While the fintech industry continues to grow and evolve, in recent years a new breed of sector players has emerged. Moving beyond just the balance sheet, these companies are placing more and more focus on offering solutions to financial institutions and corporates aimed at facilitating and expediting their ESG targets.

A new report published by Royal Park Partners provides a closer look at B2B platforms that are enabling companies to manage their ESG objectives, as well as providers of data & analytics solutions to investors, banks, asset managers, and businesses across sectors.

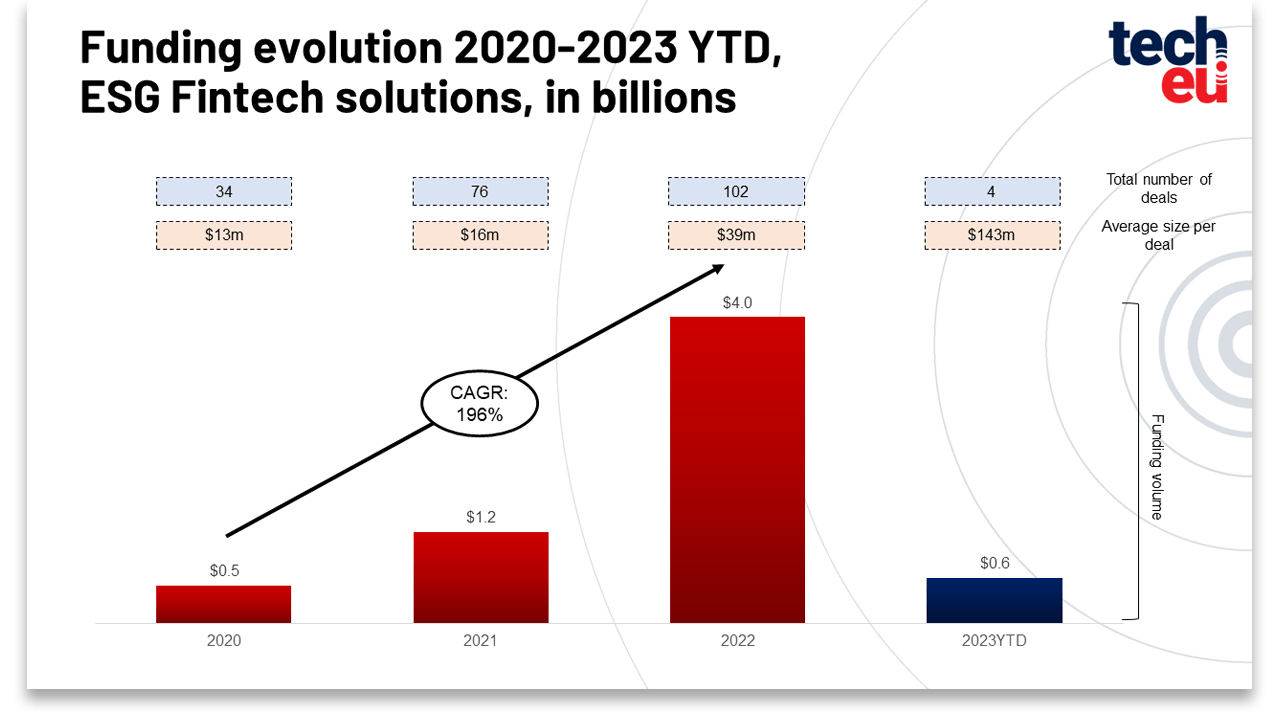

According to the report, since 2020, there have been around 216 financing deals globally in the ESG Fintech space, amounting to roughly $6.2 billion (almost 2x growth between 2020 and 2022). Additionally, the ESG Fintech space has seen a robust increase in capital funding on a global scale over the last 3 years reaching around $4.0 billion in 2022 (almost 2x CAGR for 2020-2022).

Looking at M&A activity & consolidators in the ESG Fintech space, the report concludes that ESG Fintech is a highly strategic area of growth for data providers and market infrastructure companies that are looking for plug & play targets to broaden their ESG data provision and asset management players needing to incorporate ESG metrics, ratings, and criteria as part of their investment processes.

The data indicates that over 300 transactions below $2 million of capital were raised in the last 3 years, and that the sector consolidation will be driven by a large dispersion of capital.

In their analysis, Royal Park Partners found that the ESG Fintech universe has been segmented into two sub-verticals:

- ESG Analytics and GRC solutions – including a broad universe of companies capturing solutions for: (i) risk assessment, (ii) data analytics, (iii) strategic and investment decisions, and (iv) disclosure and reporting tools and

- Carbon Management – covering the development of innovative solutions (technology-driven) for the acceleration towards a net zero emission world

Based on these sub-verticals, the report profiled 50 B2B ESG Fintech companies including Risilience.

A spin-off from the University of Cambridge’s Centre for Risk Studies, Risilience recently raised $26 million in a Series B round led by Quantum Innovation Fund, with existing investors IQ Capital and National Grid Partners participating.

The company provides climate and enterprise risk management solutions to global blue-chip enterprises. Its SaaS platform, through a proprietary “Digital Twin” technology, provides companies with solutions to analyse and report their climate impact, estimate their value at risk, and create Net Zero strategies.

The platform provides multi-decadal projections of how climate change will make extreme weather patterns more impactful on business assets and operations, and also short-term scenarios for how carbon pricing and market demand will likely change in different countries of the world.

ESG Fintech trends

According to the report, the ESG Fintech space is benefiting from:

- Shift towards a low carbon economy – it is estimated that a $300 trillion investment is needed to reach net zero by 2050

- Increasing regulatory disclosure requirements and – the adoption of ESG Fintech tools are driven by new reporting and disclosure requirements for companies and financial institutions

- Still largely unmet demand for innovative solutions for risk analysis, harmonization of disparate data sources, and incorporation of ESG into business and strategic decisions.

“…Companies face huge external pressures to adapt to climate change, including new regulations, increases in costs, changes in consumer purchasing, and investor demands…” Andrew Coburn CEO and Co-Founder of Risilience

Clearly, ESG Fintech is advancing beyond just an industry buzzword, with real, tangible results starting to bear fruit. With notable transactions including EcoVadis, Clarity AI, ESG Book, Watershed, Sweep, Patch, and Risilience, on the books, this is one space we'll be watching closely over the coming months.

Lead image: Karsten Würth

Would you like to write the first comment?

Login to post comments