Bristol investment broker Wealth Club has invested £2.35 million from its EIS clients to lead a £4.5 million for London-based licensing data SaaS platform Fabacus.

Wealth Club managed to syndicate its original allocation in just five days. It pledged £500,000 initially but saw "unprecedented client demand" and decided to expand its ticket.

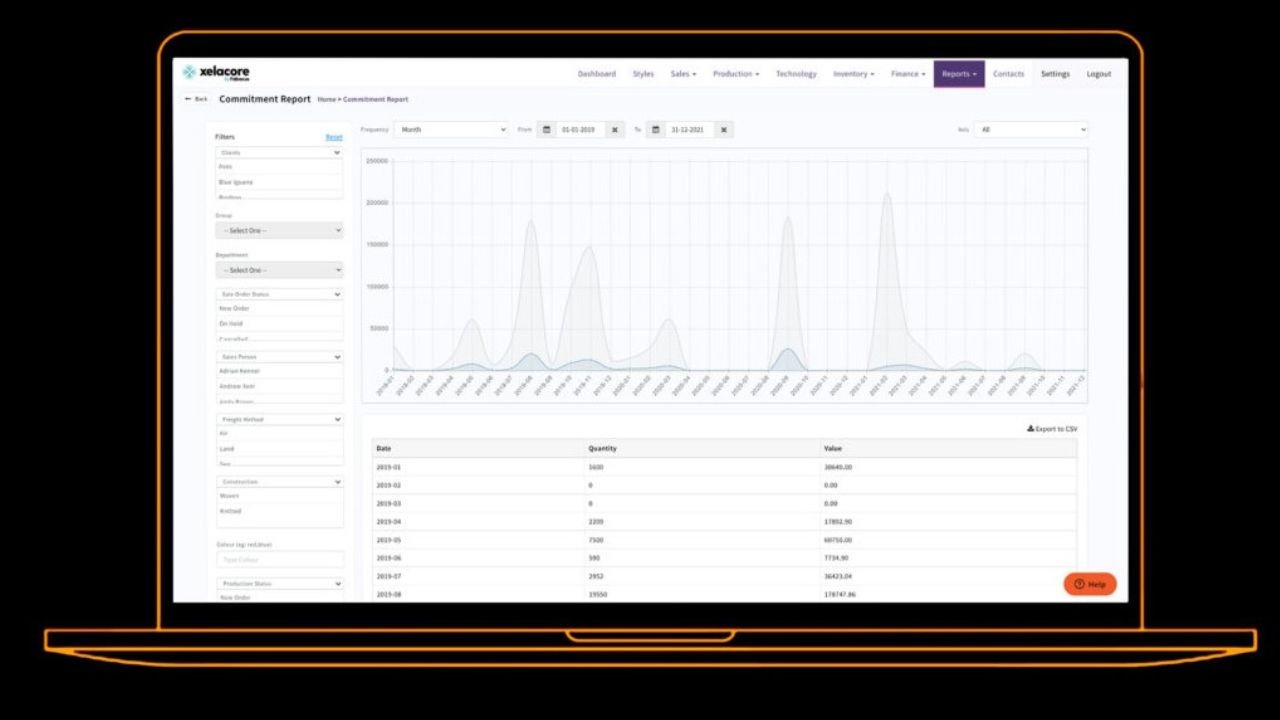

Founded in 2016, Fabacus has built a data intelligence platform, Xelacore, connecting fashion brand licence holders, licensees and end users. It has spent the past three years or so building its reputation by fostering a dialogue around best practice protecting fashion IP.

Fabacus claims existing operating procedures for monitoring licenced IP are "largely siloed." Due to a lack of data and tougher governance rules, licence holders frequently struggle to reconcile royalties that should have been paid on their product.

Alex Davies, Wealth Club founder and CEO, commented: "Our clients were quick to act when we launched this deal and it was oversubscribed in just five days.

"Global licensors have already demonstrated strong demand for Fabacus’ market-ready product, driven by the increasing scrutiny placed on governance standards within the industry, coupled with licensors’ strong desire to better engage audience and drive revenues.

"The company is expecting significant recurring revenues this year and if delivered this company will be a very valuable asset. Given the potential size of the market opportunity and the dedication and commitment of Andrew and his team we believe Fabacus has the potential to deliver attractive returns to our clients.”

In addition to tracking sales flow on licensed products,, Xelacore also packages that data to help devise strategies around consumer engagement, while also satisfying ESG supply chain reporting requirements.

According to Fabacus, around 20% of royalties are unpaid, with further risk to fashion brands arising from undetected counterfeiters.

Fabacus's lead founder and CEO Andrew Xeni previously started an eco-conscious fashion brand, Nobody's Child, since backed by clothing store operator Marks & Spencer.

Xeni said: "Thank you to Wealth Club and all the investors who participated, we are now set and secure for this exciting next phase.

"The team at Wealth Club have been amazing, consistently demonstrating incredible professionalism and efficiency throughout the entire process.

"Equally impressive was their swift understanding of the complex nature of our business and the intricacies of how our solution solves the deeply embedded challenges of the £300Bn+ licensing industry.

Existing shareholders in Fabacus include multiple seasoned retail operators; among them is Tom Singh OBE, founder of high street clothing chain New Look, Mitch Foreman, former EMEA consumer products CFO for Disney, and Inovia, whose lead Patrick Pichette was Google's chief financial officer. The company has also been backed before by Seneca Partners as well as Wealth Club.

In terms of its clientele, blue-chip customers include Ultimate Fighting Championship, the global mixed martial arts promoter, as well as games developers Ubisoft, Activision Blizzard, Epic Games. It also has entered into a strategic partnership with IMG Licensing, a major global licensing agency with coverage of Pepsi, Haribo, Volkswagen and Budweiser.

Equipped with £4.5 million in additional funds, Fabacus said it expected to grow headcount and strengthen its balance sheet, aiming to accelerate its expansion plans.

Would you like to write the first comment?

Login to post comments