Tech Nation, the champion of so much over so many years has published its swan song, the Tech Nation Report: How to build a scaleup, and it's one not to be missed.

In one of its last final acts, the Tech Nation report addresses key issues regarding the state of UK tech over the past decade, with the aim of providing an important resource to the technology ecosystem to help and enable better positioning and strategic planning going forward, offering up suggestions on how companies can respond to remarkable challenges and conditions, both past, present, and future.

In a poignant curtain call, Tech Nation makes a case for what needs to happen in order for the UK technology ecosystem to continue to grow, to maintain, and to strengthen its position on the global level.

By the numbers

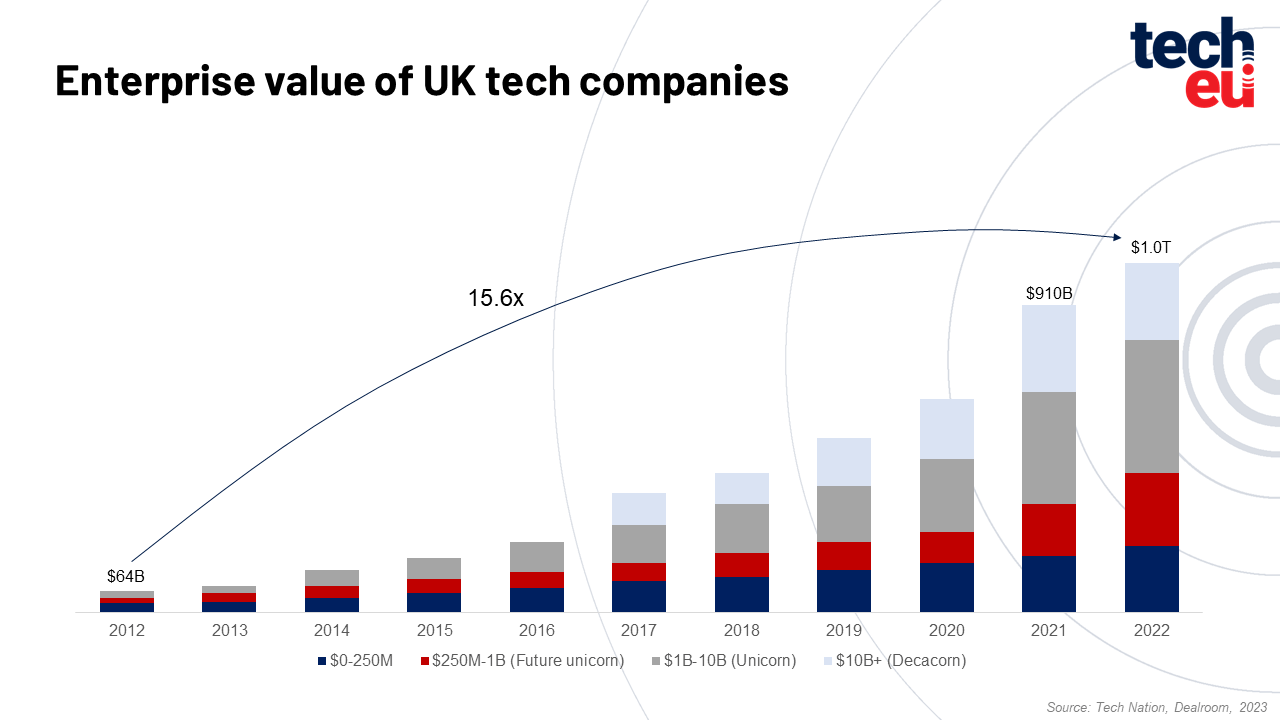

According to the Tech Nation Report, over the last ten years, scaleups in the UK have returned around $583 billion in value (with any form of exit – acquisition, SPAC, or public listing). And here is the real value – to see how the ecosystem brings economic value during its development and growth. Once something like that has been achieved, the expectations are that it will continue and grow even more. In the next decade, to return approximately the same value, the UK companies need to set a new goal – to reach an exit value worth $2 trillion.

At this moment, according to the report, the UK tech ecosystem is valued over $1 trillion. Based on projections, if the same trend continues in the next ten years, it will be valued at $2.6 trillion. On the other side, it is to be expected that better conditions for scaling will be created, which would mean that the potential increase of the ecosystem can be estimated at much more.

Despite these positive predictions and expectations of a continuation of the growth trend, what's clear is that the UK tech ecosystem is at a turning point where two scenarios are possible: first, that the bubble bursts, or second, that future growth is promoted and increased.

Investment, investment, investment?

With all the positive trends that can be drivers of further growth, it is an inevitable fact that over the last year, investments globally and also in the UK technology scene have been in decline (32% globally, or 28% in the UK). Although the volume of investments in 2022 is 72% higher compared to 2020, compared to 2021 it is smaller (by over 1,200 investments). The biggest drop in investments was in those worth $250+ million, and those in the pre-seed stage (worth less than $1 million - 41%).

First but not leading

On the global level, the UK is in third place when it comes to technological ecosystems (after the US and India).

On the European tech scene, the UK is still dominant when it comes to investments in startup and scaleup companies, and these investments are significantly higher than in France and Germany combined (which are just behind the UK).

Although the UK remains the leader, the research shows that France, Italy, and Sweden are the only countries to have seen positive growth in investment after a record year of covid recovery in 2021 (as opposed to the UK which saw its biggest 5-year drop of 24.7% ). Observed in the period of the last 10 years, France is the only country that recorded positive growth every year.

Various initiatives and policy measures in France that resulted in positive growth over the years include:

- The increased launch of growth programs in agritech, healthtech, and climate tech as well as the government backed startup agency

- Big investments (€500+ million) into deeptech startups and scaleups by the country’s state bank, Bpifrance

- Launching of the France 2030: the €54 billion Investment Plan aiming to sustainably transform the key sectors of their economy – energy, automotive, aeronautics, and space – through research, innovation, and industrial investment.

It's clear that if there are mechanisms for supporting the sector, encouraging appropriate conditions, and creating policies and measures to strengthen the sector, with continuous growth there is a chance to reach the highest position or even to overtake the lead.

The last decade of UK tech has been explosive; growth has been unprecedented, and the positive economic impact created by founders has been almost unimaginable. As UK tech continues to mature, we must take every opportunity we can to collectively re-imagine, and change ecosystem conditions for the better. Dr. George Windsor, Data and Research Director at Tech Nation

The UK as a catalyst

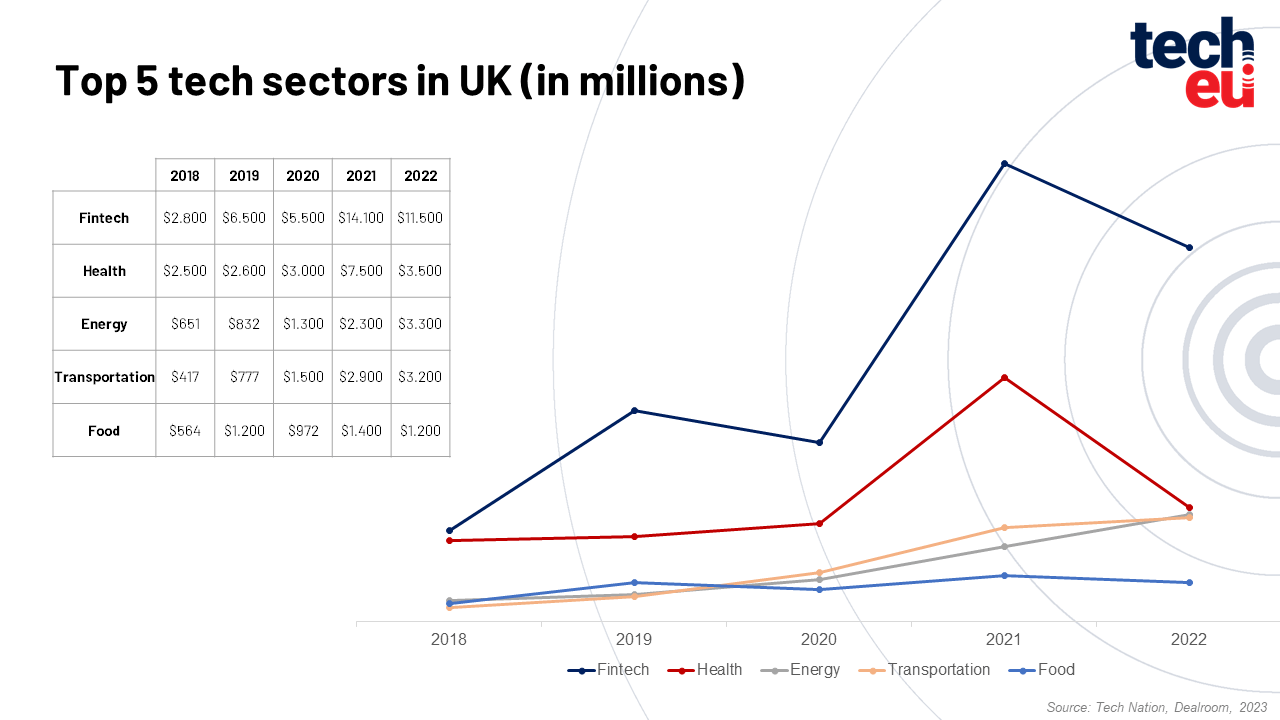

So, yes, the UK is on the top of the list and the values of the largest industries in the UK contribute to this – fintech ($11.5 billion being invested), healthtech ($7.5 billion), and energy ($3.3 billion).

As the data shows, fintech is almost 3.3x times bigger than any other industry. The development of sub-industries, such as payments with a total raise of $3.0 billion in 2022 (Checkout.com and GoCardless both receiving late-stage rounds in 2022), wealth management with total raise of $2.5 billion in 2022, and banking with total raise of $1.8 billion in 2022 (neobanks like Monzo and Starling Bank) contribute to this result.

Days gone by, days to come

The trends are clear. But, is there enough capacity and incentive to continue that trend or will the position, that was purposefully built and confirmed by the results from the last decade, be lost?

Based on other examples it can be concluded that initiative and encouragement are needed from the government, which will create clear policies and support mechanisms that respond to everyone and encourage all participants of the technological ecosystem to grow. In this way, they will create/maintain a "technological and scientific superpower that will continue to encourage growth and development".

As Stephen Kelly, Chairman at Tech Nation commented:

The Government needs to develop a plan that creates the environment and platform for UK tech to be the rocket fuel for growth in the economy and address some Achilles heels of the UK economy. The opportunity for the UK Government with the impact of tech-enabled innovation, machine learning and automation has huge potential for all industries from Agriculture to Waste Management with a massive productivity boost where currently the UK languishes at the bottom of the G7 productivity league. The opportunity is ours to take.

Recommendations that resulted from TechNation's research include the following:

- Patient capital should be included in all stages of company growth (not just at early stages) – deeptech and climatetech are the industries that need 15x investments by the end of the decade.

- Digital or tech inclusion and narrowing the talent gaps is something that needs to be developed and encouraged. Addressing this issue could add up to $400 billion in added value to the UK tech ecosystem over the next decade.

- Reaching the values should be a priority, both through strengthening capital, talent, and knowledge sharing, as well as providing support in enabling high exits, which could contribute to the creation of value in the UK technological ecosystem in the next ten-year period up to $550 billion.

Macroeconomic trends are very important and can help define and encourage individual sectors in order to maintain the growth trend and encourage the creation of additional value. However, what is inevitable is the existence of technological leaders who will create policies, incentive programs, and measures in order to continue the growth trend and maintain a highly ranked position. Therefore, not only strong rhetoric is enough, but also activities that will confirm and justify that rhetoric.

Tech Nation has years of experience facilitating and helping UK tech companies scale, both at home and abroad. Over 40 cohorts and 1000+ companies have successfully graduated from Tech Nation’s growth programmes. Alumni include Skyscanner, Darktrace, and Monzo, as well as 3 of the UK’s ‘decacorns’; Revolut, Wise, and Farfetch.

Earlier this year, Tech Nation announced that it will be closing its doors from 31st March 2023, following the termination of its core government grant funding.

Would you like to write the first comment?

Login to post comments