Munich’s investment platform Scalable Capital has raised more than $180 million in a Series E funding round led by Chinese giant Tencent. While Scalable declined to list the exact previous investors that participated, in the past, HV Capital, TEV Ventures, Blackrock, and MPGI have all invested. The Bavarians are reporting that the funds will be used to expand its international expansion efforts and further develop the product. To date, the firm has raised $320 million.

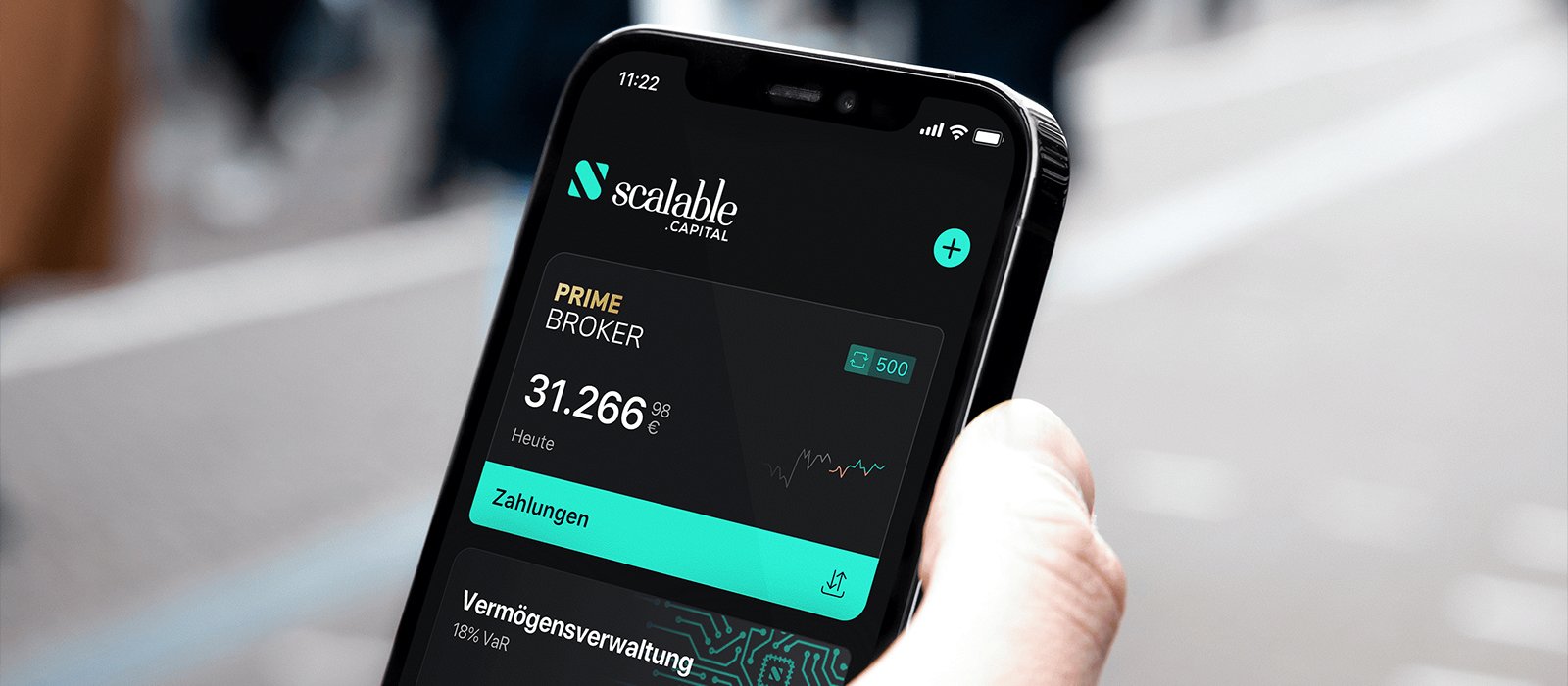

Founded in 2014 by Adam French, Erik Podzuweit, Florian Prucker, Simon Miller, and Stefan Mittnik, and set live in February of 2016, Scalable Capital counts over 250,000 clients with over $5 billion in assets on its platform. The fintech features over 1,500 Exchange Traded Funds (ETFs) available on the platform, the rest is spread across over 4,000 shares and 2,000 funds. The company reports a headquarters in Munich, as well as a talent-attracting office in Berlin. It also lists an office in London, however, Scalable Capital is, "no longer accepting new clients on our UK platform."

Further exemplifying the excess of money on the market today, and no enough places to put it, co-CEO Florian Prucker explains, “We see huge demand to invest money in the capital markets instead of leaving it in bank accounts. This comes against a backdrop of record-low interest rates, growing inflation, and a widening pension gap. Our clients can access fully managed globally diversified ETF portfolios and, in the same app, self-directed trading in shares, ETFs, cryptocurrencies, and funds. We also provide a market-leading offering of ETF, stocks, and crypto monthly savings plans. We are planning to launch derivatives trading next. We will continue on our mission to make everyone an investor.

“Demand for accessible solutions of personal investing is increasing in European markets, particularly among millennials. Scalable Capital excels in offering its customers a convenient and cost-efficient investing experience. We are delighted to be an investor and participate in Scalable Capital’s growth,” concludes Tencent Investment's Danying Ma.

Would you like to write the first comment?

Login to post comments