Nivo, a Manchester, UK-based developer of identity verification tools for regulated industries like financial institutions, has raised more than £1 million in funds to enable its "global" growth plans.

The £1 million sum came through Maven Capital Partners' Northern Powerhouse Investment Fund with additional support from banking group Barclays.

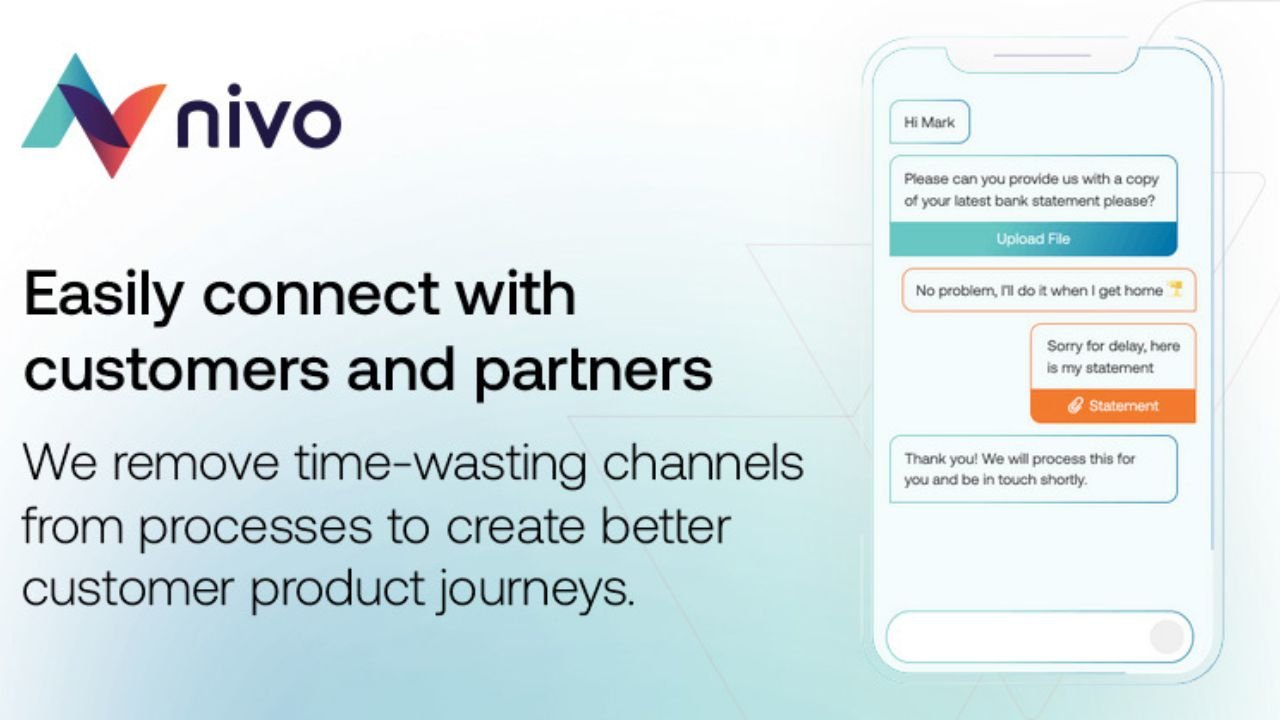

Nivo's software platform offers a secure instant messaging channel for communications from financial services firms to their customers, with baked in security tools like e-signatures, automated identity document scans and facial recognition.

The automation toolset is no-code meaning it can be implemented without programming scripts, and also includes support for open banking integrations with external financial services platforms.

Talking to your bank via a chatroom, whether automated or manned, can pose advantages for the customer. There's something less pushy about a WhatsApp-like discussion with a customer service rep, as opposed to a phone call, especially when financial product sales are involved.

More than that, the ID checks can be a real drag. I know for me personally, scrambling to remember some arbitrary detail from my credit record to clear banking security is one reason I rarely phone my bank.

Nivo claims around 85% of those who express interest in buying a financial services product fail to close the deal.

Founded by its CEO Michael Common and his chief commercial officer, Matthew Elliot, the startup's gaining ground with the UK financial players including some of the industry's more underserved segments.

For example, credit unions still make up a significant share of UK financial transactions. Despite the name, these institutions operate in a similar way to a commercial bank providing current accounts, savings and credit, the main difference being they have a non-profit ownership structure and co-operative ethos.

Nivo claims it has on boarded a "large proportion" of the UK credit union market, as well as many of its banks, building societies, lenders and brokers. Its traction with credit unions makes sense given that digital transformation for many unions won't always have been a big priority, at least for as long as some of the well known banks.

Nivo is a graduate from the 2017 cohort of Barclays' accelerator programme. The UK banking giant's principal investments MD, Gavin Chapman, says Nivo has demonstrated its market appeal since then.

"We are pleased to continue our support for Nivo, who have demonstrated strong traction since graduating from our 2017 accelerator program," Chapman said, "Nivo have developed a niche, yet fundamental innovative solution looking to disrupt the financial services industry. "

Nivo's B2B product is currently racking up 1,000 downloads of its verification-enabled secure messaging each day. It says in a typical month over 50,000 people use its platform.

Post-fundraise, the team is looking at making new hires in product development, marketing, customer success and sales. It will bring on a new sales director to complement its senior leadership team.

Speaking on behalf of Maven, investment director James Rosthorn said Nivo's offer represented a "pioneering" advancement for regulated financial institutions.

"Their product has become integral to many businesses and is embedded into many of their processes, saving them time and money," Rosthorn said.

Nivo's Michael Common added: "We are really pleased to be able to attract investors of the pedigree of Maven and Barclays into Nivo.

"We look forward to working with them, and to continue to build a leading Manchester technology company that continues to eliminate the paper, email and phone based processes that we’ve all had to endure when dealing with the financial sector and other service industries.”

Would you like to write the first comment?

Login to post comments