Founded in 2012 by serial entrepreneur Ali Nikam, bunq is racking up quite a list of trophies. It holds claim to being granted the first European banking permit in over 35 years, was bootstrapped for nearly a decade, and now claims to be the first EU-based neobank to report a quarterly profit.

More specifically, a pre-tax profit of €2.3 million over the last quarter of 2022.

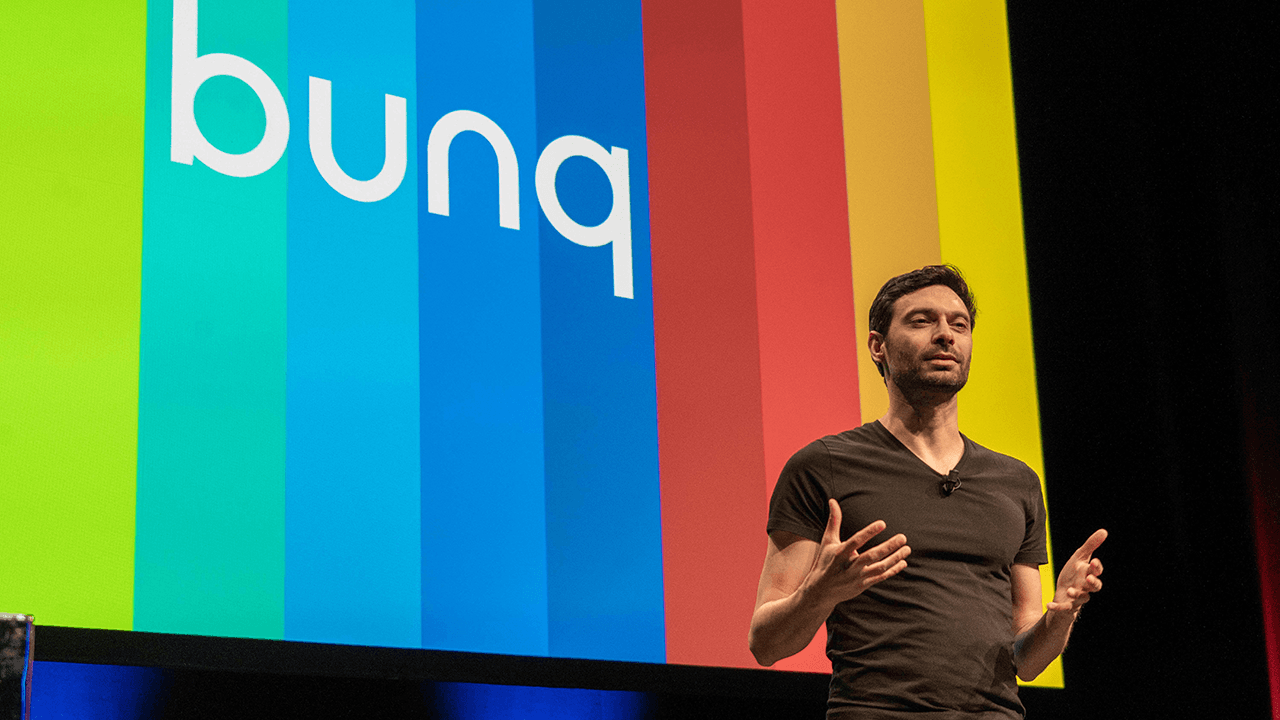

“I’m incredibly proud that, just a decade since our inception, bunq’s service-oriented business model has proven to be profitable. Truly aligning our user-centered philosophy with financial success, we were able to build a business that’s only successful as long as our users are happy,” said Niknam.

In the last quarter of 2022, bunq’s net fee income grew by 37 percent year over year and user deposits grew by 64 percent, to €1.8 billion at the end of 2022. According to a statement issued by the company, the €2.3 million in profits will be used to invest in further growth and expansion plans.

As a reminder, bunq’s first and only external funding, €168 million was provided by Pollen Street Capital, saw the company achieve a valuation (at the time) of €1.6 billion.

With the external capital, bunq indicated that M&A activities were on the horizon, and the announcement coincided with the company’s first - now former Pollen Street Capital property Capitalflow Group, an Irish digital specialist business lender.

Would you like to write the first comment?

Login to post comments