“You shouldn’t be using BNPL to buy a pizza,” says the CEO of French 'buy now, pay later' startup Alma, taking a pot-shot at rival players in one of the hottest areas of financial services right now.

BNPL, which allows consumers to pay for goods in instalments typically interest-free, has been on a bull-like charge across Europe in recent years, supercharged by ballooning e-commerce spending during Covid.

Swathes of Gen Z'ers across the continent are opting for BNPL instead of credit cards, wooed by influencers promoting BNPL firms like Klarna and Clearpay on social channels like Instagram.

Amid growing merchant acceptance, BNPL is set to grow to a €300 billion industry in Europe by 2025 while Deloitte says by then it will have captured around 11 per cent of the European e-commerce market.

BNPL has mainstream appeal

While still smaller than the credit card industry, the upward trajectory of the market points to its mainstream appeal.

Joerg Diewald, chief commercial officer of Germany-headquartered fintech Solaris, which is behind BNPL product Splitpay, said: “The UK market was one of the early adopters of BNPL which led to a ripple effect across the major European markets.

“While retail purchases are the first examples of BNPL that might spring to mind, I can see the trend moving into essential sectors such as healthcare, energy or travel, especially as costs rise.”

Upward trajectory held in check

Yet BNPL’s rapid growth has not been without controversy and challenges: critics say the still largely unregulated industry is a trapdoor to unsustainable spending and reliance on debt.

Furthermore, European BNPL golden child Klarna, valued at $6.7 billion, has lost its sheen, hit by job cuts and a valuation cut while BNPL providers are also facing the challenge of rising interest rates, meaning a higher cost of funding.

Tech.eu spoke to a range of BNPL players across the continent and fintech experts, taking a temperature check on the BNPL industry and where it is heading.

BNPL European players

BNPL is undoubtedly one of the most popular areas of financial services right now: everybody wants in on the action.

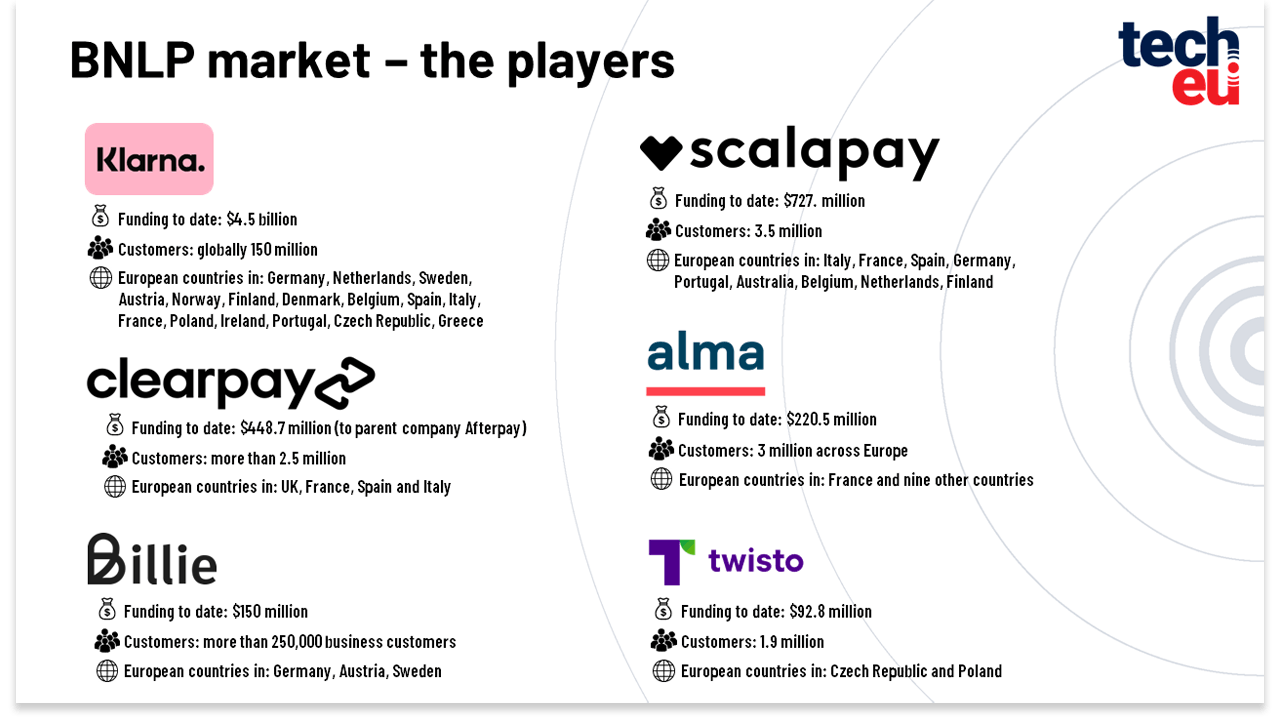

Globally, along with those firms synonymous with BNPL like Klarna, Clearpay, Scalapay, Alma, Billie and Allegro Pay; there are BNPL offerings from card giants MasterCard and Visa; Goldman Sachs and Apple; PayPal; traditional banks; fintechs like Revolut and Monzo; and a whole host of other startups.

In Europe, Klarna is currently the dominant force, yet rivals are also making a name for themselves across the continent.

Positioning of BNPL firms

On the face of it, some of Europe’s BNPL players may appear indistinguishable from each other, offering a similar service at a website check-out, albeit wrapped in flashy marketing targeting millennials.

But along with their colour brand positions, and flexibility on repayment terms, there are other differences.

On strategy, Klarna boasts diverse revenue streams and its end goal is to be an e-commerce platform with payments as the heartbeat of its monetisation model.

Others are seeking to differentiate themselves through their target market or their brand pitch.

For example, France’s Alma, headed up by the 37-year-old former Stripe executive Louis Chatriot, has taken advantage of Klarna not being in its domestic market.

BNPL with a social conscience

The five-year-old startup, which processes more than €2 billion worth of transactions annually, does not charge late payment fees, unlike some of its rivals.

“We are the only BNPL in Europe that has never charged a single euro of late fees,” he says.

“We want to be successful but not at the expense of the consumer. That means we have a very strong incentive to lend to the right people."

He makes the point that rivals reaping high margins through late payments fees are “incentivised” to lend to the people who will struggle to pay back.

Furthermore, Chatriot also says that its product can’t be used to buy groceries or food delivery, a controversial subject with critics saying it pushes families struggling with the cost of living into unmanageable debt.

A newspaper investigation in the UK last year found that BNPL firms Zilch and Clearpay were among those advertising BNPL deals to buy groceries and alcohol while Klarna and Deliveroo faced criticism for teaming up to allow customers to pay for their take-aways in instalments.

Chatriot adds: “When we look at Klarna, in particular, and UK-based companies, it is true we are sometimes puzzled by some actions , also sometimes puzzled by the idea of working with food delivery."

“You shouldn’t be using BNPL to buy a pizza,” he added.

Klarna of Eastern Europe

Meanwhile, Czech banking app Twisto, which calls itself the “Klarna of the East”, is trying to corner the BNPL markets in the Czech Republic and Poland.

It was created by tech entrepreneur Michal Smida, who came up with the idea of Twisto while working in London, believing that personal banking in the Czech Republic lacked security and autonomy.

CEO Smida believes Twisto’s BNPL omni-channel offering (which can be used online and in physical stores) gives customers security in online shopping.

Unlike Western Europe, he says “credit has been a bit of a taboo and has a bit of a stigma” in Eastern and Central Europe.

He says: “People don’t like to borrow, they don’t like to leverage themselves up. So I would say that 'buy now, pay later' is still at an early stage in Eastern and Central Europe.

“And the penetration is maybe at five to seven per cent of the market, compared to the UK maybe 20 or 30 per cent,” Smida added.

The rationale for Twisto to focus on Eastern Europe, he says, is that there are “a lot of local winners across Europe” in BNPL.

He argues that even giants like PayPal would have trouble dislodging home-grown BNPL giants.

Unlike Alma, Twisto –which is currently being divested by its parent company, the Australian BNPL firm Zip- can be used to buy groceries.

Smida says that one of its biggest clients is grocery delivery giant Delivery Hero, but highlights that its product is a monthly billing product.

He says: “We position ourselves more as a daily payment provider, so we offer an app, we offer a revolving line of credit. Twisto today is used for daily payments and people use us almost as a credit card.”

The B2B BNPL

Business-to-business BNPL is the sizzling sister of the B2C BNPL sector and could become the “driving force in the short-term business financing space”.

Berlin-based B2B outfits Billie and Mondu, and London-based Hokodo, are some of the leading lights in B2B BNPL across Europe.

The market comes in various forms, including B2B marketplaces, while Billie is focused on transactions between B2B e-commerce firms.

Matthias Knecht, the CEO and co-founder of Billie, which is valued at $640 million and is the B2B partner of Klarna (crazy pink logo and Snoop Dogg not a good fit for the business world) and Mollie, the Netherlands-based payment company.

Knecht says: “This is our core strategy of working with very large partners like Klarna and Mollie and others in addressing their merchant base.”

Knecht explains the attraction for businesses.

He says: “They want to have a very simple process. For some businesses, it is about paying later and getting the financing aspect to it. But for others, they just want the simplest and easiest payment method they can get.”

He says businesses are used to paying via Klarna and PayPal for consumer goods, and expect a similar type of “easy checkout” service for business purchases.

B2B lagging behind B2C

Knecht adds: “Over the last 20 years, we have seen the B2C payments being completely transformed. However, none of this innovation has made it over into the B2B space just yet.

“B2B payments is still stuck somewhere in the late 1990s, with paper-based processes, completely manual processes.”

But B2B BNPL is a much more complex process than B2C BNPL, he hastens to add.

Unlike B2C, B2B BNPL providers deal with a smörgåsbord of businesses from sole traders to public services to big corporations.

Then throw in the difficulty of credit and fraud scoring, and according credit limits to businesses, and one can understand why B2C players are giving B2B a wide berth.

Geographically, Knecht says the general level of demand for B2B BNPL is “ubiquitous” across Europe, but it is perhaps more pronounced in German and Switzerland.

On B2B BNPL, Diewald says: “It could become a driving force in the short-term business financing space moving forward, especially for small businesses and freelancers as the gig economy continues to grow.”

But Kieran Hines, an analyst at Celent, is not convinced B2B BNPL will be a bigger market than BNPL B2C.

He says: “There will no doubt be use cases for this in the B2B space, but there are already many ways for businesses to access credit.

“BNPL would exist alongside those, so may not have such a clear growth path as it has had in the B2C space, where it’s become well entrenched in the check-out offerings of quite a few retailers.”

New regulations coming in

One of the key reasons the BNPL sector has been able to grow so quickly, and the reason valuations of BNPL firms like Klarna have been so high, is the sector has hitherto been lightly regulated.

Currently, many BNPL providers have the same model in each country they operate in across the continent.

However, things are changing, and regulation is coming to the UK BNPL market and across the EU, where it is set to fall under the gaze of the revised Consumer Credit Directive.

What impact this will have on the revenues of BNPL providers will be seen over time, but will likely professionalise an industry which, some argue, still carries a whiff of youthfulness and, in some cases, amateurism.

Changes are afoot

One particularly hot topic within BNPL of late has been the sharing of credit information.

Last year, Klarna said it would share its repayment data with two of the UK's biggest credit reference agencies. Others have also gone down this path.

Across Europe, Chatriot is calling for more “data sharing”, with EU rulers forcing banks and utility firms to share customer data with BNPL providers so they can make better lending decisions.

He says: “So many bad stories could be avoided with the right knowledge of the customer.”

Experts say that, in general, BNPL providers report higher levels of bad debt than credit cards.

According to estimates from anti-fraud firm Fraugester, for every $1 billionof transaction volumes, the BNPL providers have an average of $19.2 million in bad debt, compared with $270,000 for credit card companies.

The future outlook

With new entrants continuing to pour into the market (Apple and Goldman Sachs are the latest with Apple Pay Later), the sector is heating up.

On the future of the industry, Chatriot says there will be consolidation between BNPL providers with some companies “dying”.

He says two types of BNPL will emerge: one focusing on consumers, like Klarna, and the second will be merchant-focused firms, like Alma.

Smida says: “I don’t think it is a game of winner-takes-all. I don’t think it is a market like MasterCard and Visa where you have two oligopolies globally running the payment rails.

“I think you can have multiple players servicing multiple niches. Maybe some focus on FMCG, somebody focused on car repair.”

Some experts say that to survive, smaller and mid-sized BNPL firms will have to be acquired by bigger players that can use their BNPL service.

Alternatively, these BNPL firms will have to offer other services, perhaps launching bundled subscription services or embedding more banking services in their offering.

There is little doubt BNPL is a strong stepping stone to acquiring customers and those that can monetise this customer base with multi-pronged financial businesses will be the winners, experts say.

But whether BNPL will ever replace credit cards, as some have said, is open to debate.

Hines adds: "What is likely is that BNPL will replace some credit card transactions, particularly at the kinds of merchants where it has the most applicability, but that credit cards will also continue to play a major role in the way customers pay.”

Also read:

Neobanks across Europe fatten up as VCs demand profits

33% of Millennials and Gen Zs in the UK consider putting money in stocks and shares ISA

Would you like to write the first comment?

Login to post comments