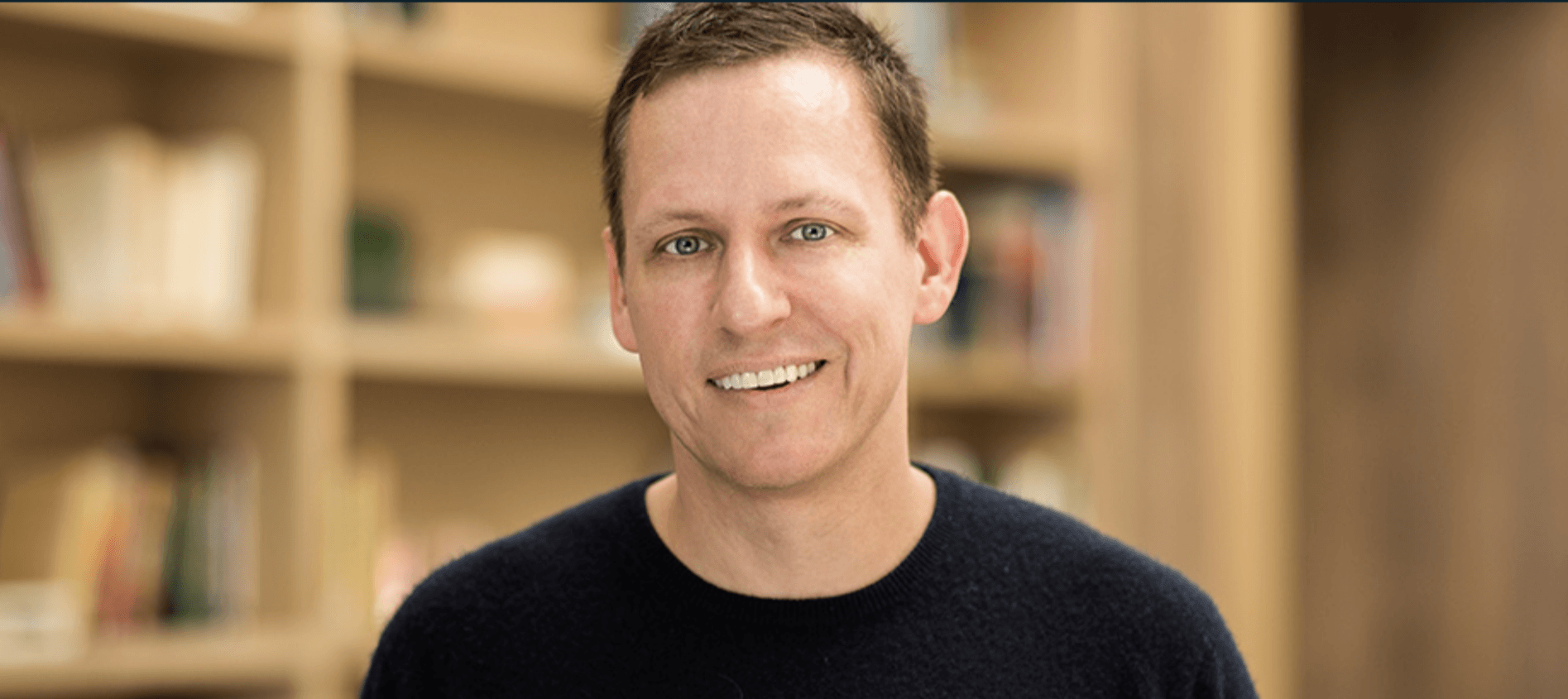

Palantir, the infamous data analytics firm co-founded by Peter Thiel recently went public, netting another sizeable payday for the PayPal co-founder and early Facebook backer - but while this was going on, one of the funds he co-founded was signing off on yet another deal in Europe.

Austrian cryptocurrency exchange Bitpanda announced its $52 million Series A round, led by Valar Ventures, the US venture capital fund co-founded by Thiel, that has become a major VC backer in European fintech.

Based in New York, Valar Ventures was spun out of Thiel Capital and is one of a number of funds linked to the PayPal co-founder that has invested heavily in Europe. This year, Thiel Capital invested in German drug development company ATAI while Founders Fund, the prominent Silicon Valley firm where he is a partner, counts Spotify and DeepMind among its portfolio of big-name players.

Thiel-linked funds have been very active in Europe for some time, but the billionaire hasn’t pulled punches in criticising the European ecosystem either.

In 2018, while discussing European regulation, he said that “there are no successful tech companies in Europe” and that regulatory clampdowns on American big tech was driven by jealousy. This wasn’t out of the ordinary though; Thiel previously called Europe a “slacker” in 2014. Since those comments were made, Spotify went public and the dim view hasn’t stopped funds from flowing into Europe.

Andrew McCormack and James Fitzgerald, the duo that leads Valar, have inked investment deals with many European fintech companies that have gone on to become major entities in the market and it appears to be a sector that it’s keen to continue backing after several more deals this year where Valar has cut a fresh cheque.

Fintech backer

In May, Valar committed more funds to one of its larger portfolio companies N26. The German neobank announced a $100 million extension to its Series D which brought the round to $570 million. The Berlin company is currently valued at $3.5 billion.

Valar invested in N26 at its Series A in 2015, identifying a key trend that would emerge in the coming years. N26’s competitors in Revolut and Monzo were also raising around this time as they sprinted to become the leader in the new wave of banking apps.

Also this year, Valar invested in another German fintech startup, Taxfix, as part of a large $65 million Series C round. Similarly, this was a case of the firm re-investing in the company, having first backed the startup, which makes automated tax software, at Series A.

It further backed up its arsenal by once again pumping money into Qonto, the French challenger bank for businesses, in its $115 million Series C in January of this year.

One of the jewels in Valar’s portfolio crown though is TransferWise, the UK-based money transfer company that is one of Europe’s biggest fintech operators. It recently reported annual revenues of £302.6 million with net profits of £21.3 million for the year ended March 2020 – its fourth straight year of profitability, making it anything but a slacker.

Plenty of deals have happened in 2020 under the shadow of Covid-19 but looking back even further, Valar’s money can be found flowing into other fintech startups like German open banking platform Deposit Solutions, which just recently launched in the US, and it has led rounds in German insurance tech outfit Coya. Elsewhere Mithril Capital Management, another Thiel fund, has backed Israeli AI startup Epistema.

Challenges

Despite successes, in venture capital there’s no such thing as a totally safe bet.

Monedo, a German fintech startup that Thiel has invested in - though not through Valar Ventures - shut up shop when the Hamburg-based startup filed for bankruptcy. Previously known as Kreditech, Monedo was a loan platform and went through various iterations in trying to settle on a business model.

Announcing its rebrand in March, just as coronavirus lockdowns were starting to grip Europe, Monedo said it was in a strong financial position – it had claimed it would break even in 2020 – but as the pandemic upended the market, that all changed.

In an economic downturn, lending becomes a difficult business and regulations introduced in various markets like Spain and Poland to protect borrowers impacted on Monedo’s operations, as reported by Finance FWD. An administrator has been appointed to the company to find new investors that can salvage and restructure the business.

More broadly, fintech is facing a crossroads after years of high growth but mounting losses.

Challenger banks like Revolut and Monzo continue to lose money after years of rapid expansion. For Valar’s investment in N26, the German bank pulled out of the popular UK market in February, citing Brexit, though it had actually launched there post-referendum. Instead it’s hoping to boost its presence elsewhere in Europe as well as focus on its forays into the US and Brazil, which will be capital-intensive missions.

Valar Ventures’ investments touch on key trends in the wider fintech space, from business banking to consumer payments to open banking. By following the money, we can see that it has been identifying many more winners than losers and this year it has reaffirmed its commitment to a number of companies during the trials of the pandemic, shoring up resources for the long economic turbulence ahead and wagering on more wins.

Image credit: Founders Fund

Would you like to write the first comment?

Login to post comments