London-based all-in-one car admin platform Caura has raised £4 million via Lloyds banking. According to the company, the new fuel will be used to further develop existing products including admin, payments, and insurance, as well as press forward on an ambitious product roadmap. Since early 2019, Caura has raised in excess of £8.4 million.

Previous backers of Caura include the likes of TwinFocus, InMotion Ventures (the venture arm of Jaguar Land Rover), Road Ventures, Pareto Holdings, and Quiet Capital, alongside angel investors Jon Oringer, founder of Shutterstock, Antony Sheriff, former CEO of McLaren Automotive, and Rob Wilmot, serial entrepreneur, investor, and advisor to the UK Government.

Previous backers of Caura include the likes of TwinFocus, InMotion Ventures (the venture arm of Jaguar Land Rover), Road Ventures, Pareto Holdings, and Quiet Capital, alongside angel investors Jon Oringer, founder of Shutterstock, Antony Sheriff, former CEO of McLaren Automotive, and Rob Wilmot, serial entrepreneur, investor, and advisor to the UK Government.

While I personally haven’t owned a car in close to 25 years now, I know plenty that do, and while the admin behind one has advanced by leaps and bounds, at the end of the day, it’s still a tedious process.

However, if Caura gets its way, even the tedium’s days might be numbered.

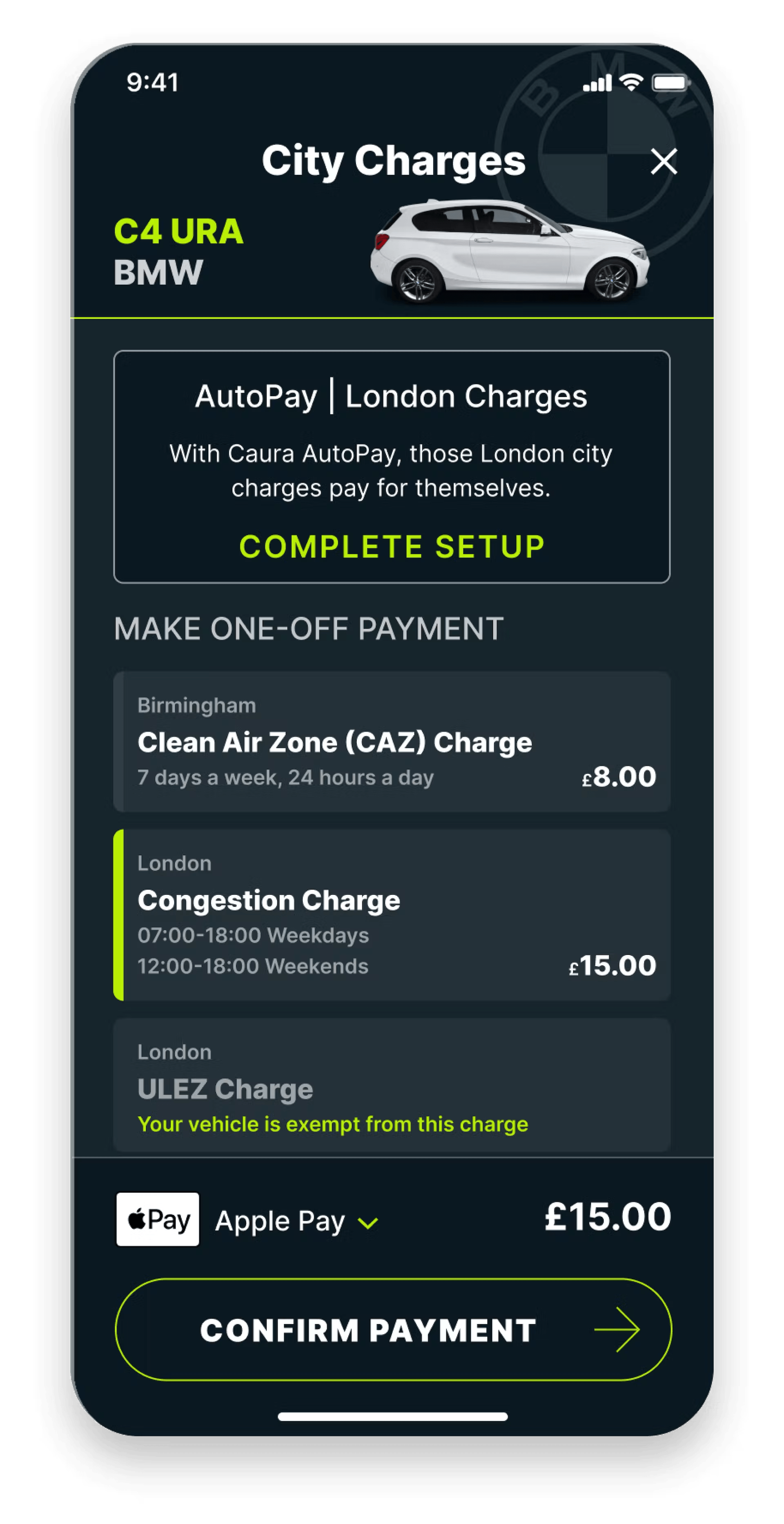

Founded in 2019 by former Apple Business Development Manager, Dr. Sai Lakshmi, Caura’s iOS and/or Android apps are putting all of the paperwork, payments, and protocols in one handy app, ultimately shaving hours off the admin that keeps the tyres on UK cars making contact with the road.

Tolls, MOT, vehicle tax, car insurance, and city congestion zone charges, are all handled with a few swipes and a few details taken. According to the company, one of the planned roadmap rollouts includes an option to handle parking charges as well.

“Lloyds Banking Group’s investment will help accelerate our plans to improve Caura for our consumer customers and our industry partners. As part of our mission to take the pain out of driving, we have already simplified payments for tolls, city charges and vehicle excise duty. Our next step is to apply our technology to overhauling the car insurance and maintenance processes which have remained antiquated and resistant to change,” said Lakshmi.

“Our future plans for Caura include developing embedded financial services such as motor loans and insurance, white-labeled payment solutions for automotive partners, and self-service SaaS solutions to SME customers.”

Would you like to write the first comment?

Login to post comments