For decades, silicon has been the backbone of the semiconductor industry. Diamfab believes the next era belongs to diamond. I spoke to CEO Gauthier Chicot to find out why and learn what it takes to industrialise an entirely new material platform.

French company DIAMFAB is a spin-off from the Institut Néel-CNRS. Its technology is based on 30 years of R&D into the growth of high-quality synthetic diamonds for demanding electronic applications.

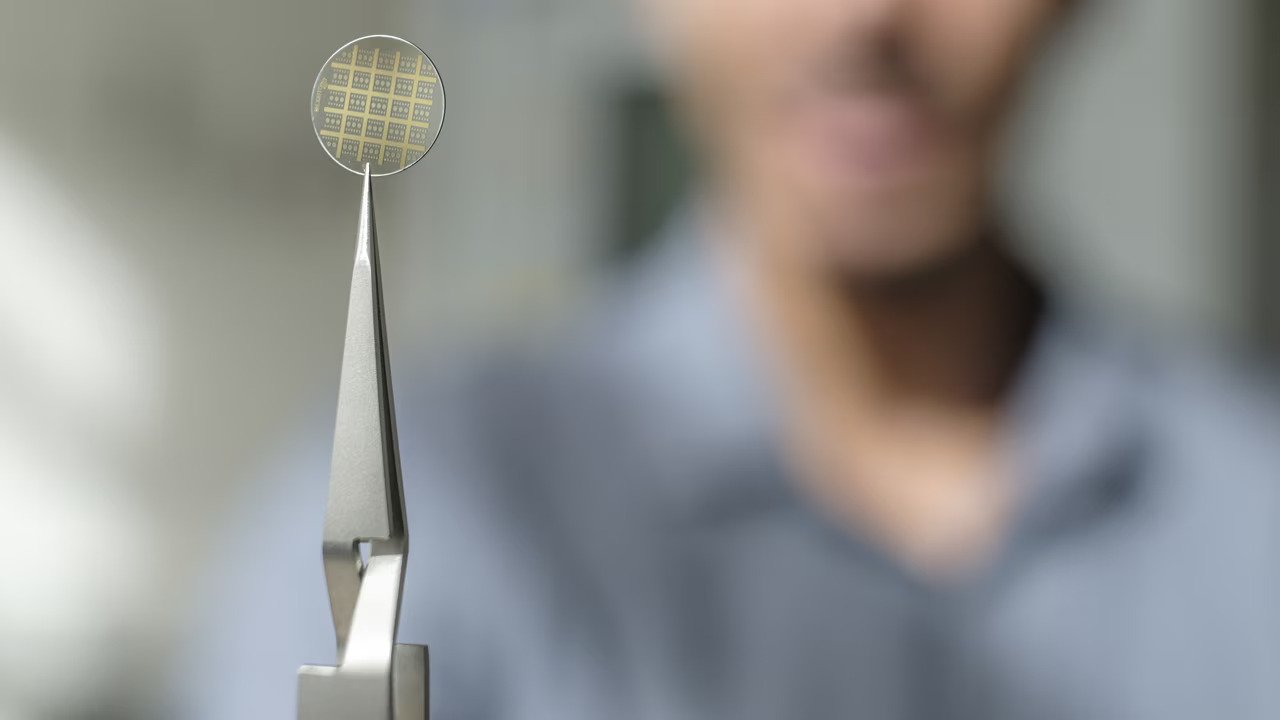

It manufactures synthetic-diamonds that act as an alternative to conventional semiconductor materials(like silicon, silicon carbide (SiC), and Gallium nitride (GaN), especially in power electronics, which convert, manage or distribute high electrical power.

Diamond is no longer a laboratory material. It is becoming an industrial material. Japan’s Ookuma Diamond Device has raised more than €30 million, while more established US player Diamond Foundry is scaling rapidly — this week announcing a €753 million investment from the Spanish government to build a new microchip manufacturing plant.

For Diamfab, this rising international activity isn’t a threat — it’s validation.

“Diamond chose me”

Like many deeptech materials innovation spinouts, Diamfab was born in academia. Chicot admits, “I didn’t choose diamond — diamond chose me. I studied semiconductor materials and started on other semiconductors, but then I got an opportunity to work on diamond during my PhD thesis. That’s when I discovered diamond and all the properties it can offer.”

Electrification demands a new class of power materials

Chicot notes that as more systems become electrified—electric vehicles being a prime example—the need to handle large amounts of electrical power efficiently is growing rapidly. Most power-conversion devices today are still made from silicon, a material that reaches its limits when operating at high power.

According to Chicot, for 20 or 30 years, we’ve been looking for materials to replace silicon.

“We’ve already moved from silicon to silicon carbide — every Tesla Model 3 has SiC converters inside the car. But we still want to improve efficiency and simplify the system.

The most effective material is diamond. It outperforms silicon carbide.”

Smaller, lighter, tougher Diamond can withstand a voltage three times higher than silicon carbide and thirteen times better than silicon. Further, diamond is extremely good at dissipating heat, even better than copper.

“That means a diamond device can deal with a lot of power and evacuate its own heat efficiently. If a device heats up, its performance drops. So today we use fans and cooling systems, for example, in electric cars. These systems are bulky and complex. Diamond helps avoid that, “ explains Chicot.

Finally, diamond also reduces the carbon footprint.

Chicot details:

“We need very small amounts of diamond material to fabricate a device. So from fabrication to usage, the footprint is lower.”

In practice, the use of diamond makes semiconductors compact, lightweight, stable at high temperatures, tolerant to high voltage and radiation, and more energy-efficient than silicon.

It's invaluable for rugged conditions electronics such as EVs, aerospace, power grids, and radiation-hard systems, while there are also opportunities growing in radio frequency, optoelectronics, high-energy detectors, and quantum technologies using diamond’s NV-centre capabilities.

Building the pilot line: from prototypes to industrial reality

It's still relatively early days for Diamfab when it comes to rollout, with the team providing prototypes to customers and partners. In March 2024, the company raised €8.7 million.

The team is building a pilot line, which will enable it to develop and test wafers and devices in conditions that represent industrial reality. “It also shows partners that we are ready for industrialisation,” explains Chichot.

Further, there are already niche markets using diamond as a conductive electrode for other materials.

“It’s less “sexy " than full diamond power devices, but it generates revenue and helps us learn how to operate as an industrial company.”

The art of transforming a conservative industry

Overall, part of the challenge is convincing customers to embrace what is still in many respects, frontier tech. According to Chicot, a lot of industrial players have heard about diamond, but 10 or 20 years ago.

“Back then, it was the beginning, and we need to update them and show that the technology has dramatically improved.”

“We also need to show them that we are the right partner to work with. The industry is very conservative. We’re 20 people dealing with companies like Schneider Electric.

So we need to balance showing what we can do, convincing end users, and driving the conversation through the value chain.

We need to convince the end users first. We need to show them the added value and the performance gains. Then the end user will convince the semiconductor player to start working on it.”

Chicot contends that in France and Europe, companies are more conservative, but most industrial players are now convinced that diamond will be the next material for power electronics. But outside Europe, Japanese companies like Toyota have been exploring the potential of diamond.

“Interest is strong internationally. The question is when. It depends on how many actors—startups and big players—enter the game.”

When wafers scale, industry giants will listen

Crucially, one of the biggest wins in Diamfab’s work is that it fits into existing supply chains. According to Chicot, while the beginning of the value chain —”substrate and the layer we grow” — is specific to diamond.

“But once you have the substrate plus the active layer, you can process the wafer in standard clean rooms. Metal deposition, lithography, and so on — it’s the same equipment as for other semiconductors. The only requirement is wafer size. Industrial facilities need at least a 4-inch wafer to enter their production line.

But the equipment itself is the same. For example, to fabricate prototypes today, we use research facilities with the same equipment used for gallium nitride and others, just with an adapted recipe.”

When the material is ready in sufficiently large wafers, the team can propose it to STMicroelectronics, TSMC, and so on.

“They will need a dedicated line to avoid cross-contamination, but the equipment doesn’t need to be different. The value comes from the diamond material itself,” explained Chicot. ´

Why diamond is Europe’s best shot at reindustrialising semiconductors

Chicot contends that Diamfab's mission is to demonstrate that diamond has an industrial reality:

“In Europe, we actually have almost everything we need to build a diamond semiconductor supply chain: research centres, substrate providers, device expertise, and major industrial players.

This is an opportunity to reindustrialise semiconductors in Europe. Diamond power electronics is a new technology — and Europe is strong in power electronics.

It’s easier to industrialise a new technology than to close the huge gap in silicon manufacturing, where Asia is already mature. We need to take advantage of this new technology to build a new ecosystem in Europe.”

Lead image: DIAMFAB wafer diodes. Photo:Grenoble Alpes Metropole. Lucas Frangella.

Would you like to write the first comment?

Login to post comments