Stockholm-based Bits Technology has raised €4 million in a seed funding round that will see the company further develop its API that allows fintech product builders to connect to multiple service providers and data sources for Know Your Customer and Know Your Business processes.

The €4 million seed round was led by Unusual Ventures with Fin Capital participating alongside existing investors including Cherry Ventures, Alliance Ventures, Forward VC, and Greens Ventures.

There must be some kind of way out of here

If you’ve been paying attention, there’s certainly no shortage of companies out there working on solutions to make the lives of fintech product developers easier.

One headache for many a fintech developer is the business of KYC, KYB, and AML (anti-money laundering) checks and the detection thereof. Specifically in the sourcing of data and the troubles of being locked into a single provider.

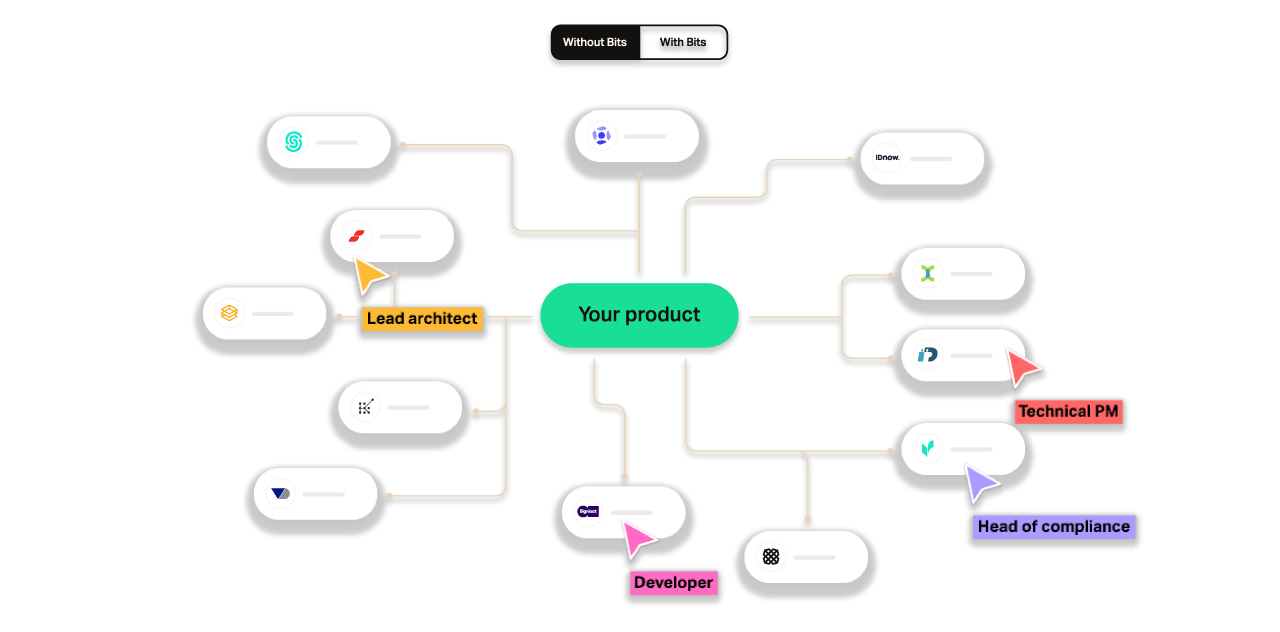

To solve this issue, they’ve often resorted to Machiavellian tactics, stitching together a patchwork of various systems all suited for different purposes but achieving the intended outcome in the end.

There’s too much confusion

The problem with this approach is that these cobbled-together workflows provide no centralised overview, and ultimately affect the onboarding of new customers and users.

Now add to the fact that the customers of fintech services providers each have their own unique set of specifications and needs and the patchwork needs to be rejiggered for each client, and you’ve now set the stage for a great deal of explicatives being muttered under ones breath.

I can’t get no relief

Bits founders Jonatan Klintberg (ex-Tink), Robin Lantz (ex-Tink and Klarna), and Fredrik Eriksson (ex-AWS) say we've been through that, and this is not our (customers) fate.

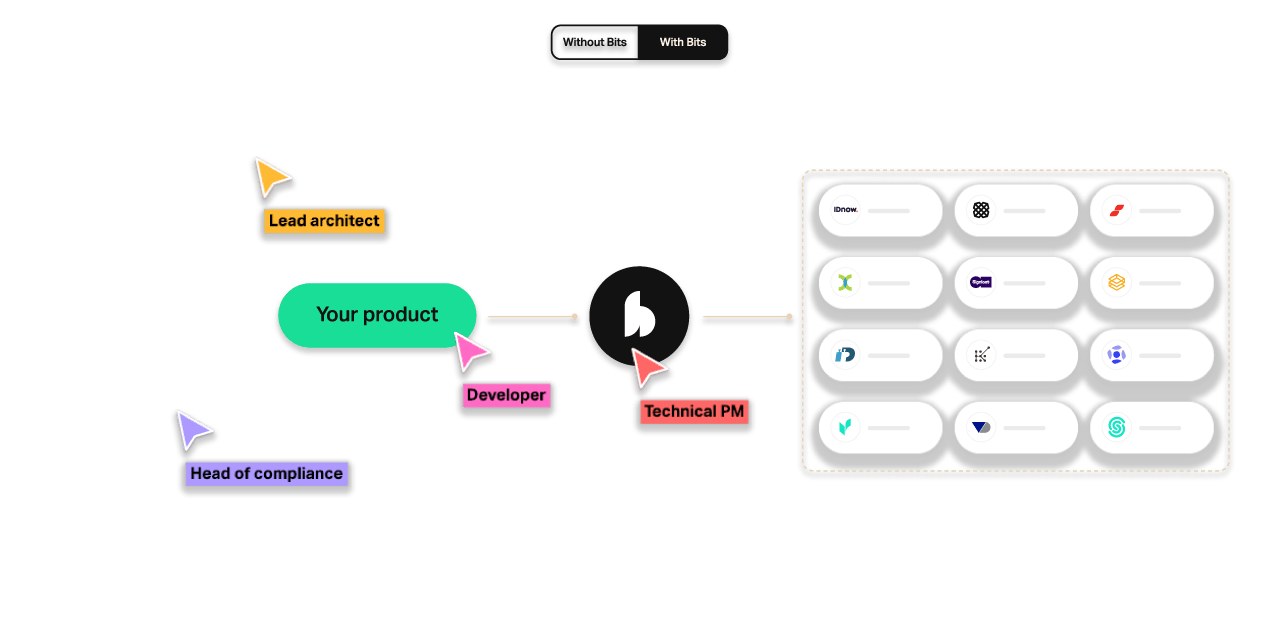

Along the lines of what Alloy, Sardine, and Sikoia are all working on, Bits is bringing forth an API that allows customers to all but eliminate the headaches associated with the KYC and KYB process. According to the startup, customers can create onboarding flows that can be scaled across multiple markets without fretting about local compliance regulations and the integration of new service providers.

In so much, Bits' solution provides teams with the ability to build a customised onboarding experience alongside customer reporting functionality that meets AML requirements and user management, have access to actionable data, and the ability to customise rules, assess risk, prevent fraud, and maintain compliance.

All along the watchtower.

Would you like to write the first comment?

Login to post comments