According to a new report "How to influence fintech buyers" published by PR & marketing consultancy CCGroup, 70% of European financial institutions expect to increase investment in financial technology over the next 18 months, despite the challenging macroeconomic environment and wider economic downturn.

For providers who are looking to sell to banks and fintechs, on one side, this is good news, with market changes driving increased demand and investment, but on contrary it might be bad news because buyers are becoming more discerning in what they are looking for from providers.

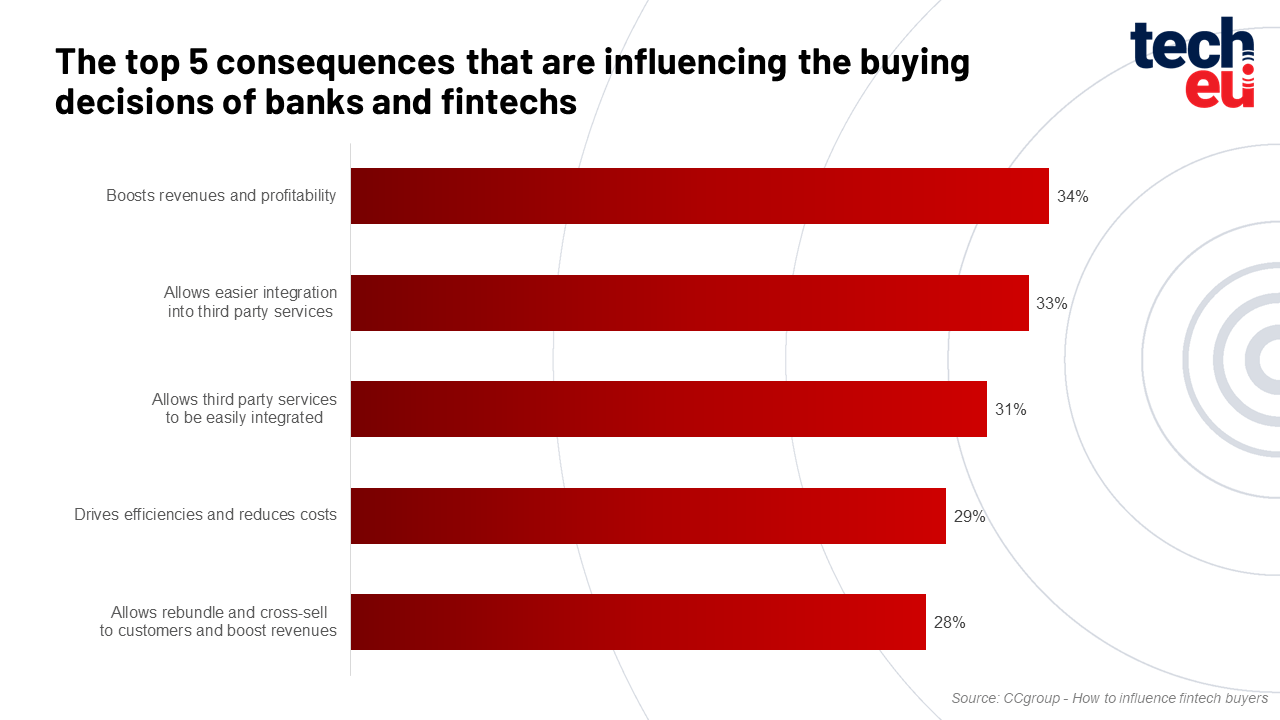

The average ticket price for upcoming tech stack investments marked a 300%+ increase compared to 2020 data (valued at €290,000 - €570,000). So, the buyers want solutions that will boost revenue and profitability (34%), allow them to more easily integrate third-party services (33%), and, conversely, allow third-party services to be more easily integrated into their propositions (31%).

Around 45% of buyers stated that they are only engaging with a supplier at both the discovery and/or purchase stage, meaning that a significant number of buyers are selecting a provider based on their market presence, rather than direct conversations.

According to the report, it looks like a fintech service provider's market presence is critical to getting through the longlist and shortlist stages. This notes a significant shift over the past two years, when just 4% first engaged at the stage of purchase, whereas today's numbers point to 20% engagement at the same stage now.

“…The biggest issue fintech providers face is that nearly half of buyers are only engaging with a supplier at the discovery or even the purchase stage. This means that firms are being evaluated from afar and selection depends on their reputation and online presence. Effectively, it’s all about the shop window...” Daniel Lowther, Head of Fintech at Ccgroup

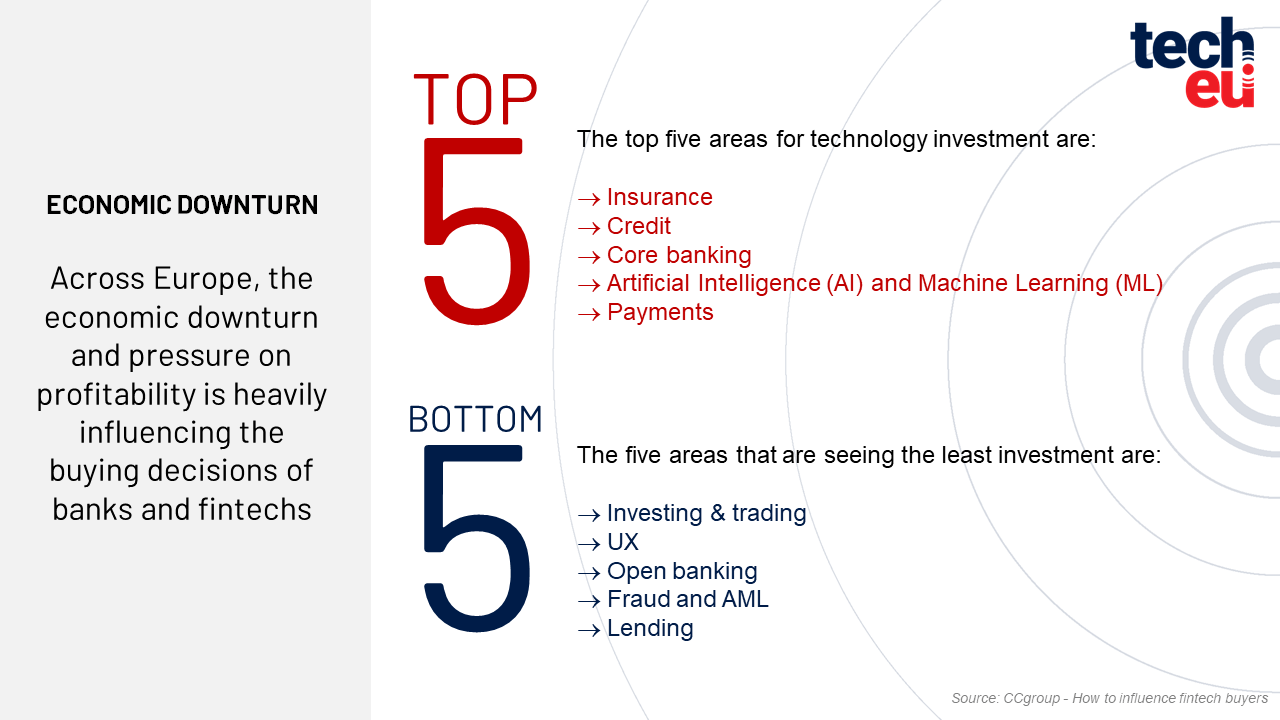

The report also analysed the buying landscape that technology providers will need to navigate, arriving at the top five areas for tech purchases: insurance (25%), credit (22%), core banking (21%), artificial intelligence & machine learning (20%) and payments (19%).

Speaking to channels, content types, and provider attributes that have more influence on the buying decisions of banks and fintechs than others, the report highlights that in the shortlist stage, channels such as trade media, advertising and internal business analysts, and content such as analyst reports, news articles, and industry debates perform most strongly.

When shifting from shortlisting to the selection, the channels and content of influence become more narrow because once buyers have identified potential technology providers, they want to deep dive into that business to inform the final selection.

The most influential channels are social media, search and events, and content such as analyst reports, whitepapers, and opinion articles. But, even though a firm may get the right mix of channels and content types, if it is not carrying the right messages or demonstrating the right credentials then the provider will ultimately be unsuccessful.

The report emphasises that the buyers want to work with providers that have market momentum, can provide evidence of performance with a company and technology information that is easily found online, and are reputable among media and industry analysts.

In addition to asking banks and fintechs what would boost their selection of a technology provider, the CCGroup also probed what would discourage banks and fintechs from selecting a provider. The top responses were lack of awareness among industry analysts (31%), lack of news from the supplier (29%), and lack of information about the supplier online (28%).

According to the report, the biggest obstacles to getting a purchase over the line were the due diligence process regarding the supplier (38%), getting consensus across the business (36%), and lack of performance data and evidence from the provider (33%).

“..The purchasing landscape is evolving. Increasingly, buyers are looking for technology providers that put a major focus on values and ethics, governance and oversight, and supplier reputation over the more traditional metrics like cost, flexibility, and cutting-edge tech. Purpose-driven firms with strong reputations and track records that can evidence their performance are best placed to win…” Alexandra Santos, Head of Emerging Fintech at Ccgroup

Decision-makers are becoming increasingly demanding, and what was before perceived as winning factors for vendors - cutting-edge technology and cost-effectiveness - are sinking lower and lower on the priority list, with attributes such as ESG, company culture, and simplicity of integration taking the lead in determining which tech provider to select.

Would you like to write the first comment?

Login to post comments