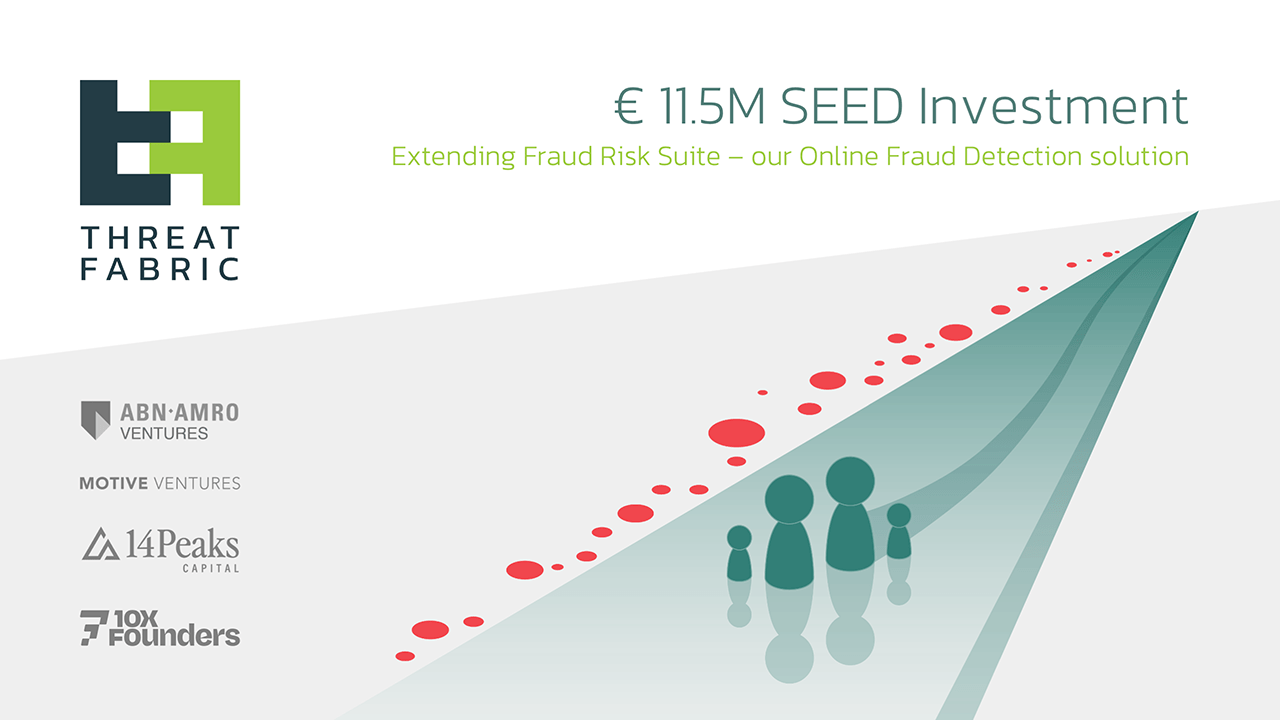

Amsterdam-based provider of fraud detection solutions and intelligence ThreatFabric has raised €11.5 million in a seed funding round. The company intends to use the investment to further develop its fraud detection technologies, specifically incorporating those of behavioural-based detection techniques.

ThreatFabric’s €11.5 million seed round was co-led by ABN AMRO Ventures and Motive Ventures and saw participation from 10xFounders and 14Peaks capital.

While fraud itself is nothing new, as with any and many new and emerging technologies, there’s always potential for nefarious actors to use this technology to their advantage. And such is the case with the rapid advancements in AI.

A UK Finance report highlighted the annual increase in online fraud numbers, with losses totaling £1.2 billion in just the first half of 2022 alone, a figure up 7% year-over-year from 2021.

And while there are a number of anti-fraud startups making a positive contribution helping clients, in this case banks and financial institutions fight back against the fraudsters, Amsterdam’s ThreatFabric thinks its approach stands out from the crowd.

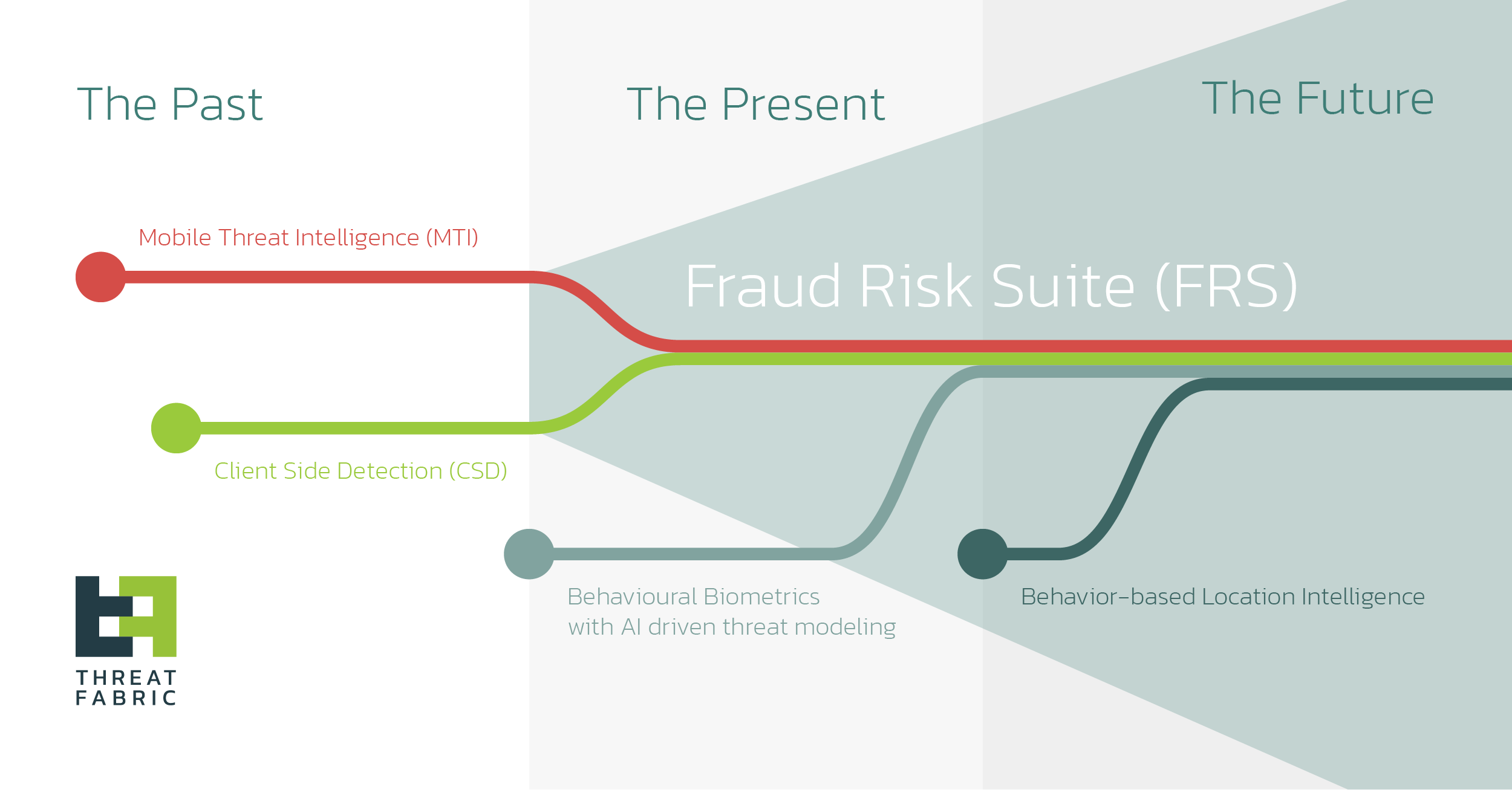

According to the company, their approach to validating if a user is genuine analyses behaviour biometrics based on mobile sensors or keystrokes, but also has indicators of very clear potential attack paths and the continuous changed footprint of fraudster tools inside any payment solution.

Once a fraudster visits these attack paths, such as a strong request/desire to empty savings accounts, or uses new attack tools (cough AI cough), ThreatFabric’s additional risk scores get tacked on to an overall behavioural analytics engine, thus separating the wheat from the chaff. Or in this case, the verified you-are-who-you-say-you-are user vs. the phony.

On the investment ABN ARMO Ventures’ Managing Director Hugo Bongers commented, “The fraud issue is large and complex problem, that is only expected to get bigger in the future, as technologies like AI further develop. As a long-standing partner of ThreatFabric, ABN AMRO Bank has seen ThreatFabric’s profound understanding of the fraud issue and the high-quality solution the company offers.”

Would you like to write the first comment?

Login to post comments