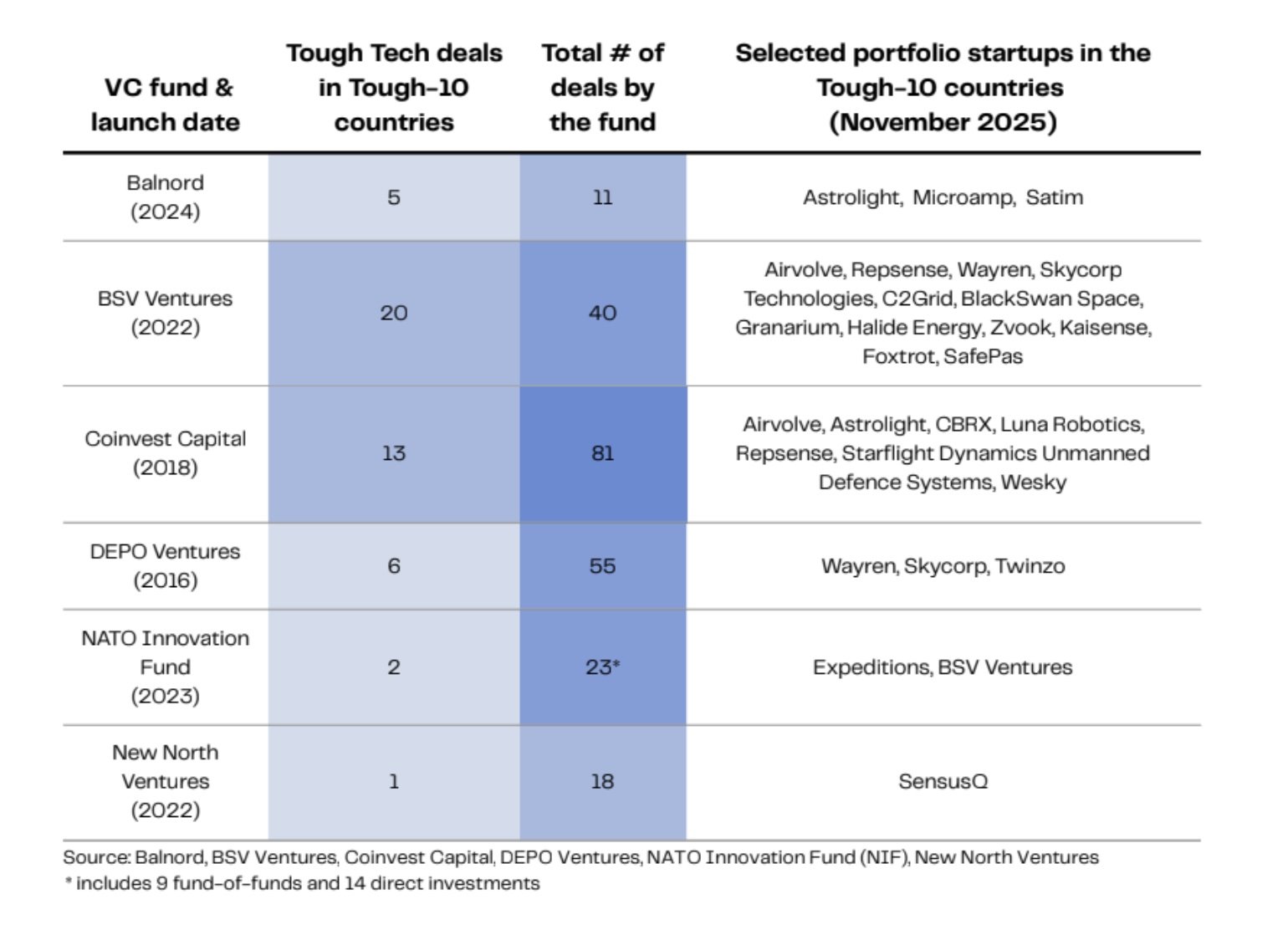

Today, Coinvest Capital, the NATO Innovation Fund (NIF), Depo Ventures, BSV Ventures, Balnord, and New North Ventures — six VC funds actively investing in dual-use and defence — together with market-intelligence platform Dealroom, unveil the inaugural Tough Tech by the Tough Ten report,

The report is the first comprehensive mapping of tough-tech ecosystems spanning mission-critical defence, dual-use, and space innovation across Europe’s eastern frontier. It examines how these “Tough Ten” nations are mobilising talent, capital, and technology in response to shifting security realities.

It covers priority innovation domains identified by NATO, from AI and quantum technologies to hypersonics, energy, and next-generation communications.

The tough ten countries sit from the Baltic to the Black Sea, and include Finland, Estonia, Latvia, Lithuania, Poland, Czech Republic, Slovakia, Romania, Hungary and Bulgaria.

The report highlights the true dynamics of defence innovations in the region. Key findings include:

- The Tough Ten nations are outpacing the rest of Europe in mission-critical innovation.

- Between 2019 and 2022, tough-tech ventures made up 7 per cent of all startups in these countries, compared to 5 per cent across the rest of Europe.

- By 2023–2025, this share more than doubled to 16 per cent, while the rest of Europe lags at 10 per cent.

- By 2025, 53 per cent of all Deep Tech and 23 per cent of total VC investment will flow into Tough Tech, a dramatic shift from software convenience to hardware courage.

Futher, as part of defence efforts, NATO launched Operation Eastern Sentry; the European Union (EU) is building the European Drone Wall and Eastern Flank Watch; and the Baltic countries and Poland are creating the Eastern Shield and Baltic Defence Line.

Space and quantum dominate defence investment across the Tough Ten

Across the Tough Ten, defence tech investment remains concentrated in a few deep-tech verticals:

Quantum computing, cryptography, and sensing ($606 million) and Space and Satellite ($703 million) dominate, accounting for most funding since 2019.

Broader security segments, such as Energy Security ($253 million) and Health Crisis Preparedness ($166 million), highlight an expanded notion of defence, linking resilience and infrastructure.

Core military areas - C4IS — which stands for Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance — ($22 million), UAVs/UGVs ($28 million), and Advanced Materials ($38 million) — show steady but limited venture traction, reflecting Europe’s ongoing shift from early-stage R&D to scalable dual-use commercialisation.

The rise of a defence-driven innovation economy

Tough tech in the region has grown from a handful of early-stage experiments into a mature, multi-stage pipeline, with companies now progressing from pre-seed through to Series C.

This acceleration is reinforced by national initiatives across Finland, Estonia, Lithuania, Poland, and others, which have launched sovereign funds, defence-industry parks, DIANA hubs, and rapid-testing frameworks to support scalable dual-use innovation.

At the European level, programmes such as SAFE, EDIP, and the European Defence Fund add more than €150 billion in stimulus, creating unprecedented momentum for defence and resilience technologies across the Tough Ten.

What began as a necessity to deter and defend is fast becoming the region’s competitive identity. This surge underscores a decisive strategic shift: proximity to geopolitical pressure has translated into faster mobilisation, deeper investment in dual-use capabilities, and a sharper focus on technologies with defence and resilience applications.

The steady climb since 2020 signals ecosystem maturity, where early-stage experimentation is giving way to scalable, capital-intensive breakthroughs in defence, autonomy, and deep industrial tech - proof that the region no longer only invents, but begins to industrialise innovation.

According to Viktorija Trimbel, Managing Director at Coinvest Capital, who has initiated the report, with geopolitical tensions on the rise, this report, for the first time, provides summary insights into the defence innovation trends, key ecosystem players, funding instruments available, and most notable startups to be watched and partnered with:

“Living at the borders of the European Union, having experienced in our own lifetime the Soviet Russian occupation, makes each of us very much aware of the price we all have to pay to protect our freedom and way of life. Currently, the highest price is being paid by the freedom fighters and people of Ukraine.

Here in Europe, we must ensure that the time we still have is put to the best use, investing in deterrence, building resilience, and advancing innovation, capabilities, and competitiveness.

Our region demonstrates just that by actions taken and changes initiated at increasing speed.”

“Tough tech is Europe’s new competitive edge. Founders on the Eastern Flank are proving that innovation is the real deterrent. With unprecedented capital ready to deploy into resilient, dual-use, and industrial tech, Europe has never had a stronger moment—or greater responsibility—to build the technologies that will secure its future,” shared Jarek Pilarczyk, Operating Partner at Balnord.

Sandra Golbreich, General Partner at BSV Ventures, sees tough tech as more than a category:

"We invest in people who take on the hard problems because they have to, because it's a mission for them, not because it’s fashionable. That’s where real value and real impact come from.

As BSV we’re glad to contribute towards this report and the community in the ecosystem, choosing to build and back things that last — and to stand for something that does too."

For Patrick Schneider-Sikorsky, Partner, NATO Innovation Fund, defending the Alliance’s Eastern Flank isn’t just about presence - it’s about preparedness.

"Supporting and scaling local innovations is essential to that effort.

Their technologies, which are informed by each nation's capability needs - across sensing, autonomy, and secure communications - are helping to ensure that our forward defences are smarter, faster, and more connected. The growth of these innovative companies strengthens not just the Eastern Flank, but the Alliance’s collective technological edge."

Would you like to write the first comment?

Login to post comments