Amsterdam-based Connected Capital has announced the close of its oversubscribed second fund at €154 Million. Reloaded for round two, the firm intends to retain its singular focus on European B2B SaaS companies, invest in no more than 10 later-stage businesses, and offer a ticket size of up to €40 million.

When managing partners Wim Haring, Geert van Engelen, Mathijs Robbens and Olaf te Spenke opened the doors at Connected Capital in 2017, one thing was for sure: it was B2B SaaS success or it was go home.

With CVs packed full of names such as Waterland, Credit Suisse, Freshfields, Bain, and BCG, Connected Capital is able to offer not only a financial investment but, perhaps even more importantly, the oft-requested value add.

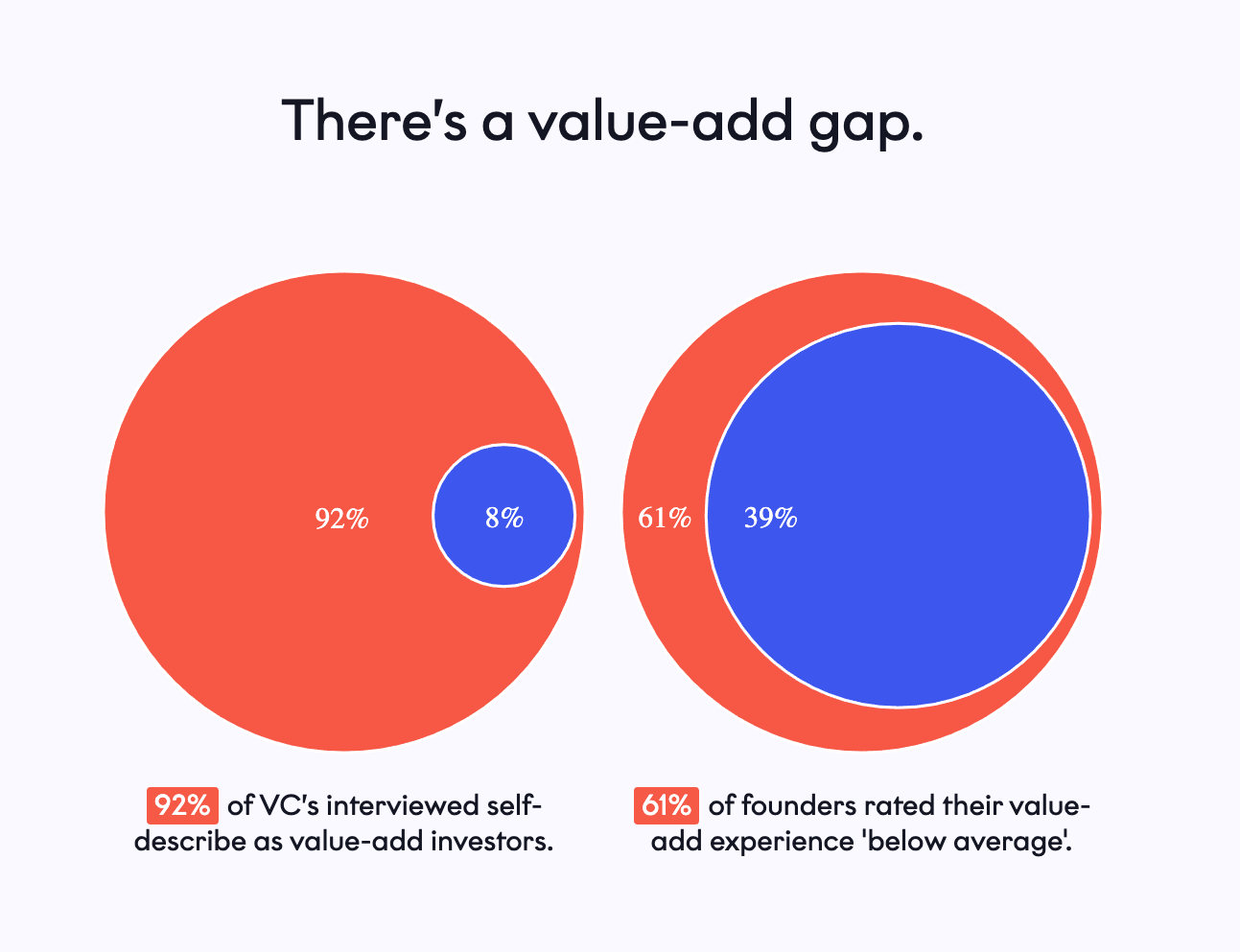

Now, the talking up of “hands-on” investors who offer “extensive operations experience” might seem like an all too common European VC house theme-du-jour, but Connected says it's different. Namely in the composition of its team and their backgrounds in mergers and acquisitions, private equity, law, and strategy consulting.

“Our ambition is to become the most sought-after B2B SaaS investor in Europe. Obviously, the most important ingredient of that is the value we bring and our portfolio companies and founders benefiting from that,” explained Robbens. “When we invest in a company, we commit to the founders and we do everything we can to help their companies accelerate growth.”

While larger firms might want to cast the nets farther and wider, Connected’s focus on one sector also gives the firm a competitive advantage when comes to deal sourcing, as well as the all-important due diligence processes. An advantage evidenced in the seven out of nine times Connected Capital has led the rounds of it's portfolio companies.

When it comes time to walk down the aisle together, managing partner Mathijs Robbens wasn’t shy with his words when asked what he's looking for, “We look for founders with a thoughtful and pragmatic tolerance for risk, who can also recognize their strengths and weaknesses in order to build a larger pool of talent and delegate properly. Strong fundamentals are key for business growth, but a flexible, diverse, and adaptive team is what makes success sustainable in an evolving, competitive industry like B2B SaaS.”

Connected Capital’s second fund saw commitments from a number of returning LPs, a substantial GP commit, and new blue-chip institutional investors.

Would you like to write the first comment?

Login to post comments