The first half of 2025 showed continued momentum across Europe’s foodtech landscape, driven by growing demand for sustainable, scalable and resource-efficient food solutions. Investment activity reflected a maturing ecosystem in which innovations are increasingly focused on transforming core elements of the food value chain rather than solely introducing new consumer products.

Activity centred on next-generation proteins such as precision-fermented dairy, mycelium-based ingredients and advanced plant-based meat analogues, with an emphasis on realistic sensory qualities, clean labels and scalable production. Alongside this, there was notable growth in circular and upcycling solutions that convert agricultural and food-processing sidestreams into high-value ingredients, as well as innovations in aquaculture and blue food, including land-based farming and seafood by-product valorisation. Fermentation-driven flavour and ingredient platforms also advanced. Overall, the period underscored a shift toward technologies designed to improve the efficiency, sustainability and resilience of Europe’s food system.

The following are the ten largest funding rounds in the European foodtech industry during the first half of 2025.

LAXEY (Iceland)

Amount raised in H1 2025: €130M

Laxey is an Icelandic aquaculture company pioneering sustainable land-based salmon farming on the Westman Islands.

The company develops advanced facilities that produce high-quality Atlantic salmon using environmentally friendly energy, innovative water-reuse technologies, and controlled systems that minimise environmental impact and eliminate the need for antibiotics.

Laxey’s integrated operations span from smolt rearing to grow-out and processing, with the goal of scaling production substantially while creating local jobs and supporting the regional economy.

In May, Laxey secured €130 million in combined equity and debt financing to support the next phase of its development.

Vivici (Netherlands)

Amount raised in H1 2025: €32M

Vivici is a company redefining how dairy proteins are made for the food and beverage industry.

Using precision fermentation, Vivici produces animal-free dairy proteins that offer high nutritional value and superior performance while significantly reducing environmental impact compared with traditional animal-derived proteins.

Founded in 2023, Vivici works with food brands worldwide to accelerate product innovation and bring sustainable, high-quality protein solutions to market.

Vivici secured €32 million in February to expand its access into new international markets, launch its second dairy protein ingredient, and establish long-term manufacturing capabilities.

Volare (Finland)

Amount raised in H1 2025: €26M

Volare is a company that is transforming food industry side streams into sustainable, high-quality ingredients such as protein, oil and fertiliser for aquafeed, pet food, agriculture and chemical applications.

Built on research from the VTT Technical Research Centre of Finland, Volare uses innovative circular economy technology centred on the black soldier fly to upcycle food waste into natural, drop-in ingredients that reduce environmental impact and support a more resilient food system.

The company is scaling its operations with industrial-scale production facilities and has secured significant funding to expand its breakthrough insect-based protein platform.

In May, Volare closed a €26 million funding round to build protein production plant Volare 01 and to advance its unique technology.

Heura Foods (Spain)

Amount raised in H1 2025: €20M

Heura Foods is a mission-driven foodtech company that develops 100 per cent plant-based, sustainable, and nutritious food products with a focus on meat alternatives inspired by Mediterranean culinary heritage.

Founded in 2017 in Barcelona, Heura aims to transform the global food system by offering plant-based proteins made from high-protein legumes and quality natural ingredients, helping reduce environmental impact and promote healthier eating habits. Its products are sold internationally in thousands of stores, and the company continues to innovate in new categories beyond plant-based meat.

In May, Heura Foods received €20 million boost from the EIB to expand sustainable food tech.

Project Eaden (Germany)

Amount raised in H1 2025: €15M

Project Eaden is a company focused on creating the next generation of sustainable, animal-free meat alternatives that closely mimic the taste, texture, and experience of conventional meat.

Using advanced platform and fibre-spinning technologies inspired by the textile industry, Eaden develops ultra-realistic plant-based products designed to meet growing global demand while significantly reducing environmental impact.

The company aims to make delicious, plant-based meats that appeal to mainstream consumers and help accelerate the shift toward a low-carbon food system.

Project Eaden secured €15 million in January to fuel its European retail rollout of ultra-realistic plant-based hams and to advance R&D efforts focused on developing whole-cut meat alternatives.

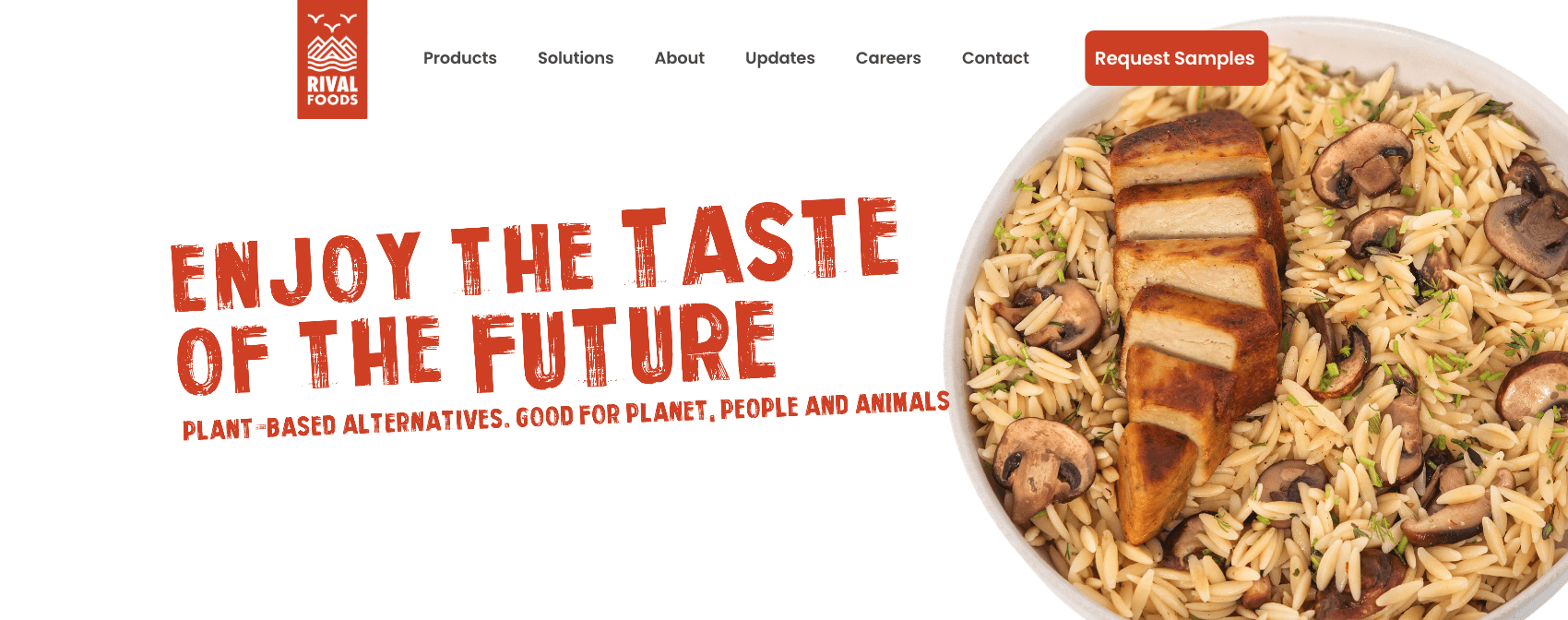

Rival Foods (Netherlands)

Amount raised in H1 2025: €10M

Rival Foods is a company developing the next generation of plant-based meat alternatives that closely mimic the texture, juiciness and bite of whole-cut animal proteins using a proprietary Shear Cell technology to transform plant proteins into layered, muscle-like structures with minimal ingredients and clean-label formulations.

Founded in 2019 as a spin-off from Wageningen University & Research, Rival Foods focuses on supplying high-quality, scalable plant-based chicken and beef alternatives to chefs, retailers and food brands across Europe, helping accelerate the transition to more sustainable protein options without compromising on taste or culinary experience.

In June, Rival Foods raised €10 million to double its production capacity, scale its proprietary manufacturing technology, and reduce production costs so it can offer plant-based meat at more competitive prices.

Fungu’it (France)

Amount raised in H1 2025: €4M

Fungu’it is a French foodtech company developing a new generation of natural, fermented aromatic ingredients to enhance the taste and nutritional quality of food products through a clean-label, sustainable approach.

Using solid-state fermentation with filamentous fungi, Fungu’it upcycles agricultural by-products into rich, complex flavourings ideal for both plant-based and traditional formulations, helping food manufacturers improve sensory profiles without artificial additives.

The company’s innovative technology addresses key challenges in the food industry by combining naturalness, functionality and circularity to support the transition toward more sustainable and flavorful foods.

In June, Fungu’it raised €4 million to build an industrial pilot plant, patent and scale its fermentation process, and develop a unique database from testing hundreds of strain–by-product combinations.

Grassa (Netherlands)

Amount raised in H1 2025: €3.6M

Grassa is a company that is transforming grass into high-quality, sustainable ingredients for animal and future human nutrition.

Using a natural process of pressing, heating and filtering, Grassa unlocks the full nutritional potential of grass to produce protein concentrates, prebiotic sugars, fibres and plant-based fertilisers, offering a locally sourced alternative to imported soy and reducing emissions and waste in agricultural systems.

By working with farmers and food chain partners, Grassa aims to build a circular, climate-positive food system that increases food production efficiency while lowering environmental impact.

In March, Grassa raised €3.6 million to support scaling up the process, demonstrating benefits to dairy farmers, and developing grass protein for human consumption.

Kynda (Germany)

Amount raised in H1 2025: €3M

Kynda is a foodtech startup developing sustainable mycoprotein ingredients for the food and pet-food industries by converting agricultural by-products into high-protein, high-fibre mycelium through proprietary biomass fermentation technology.

Its rapid fermentation process produces versatile, clean-label protein with meat-like texture and rich umami flavour, offering a scalable, low-impact alternative to traditional plant and animal proteins while upcycling under-utilised biomass.

Founded in 2019, Kynda aims to support a more circular and efficient food system by unlocking the value of crop sidestreams and expanding access to nutritious, sustainable protein solutions.

Kynda secured €3 million in February to scale up production with a new factory opening.

SuperGround (Finland)

Amount raised in H1 2025: €2.5M

SuperGround is a foodtech company that partners with global food producers to make meat and seafood processing more efficient and sustainable.

Using patented processing technology, SuperGround upcycles undervalued fish and poultry side streams into tasty, high-quality ingredients for products like nuggets, patties and fish balls. This full-utilisation approach helps companies reduce waste, lower emissions and costs, and produce more food from the same resources without compromising on flavour or food safety.

In March, SuperGround secured €2.5 million to expand its technology aimed at minimising food waste.

Would you like to write the first comment?

Login to post comments