, almost double 2021’s previous high.

In fact, Japanese-backed investment into deep tech and AI broadly has doubled since 2023, with deep tech consistently ranking as the top segment for Japanese investors. Climate tech follows close behind, while Resilience has grown to take 23 per cent of the share.

Growth investment in mega-deals

Japanese investment in Europe has also evolved from a handful of headline-grabbing mega-deals, driven by the likes of SoftBank, into a more diverse flow of capital. The number of rounds featuring a Japanese investor has jumped 5.9 per cent since 2022, rising to 140 rounds in 2024.

Japanese investment in Europe has also evolved from a handful of headline-grabbing mega-deals, driven by the likes of SoftBank, into a more diverse flow of capital. The number of rounds featuring a Japanese investor has jumped 5.9 per cent since 2022, rising to 140 rounds in 2024.

Last year also saw a record number of early and breakout stage deals involving Japanese investors, which has continued into 2025.

Recent highlights also show how this strategic breadth is being paired with impact – from tozero’s €11 million Seed in circular battery recycling (NordicNinja) to HIVED’s €38 million Series B in zero-emission delivery (NordicNinja, Yamato Holdings and Marunouchi Innovation Partners).

This focus aligns with Japan’s strategic priorities of securing supply chains, strengthening industrial leadership and accelerating the transition to a low-carbon economy.

With Europe producing over twice as many VC-backed startups and more than four times as many unicorns per capita as Japan, investing in Europe offers access to innovation that complements Japan’s industrial base.

Symbiotic by design

Corporates are not only investing in European tech, they’re increasingly active acquirers and partners. 2023 marked a record year, with 15 European VC-backed startups acquired by Japanese firms, from Asahi Kasei’s $1.3 billion purchase of Calliditas in pharma to Mitsubishi’s acquisition of Scibreak in grid hardware.

This is on track to reach eight in 2025, double 2024’s figures.

At the same time, cross-continental partnerships are now translating European innovation into global scale. In mobility, Wayve’s collaboration with Nissan and investment from SoftBank is bringing autonomous-driving systems to Japan’s roads. In robotics, the UK Atomic Energy Authority and Japan’s Fukushima Institute are creating robots for extreme environments.

Meanwhile, IQM and TOYO Corporation, and Quantinuum and Mitsui & Co., are advancing quantum computing and distribution in the Asia-PaciAccording to Tomosaku Sohara, Co-founder and Managing Partner from Japan-Europe VC, NordicNinja,this is not capital tourism:

“Japan has a long tradition of building enduring partnerships rather than one-off transactions. We see a rare window to turn cross-border collaboration into lasting strategic advantage.

When Europe’s entrepreneurial drive meets Japan’s engineering excellence and industrial networks, scalable and resilient solutions emerge.

At NordicNinja, we exist to make that bridge tangible, turning collaboration into long-term impact innovations.”

Timo Toikkanen, CEO of virtual and mixed reality company Varjo, said:

“Europe is where deep tech innovation takes shape, and Japan is where precision and scale turn that innovation into operational strength.

For Varjo, bridging these capabilities means advancing mission readiness and transforming how modern defence forces can train and operate through mixed reality.”

Aaike van Vugt, co-founder and CEO of advanced materials and deep tech startup VSParticle, said:

“Europe has the science, Japan has the industrial scale. By connecting the two, we can accelerate the journey from breakthrough research to global production.”

Sarah Fleischer, co-founder and CEO of battery recycling startup tozero, contends that Japan understands better than most the strategic importance of critical raw material independence for resilient supply chains:

Partnering with Japanese investors gives us not only capital but also deep industrial know-how and a bridge into global markets that are critical for scaling deeptech technologies.”

Would you like to write the first comment?

Login to post comments