Life after Tink, the fintech pioneer that was snapped up by Visa for €1.8 billion in mid-2021, three former team members, Joel Nordström, Joel Wägmark, and Johannes Elgh have set out to create what they’re terming as “the operating system for bank payments”. In so much, founded in May of this year, the startup has raised €5 million in a seed funding round.

An estimated €260 trillion moves through European banks on an annual basis via payouts, insurance premiums, deposits, loan payouts, and the like. With numbers as such, you’d think that there’s a great deal of automation at work here, but surprisingly, you and I both would be wrong. Spreadsheets are still the lifeblood of the direct debits, invoicing, and reconciliation machine. In 2022.

If your head is beginning to search the mental databases, you’re on the right track, but most of the fintech stories and developments of note have been by way of allowing companies to accept payments and/or open banking. All fine and dandy, and have paved the way for a number of conveniences. For, mostly, consumers and the showroom floor. Back what about the back office?

If your head is beginning to search the mental databases, you’re on the right track, but most of the fintech stories and developments of note have been by way of allowing companies to accept payments and/or open banking. All fine and dandy, and have paved the way for a number of conveniences. For, mostly, consumers and the showroom floor. Back what about the back office?

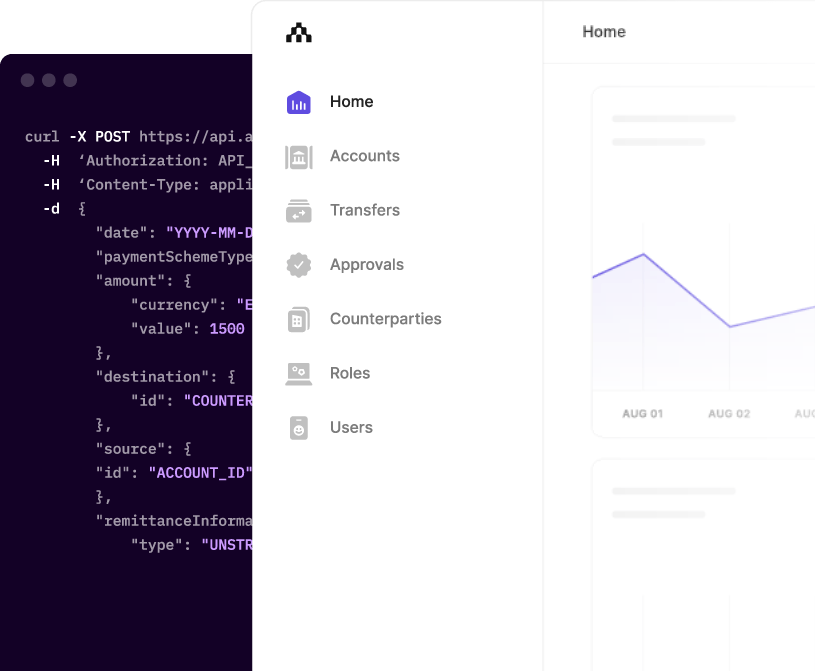

Along the lines of what Parisian startup numeral is working on, Atlar wants to read the spreadsheet its last rites and is building a platform that allows businesses to plug into an API that then in turn hooks into banks. Connecting the dots, what we’re talking about here is the automation of payment actions - initiating transfers, reconciling transactions, handling direct debits, and according to the startup, “more”.

“Accepting payments as a business is pretty painless now, but initiating them with your bank is still agonisingly slow and manual,” explained Joel Nordström, Atlar’s CEO. “This is why Atlar is on a journey to becoming the operating system for bank-based payments. By creating a new category, we hope to unleash a wave of innovation for our clients which will ultimately benefit European consumers and businesses.”

Atlar’s €5 million seed round was led by Index Ventures with La Famiglia VC, Cocoa VC, and a number of angel investors, including Revolut CFO Mikko Salovaara, former Executive Vice President of global sales at Adyen Thijn Lamers and N26 CFO Prof. Dr. Jan Kemper participating.

“Handling payments is the lifeblood of any business – but in our portfolio companies, we see how laborious it is to do that,” commented Index Ventures’ Sofia Dolfe. “Payments and payouts are exponentially more difficult for companies based in Europe, who often need to handle multiple currencies and local banking partners. Atlar’s solution is already today giving companies a boost by simplifying and automating all this unnecessary complexity. With its first-rate team, combining expertise across technology, product and customer relations, we believe that Atlar is building a key piece of infrastructure to help accelerate the growth of European tech.”

Would you like to write the first comment?

Login to post comments