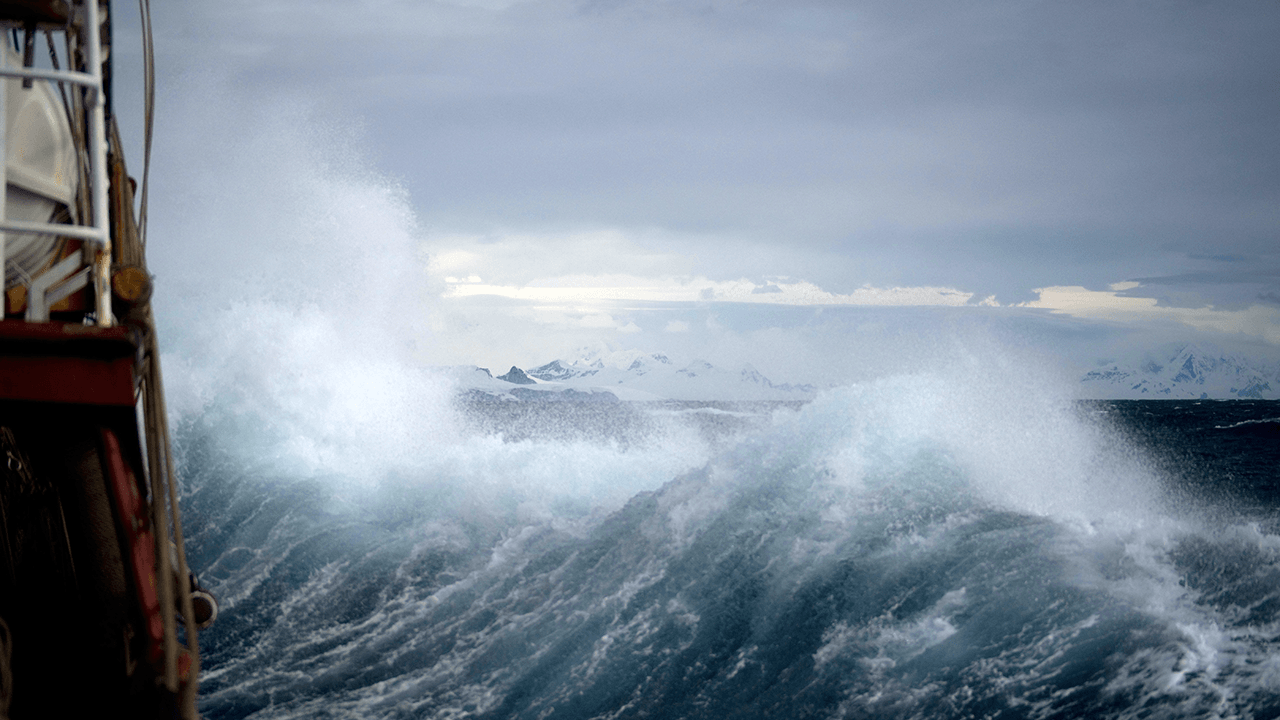

On my run this morning, The Beatles ‘A Day in the Life’ came up on shuffle, and I had a chuckle when John sang, “I read the news today, oh boy.” With black swan memos being sent out to seemingly every founder across Europe with advice on how to act at this moment, I argue that instead of weathering out the storm in the hopes that the venture lifeboats may return, founders need to deploy the spinnaker and keep growing into the storm.

If the unit economics are right, and if there is a clear case for investing more money into a growth scenario, it should be done. Without question.

Even if the company runs at low or negative profitability. But setting aloft your biggest sail is dangerous if you don't have control. This is precisely what drives great companies including Klarna and Kry to last-resort measures; bulk layoffs or raising rounds at far too premature valuations.

We collectively need to redefine what control really means.

Being controlling doesn’t automatically translate into being in control. Much like the mariner cresting heavy seas, a complete and precise picture of your business forecasts and drivers, and their associated boundaries, define control.

Having spent my better years at McKinsey, Spotify, and EQT Ventures crafting big data models that enable controlled growth, I feel obliged to share my thoughts on how best to do it. It is exactly this controlled growth scenario that the aforementioned lifeboats are going to be scouting for when the sunny skies return.

Controlled growth, not knee-jerk austerity.

Have your CFO, growth, and sales team put their models on the table, and then merge them

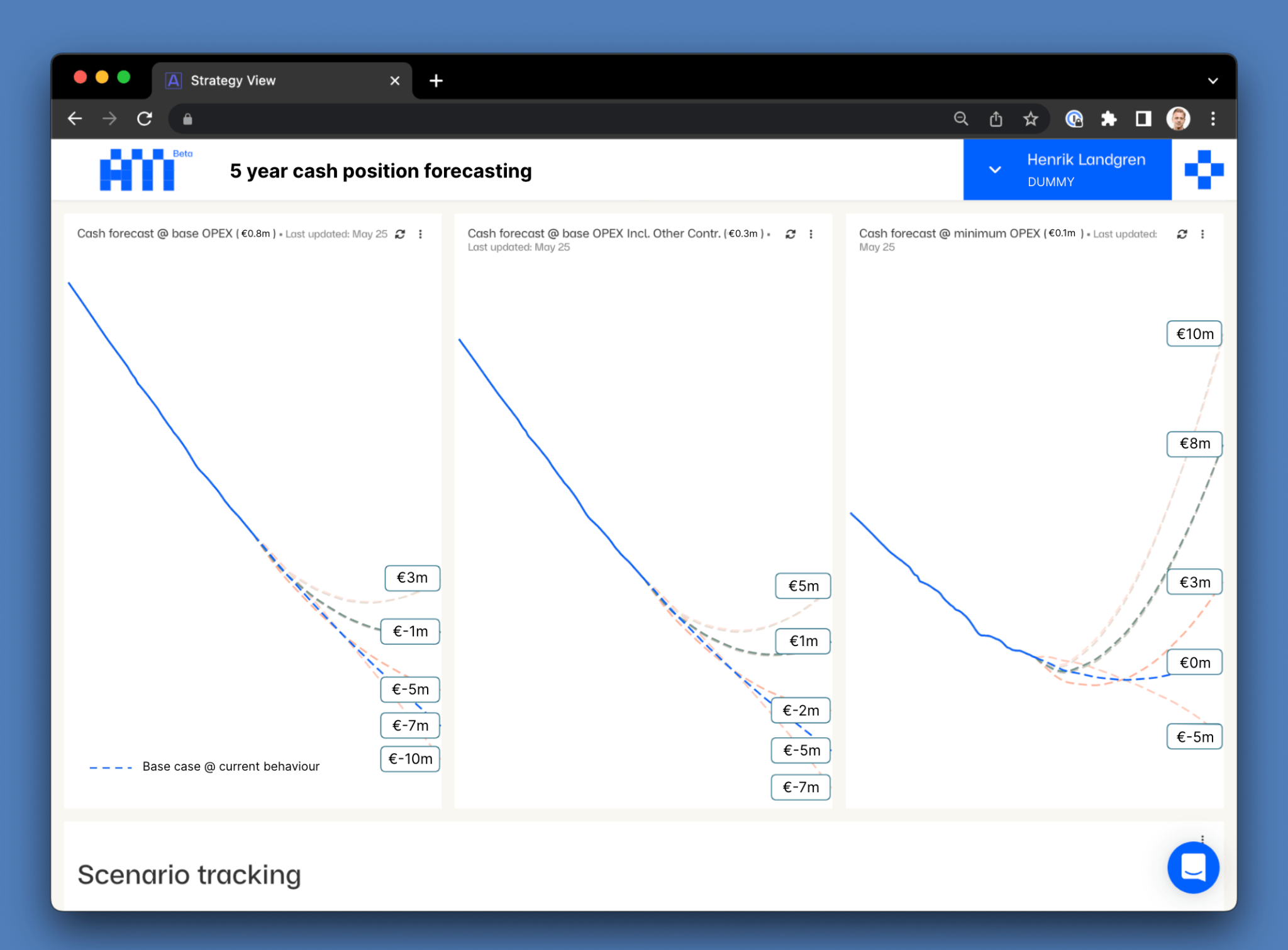

Acquisition metrics are great, cohort analyses are great, and LTV metrics are great. But if they are not connected all the way to the CFO’s cash forecasting you won’t understand how these metrics are driving your cash position forecast. Make sure you include all costs, or else you will find yourself tricked into a wall.

Continuously track your reference base case, don’t make it a one-off

The beauty of this new and complete growth model is that you can clearly see the wall clearly from the current trajectory. Make sure to keep this clarity. You need to continuously track the latest marketing efficiency trends, user behaviour trends, monetisation trends, and your opex trends - because these are all continually altering variables. Only then can you know whether you will make it to the J curve and profitability or just enough for your next round.

Start to shape your own forward-looking targets

With the base in the reference case, you can start to figure out what you can change, and how. Make sure you are fair in what effect your actions have on your drivers and what moves your cash trajectory. Use forward-looking metrics - can you move your estimated 12 month retention, your long-term LTV, your CACs, your COGS, and your OPEX? At Spotify, these models resulted in rendering whole backlogs obsolete, because they didn’t create meaningful pin-needle movement.

Be agile with your spending and accelerate when you hit the curve

Hold back scaling before you can prove you can reach the J curve within the limits of your funding scenario. Make sure to set up checkpoints so you know when you can switch scenarios.

For example, when the payback period reaches your threshold, your long-term retention reaches the threshold, and your cash forecast has turned up. This is a clear indicator that you perform better than your J curve, and it’s open skies and you’re free to accelerate. The road there will be paved with a lot of testing, but you’re forbidden to accelerate without seeing that you are on the curve.

Make sure you include your funding options in your scenarios

If you are going for external financing, you can early on define what you will need to showcase in the next round of equity or debt. By continuously updating your reference case, you will know if the scenario is going to be out of reach and if you need to fall back to a less risky scenario. If you also include some fair or conservative multiples, you will know even more about the boundaries and, crucially, as we’re seeing every day now, how to act if valuation multiples suddenly drop.

If you cut costs, cut deep

It often feels like the culturally kind thing to do - to cut your cuts into small pieces and portion them out over time. But the truth is that it has the same demoralising effect and it never amasses to the opportunities that open with deep cuts - which is the opening of several different forecasting scenarios.

We had a portfolio company at EQT Ventures who was facing hard times and they were faced with the decision to make operating expense cuts and opted for the deep option. It opened up completely new scenarios, which is exemplified by the dummy picture at the top of this piece, and as a result, they are now one of EQT Ventures’ top 5 portfolio companies.

Make the jump, be rewarded

What all of this essentially means is that by jumping from the L curve to the J curve, a rebuilding of a growth model is possible, one that can continue to successfully drive things forward. I’m not going to lie, this is no easy exercise, but with determination, skill, and thoughtful planning, you too can receive your sea legs, a.k.a. a master of growth control - and when you get it right, the capital market will reward you mightily for it.

Would you like to write the first comment?

Login to post comments