When this article gets published, I'll be sitting in the European Commission's Albert Borschette Congress Center in Brussels. If all goes well, by now I should be listening to tireless EU Commissioner Neelie Kroes, as she discusses the future of Europe's so-called 'app economy', flanked by Rovio's Mighty Eagle, mr. Peter Vesterbacka, and others.

I'm here for the launch of a report that's been a year in the making, run by NUI Galway in conjunction with our friends over at GigaOm Research.

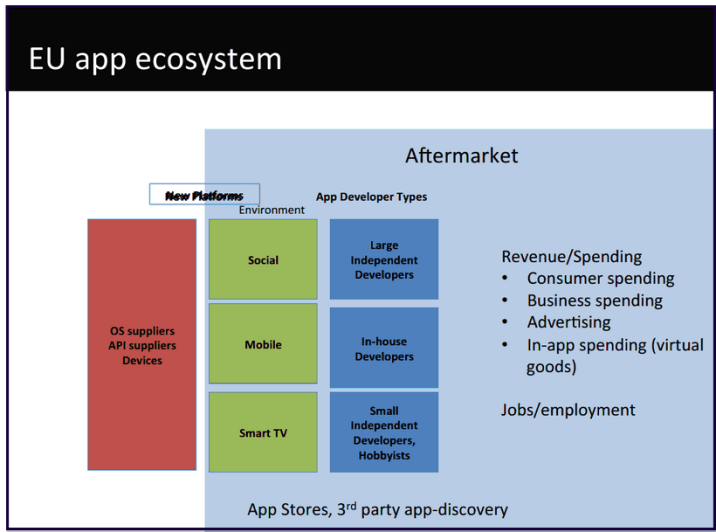

The study, entitled “Sizing the EU App Economy”, focused on the qualification of the flourishing European app ecosystem, particularly with regards to revenue generation, job creation and support, and the many bottlenecks faced by app developers across Europe.

As part of the broader Startup Europe initiative, the European Commission's intention was to find out how big and valuable the EU app economy truly is, taking into account not only smartphone and tablets apps for also applications built for platforms like social networks and smart TVs.

A 'Eurappraisal' of the European app economy

The end result, dubbed the Eurapp report (PDF), is meant to serve as a comprehensive review of the size of the app economy in Europe so that it can be further supported by the Digital Agenda for Europe (for which EU Commission VP Neelie Kroes is responsible) and other initiatives.

Conveniently, the report arrives just in time for discussion at the massive Mobile World Congress in Barcelona, which kicks off in 10 days.

“We have to think about the kind of future we want for our children and grandchildren – and seize the huge digital opportunity on offer", Kroes said in a canned statement.

"European leadership in the area of apps is fantastic – we should be supporting it, and all those who make it work. But the current fragmented patchwork is letting them down: we need the rules for a connected continent.”

Yes, we certainly do, miss Kroes, and not just when it comes to the app economy.

“Throughout the past year, the Eurapp team have interviewed a variety of stakeholders in the EU app economy, and surveyed hundreds of companies that are producing apps, both big and small,” said NUI Galway’s Dr. John Breslin, head of the Eurapp project.

Europe is home to a number of major app developers indeed, particularly in the gaming space, with companies like Rovio, King, Wooga, Supercell, Outfit7 and Nordeus - to name but a few.

So how will they benefit from this study?

“Some of the main bottlenecks facing app companies in the EU were sourced in these interviews and workshops, followed by crowdsourcing challenges where nearly 100 innovative solutions were submitted to address those bottlenecks,” Breslin said.

We were kindly given an early look at the key findings from the analysis by GigaOm’s Mark Mulligan and David Card, which is based in part on two surveys of developers targeting European markets.

A €63 billion app economy in Europe by 2018?

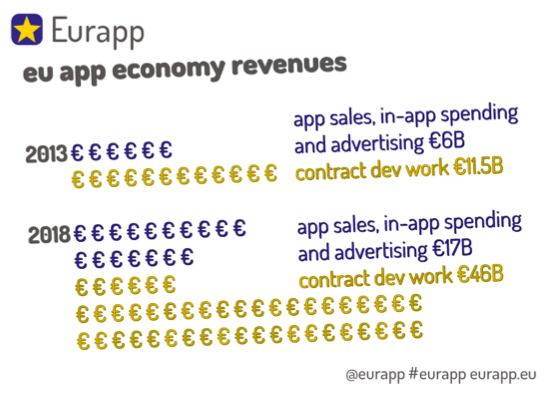

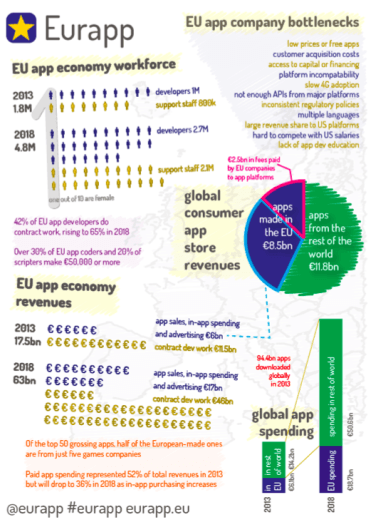

First up, the moolah: according to the study, EU developers are estimated to have generated approximately 17.5 billion euros ($23.8 billion) in revenue in 2013, and the researchers forecast that figure to increase to 63 billion euros ($85.5 billion) in the next five years.

A surprising finding is that a big chunk of this revenue is generated not from app sales (which accounted for a respectable 6 billion euros or roughly $8.1 billion), in-app payments for upgrades or virtual goods, or even advertising, but from work-for-hire.

According to the report, no less than 11.5 billion euros ($15.6 billion) was recognised from contract labour. Furthermore, this developers-for-hire business consists of many companies that aren't in the app business per se, but rather those who use apps to support and market their mainstream offerings like financial services, retailing, media and packaged goods, still according to Eurapp.

Large independent developer companies represent the vast majority (86 percent) of the most successful EU app developers, with small independent developers accounting for only 9 percent.

The researchers project that EU developers will take in nearly 46 billion euros (roughly $62.3 billion) in development work in 2018, which would be one hell of a jump.

Worth noting: a mere 28 European companies account for all the appearances of EU apps in the top 100 grossing apps in the EU and the Unites States.

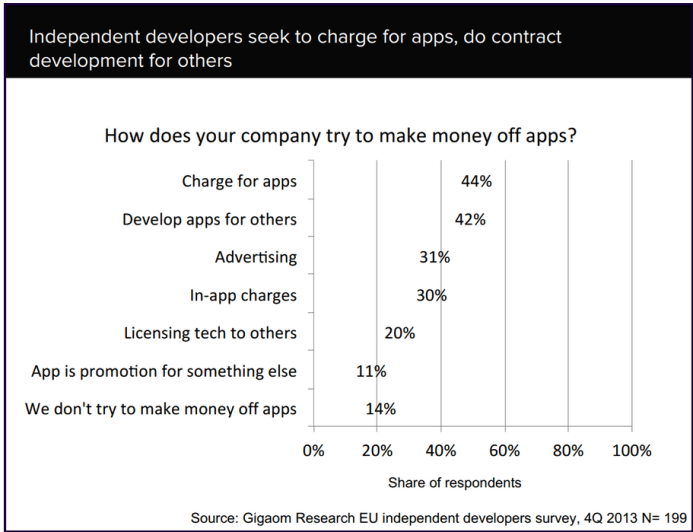

Fewer than half of the independent developers who were surveyed said they were offering services for hire. Conversely, half of the enterprises that managed app development in-house, used third-party developers in addition to that.

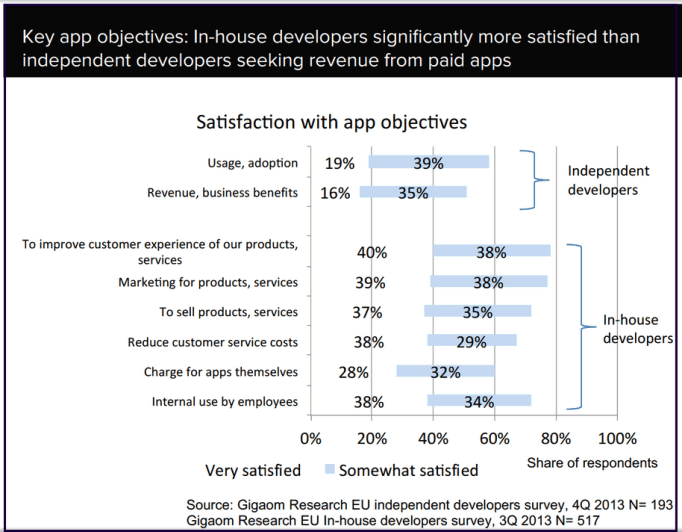

Survey data from the Eurapp study further suggests that in-house developers are generally more satisfied in achieving their commercial objectives than 'hired guns', many of whom are frustrated by low prices, free products and/or barely emerging income from advertising.

Spotlight on spending

All in all, EU spending — including user spending and advertising — totalled 6.1 billion euros (approximately $8.3 billion) in 2013, representing 30 percent of the global total.

By 2018, this is estimated to balloon to 18.7 billion euros ($25.3 billion), representing a smaller 27 percent of the global total due to stronger growth rates in later years from other regions - primarily emerging markets like Southeast Asia.

Paid app spending represented the majority of revenue in 2013 but will decline from 52 percent of the total to 36 percent in 2018, with the revenue transitioning to in-app purchasing.

Nearly triple the workforce in 5 years?

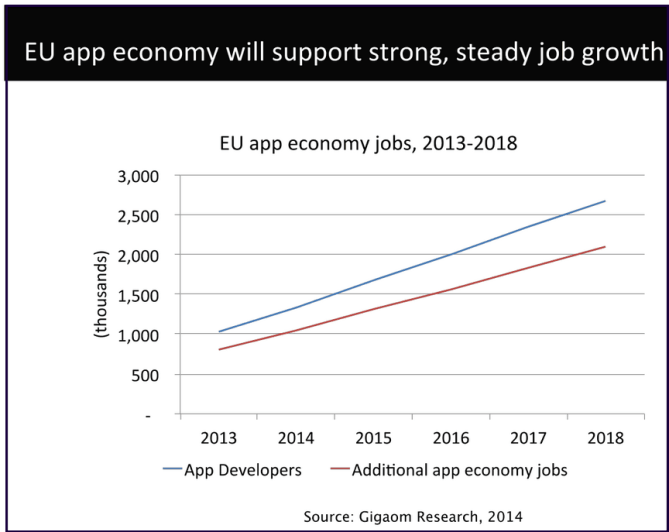

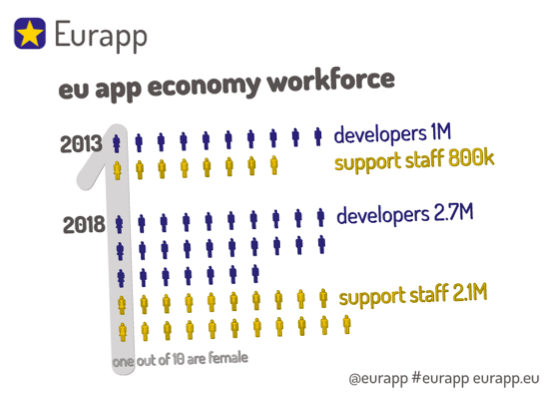

According to the Eurapp study, the European app developer workforce will grow from 1 million in 2013 to 2.8 million in 2018. Taking into account additional staff connected to the app economy (support, marketing etc.) puts the number at 1.8 million jobs in 2013, growing to 4.8 million in 2018.

The jobs in the app economy are good ones, the Eurapp researchers also concluded.

The developer category is biased slightly toward highly educated, experienced coders. Scripters and designers are next in the hierarchy, but even testers do relatively well.

The surveys suggested that support staff at the small independents were actually more experienced and better compensated than coders. On average, fewer than 50 percent had three or more years of experience, although a similar three-quarters had college or advanced degrees.

Identifying (and removing) the main barriers

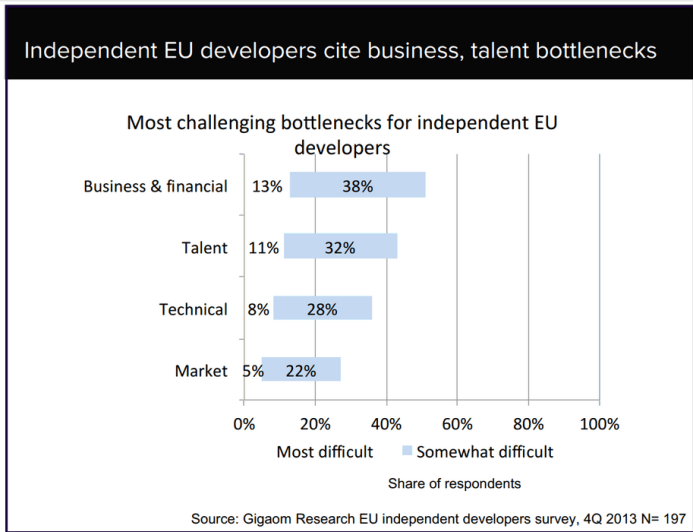

One finding that shouldn't be much of a surprise to anyone familiar with the broader European startup ecosystem, is that there's an apparent nagging lack of business acumen. Indeed, according to the Eurapp researchers, European app developers face more business-related than technical bottlenecks.

Interestingly, even the startups acknowledged their own lack of business skills.

Indie developers are seemingly getting most of their headaches on account of having to offer apps at low prices, or entirely free of charge to gain any type of traction.

Part of this can be explained by smartphone, tablet and social network users' general reluctance to fork over cash for apps, and a proposed solution is better discovery and distribution channels to help relieve the relatively high customer acquisition costs.

Another possible solution, according to the report, would be an EU-wide marketplace where companies in need of app development could identify, negotiate with, and hire developers for contract labour.

The question is whether a brand new platform is really needed for this, given the plethora of freelancing, outsourcing, and crowd-sourcing marketplaces already in existence.

Other challenges

Interestingly, another major bottleneck for EU app developers that came out of the two surveys was access to capital.

Both independent and in-house developers ranked platform incompatibility as the top technical bottleneck. In-house developers wished 4G adoption across Europe was moving faster, and the independents would like to see richer resources in terms of technologies and services available via APIs from the platform providers.

In addition to the difficulty in supporting multiple languages and inconsistent regulatory policies across EU countries, both independent and in-house developers cited U.S. platform domination.

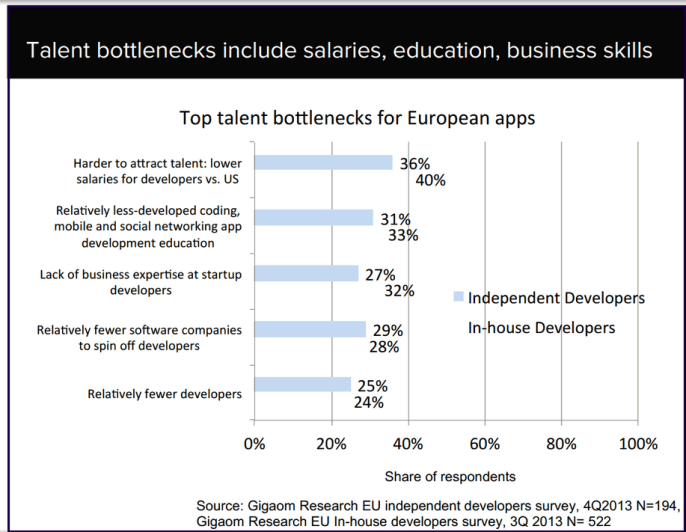

Oh, and there's the good old talent recruitment and retainment issue, of course.

As shown, the business issues are reflected by the talent or HR bottlenecks shown by the surveys. Both types of company find it hard to compete with U.S. salaries for developers and wish there were more education and training programs to teach mobile and social networking developer skills.

Leveraging platforms that are out of control

Arguably, the biggest problem for the European app economy is that the platforms are entirely out of European companies' control (or need we remind you that Google/Android, Apple/iOS, Facebook, Amazon, Microsoft/Windows Phone etc. are all American?).

Sure, it's a big opportunity for app developers across the globe to leverage these platforms and develop new businesses and economic models in an industry that didn't even exist a few years ago.

But it also means that the lion share of revenue generated by the operation of app platforms goes to North American companies (just ask Apple), and they maintain tight control over the platforms.

According to the study, European app developers have demonstrated that they can be very successful at monetisation regardless. In fact, the Eurapp report claims that European app companies account for a sizeable 42 percent of app revenue across the United States and Europe, which is equal the share of North American app developers and publishers.

Still, it's worth a reminder that app developers are largely at the mercy of the platform owners and operators, although it's clearly not a one-sided relationship either.

Commercial strategies for EU app developers

As you can see in one of the graphs above, independent app developers are mainly dependent on users paying for apps or extra features, functions and virtual goods. It’s not clear that these business models scale well outside gaming and subscription music services.

At the same time, the app advertising market is fragmented across a number of ad networks, and Google and Facebook currently dominate global mobile ad revenues. Developing apps for others, the strategy of 42 percent of Eurapp's survey base, appears to be a more lucrative route to take.

According to the study, a number of behaviour and market-specific factors will drive continued growth in the European (and global) app economy, including:

- Growing downloads per user - Growth of in-app purchases and other, new ways of monetisation - A modest spread of app store revenues beyond games - Growth in the overall number of app developers - Growth of consumer adoption of connected devices in emerging markets

Among the inevitable risks, the Eurapp researchers identified:

- The possibility that the consumer app market will not meaningfully expand outside games - The deterioration in paid app revenue in favour of in-app purchasing - The risk that the app economy is a bubble market that lacks the economic infrastructure for long-term sustainability - The difficulty of new-entrant developers being discovered by users on the increasingly cluttered app platforms

To conclude, here's an infographic showing the key findings of the study:

Featured image credit: matthi / Shutterstock

Would you like to write the first comment?

Login to post comments