Cofounder VC today announced the launch of a new early growth-stage fund that continues the investment activity of the CofounderZone team.

The fund will target dynamically growing technology companies with proven market validation and recurring revenue, offering both capital and hands-on operational support to accelerate scaling.

Cofounder VC (previously: CofounderZone) is an early-growth venture fund. The fund invests in technology companies that have validated products, growing revenue and a clear path to scaling.

Cofounder VC combines capital with operational support from an experienced investment team, Venture Partners and a broad network of business angels.

“Innovation’s value shows up only after market validation. At Cofounder VC, we aim to minimise execution risk by investing in the growth phase — when teams have proven demand, repeatable sales and clear momentum,” said Dr Tomasz Golinski, General Partner at Cofounder VC.

“At that stage, our capital and operational playbook — especially in sales strategy, market entry and team building — can make a decisive difference.

Our Venture Partners and the network of business angels we’ve built over the years are key assets we bring to founders.”

The fund is sector-agnostic but leans toward business-process digitisation, sustainability and health tech, targeting companies with at least €100–200k in monthly recurring revenue that are profitable or near break-even. It plans to invest €1–3 million per company across a portfolio of around eight startups, supported by a network of 250+ business angels for deal sourcing and co-investment.

The fund will actively support portfolio companies with:

- International expansion strategy and execution,

- Building and professionalising sales teams

- Fundraising and investor relations

- Organisational scaling and governance

- Implementing management best practices

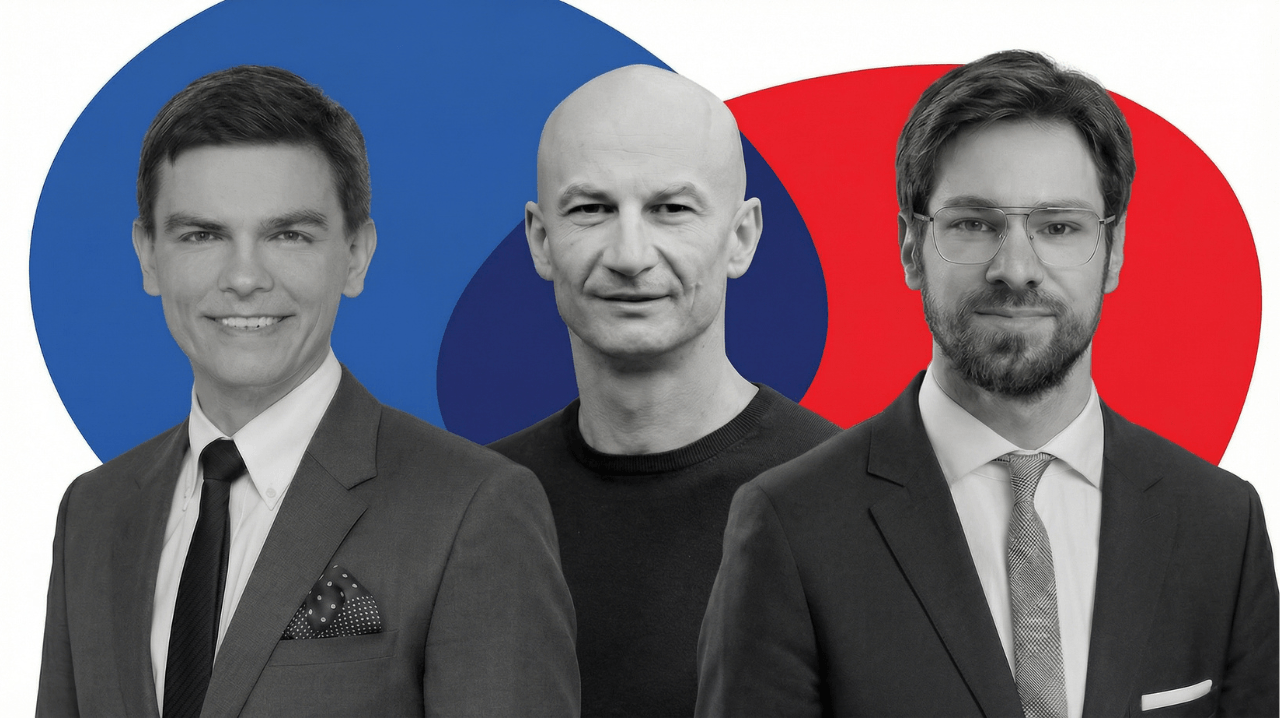

The team has been strengthened by the addition of Maciej Kowalczyk, founder and manager of Corvus Ventures, and will be supported by a group of Venture Partners — industry and operational experts who will advise deal selection and portfolio development.

“Our goal is to bridge the gap between seed financing and later-stage growth capital,” added Michal Sioda, General Partner at Cofounder VC.

“We see limited interest from many international VCs in the CEE region, which leaves a gap for promising companies.

We welcome projects that may be overlooked by large foreign funds but have strong potential to scale — and we’re ready to partner with teams that have already demonstrated early commercial success and now want to build something much bigger.”

The fund has completed its first closing. Investors include Polish Development Fund, private investors and family offices from Poland and abroad. The fund intends to continue raising capital in the coming months.

Would you like to write the first comment?

Login to post comments