GP Bullhound is bullish about the future. Revealed in their latest Titans of Tech report, "Building blocks for the next wave", the backers of Klarna, Spotify, and Revolut (to name but a few), examine company growth figures across the European tech sector in the year up to 31 March 2023 and offer up predictions on which startups are likely to achieve the coveted Unicorn status within the next 12 months.

Although in recent years the market has been tossed about on a seemingly unending sea of pandemic and post-pandemic factors, global social and macroeconomic instabilities, these conditions have led to the stark realisation that in order to survive and thrive, companies need to be (consistently) ready to adapt to new environments, new markets, and new circumstances.

The data shows that in the next decade, big companies will hit $2 trillion, specifically in the areas of AI, climate tech, and workplace productivity/HR software as these industries are gaining momentum, evidenced by the billions in funding these sectors have received as of Q1 2023.

Key takeaways:

- The total Unicorn value surpassed the $1 trillion milestone reached last year, despite the instability and uncertain social and macroeconomic factors that hit the European tech ecosystem.

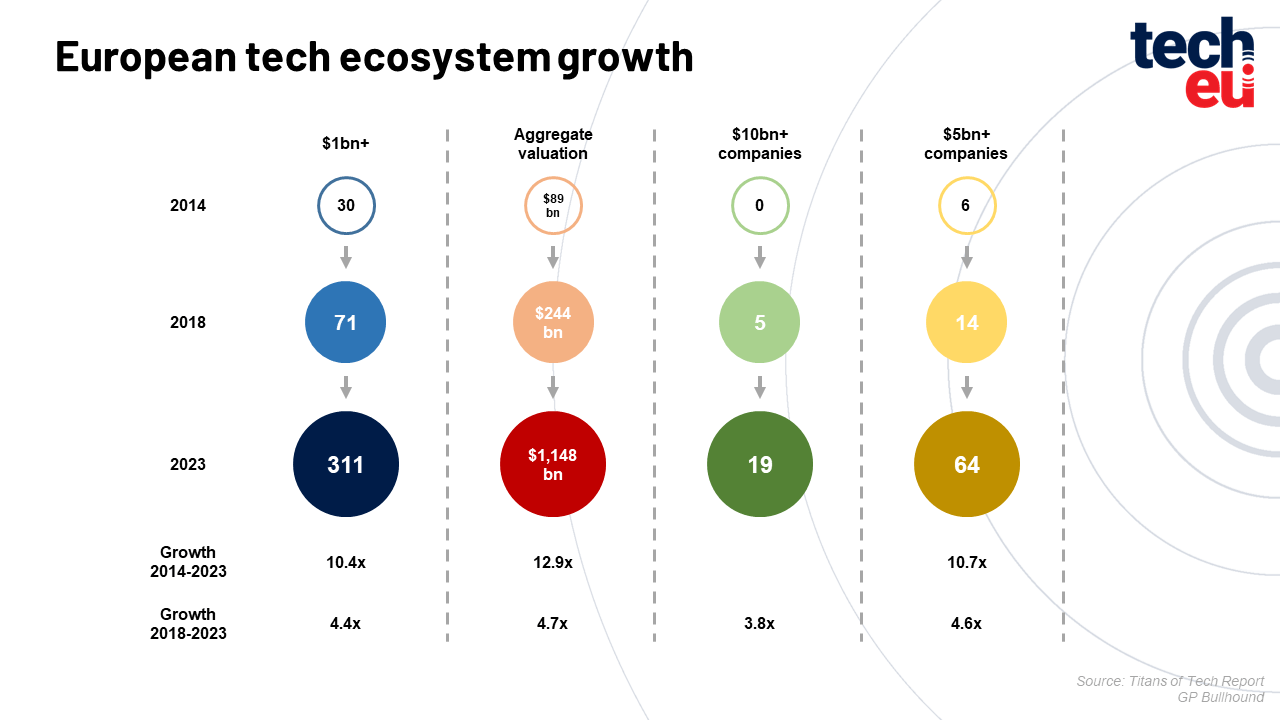

- The creation of new Unicorns is on the same level as in the pre-pandemic period, although it slowed a bit. The total number of European Unicorns is up around 10x since 2014, with Decacorns up around 4x since 2018.

- Even though the funding growth is normalised, as in Q1 2023 it returned to a pre-pandemic state, the founders still have to be careful.

- Debt funding reached €23 billion in 2022 (up by about 2x from 2021). In order to avoid the risk of a down round, some European founders have turned to private debt.

- In the next two years, France is expected to lead the new Unicorn charge, with 20% of the top contenders hailing from the region.

A slow-growth but still resilient Unicorn ecosystem

The drop in the number of new Unicorns does not necessarily mean that it is a bad situation.

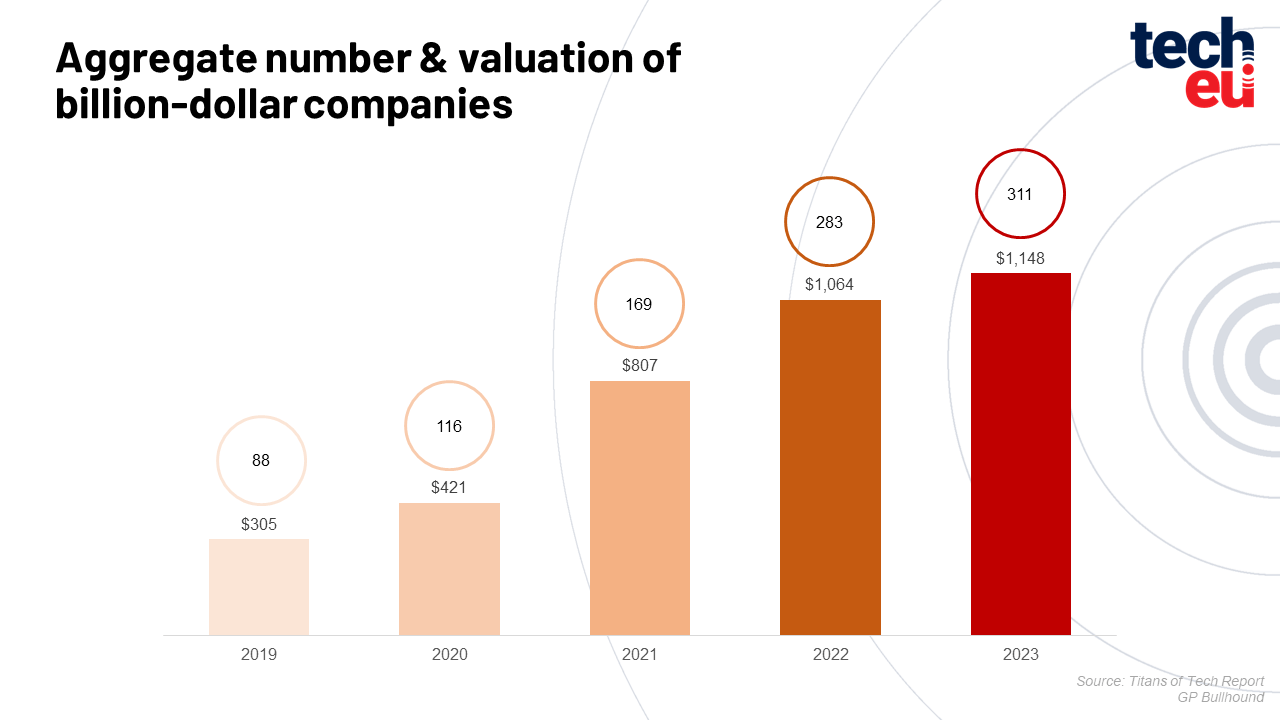

In the last 12 months, 34 Unicorns were birthed with an aggregate valuation down by 79% (to $59 billion, including Europe and Israel). This decrease might signal that the industry is returning to "normal" levels after a period of intense activity, marked by inflated valuations and excessive funding.

Overall, 311 Unicorns call Europe home. Since 2014, the number of unicorns has increased by around 10x, while the aggregate valuation of the ecosystem reached more than $1.1 trillion (with a 13x increase).

The aggregate value of the European Tech giants grew by 8% since March 2023, although it showed a notable decrease from the 32%+ annual growth as of March 2022.

Most of the value is still held by private companies and it can be expected that this trend will continue in the following short term. In the era of lowered valuations, GP Bullhound said that it's, "only a matter of time before valuations recover as technology continues to shape the way we live and work."

And where do these companies come from?

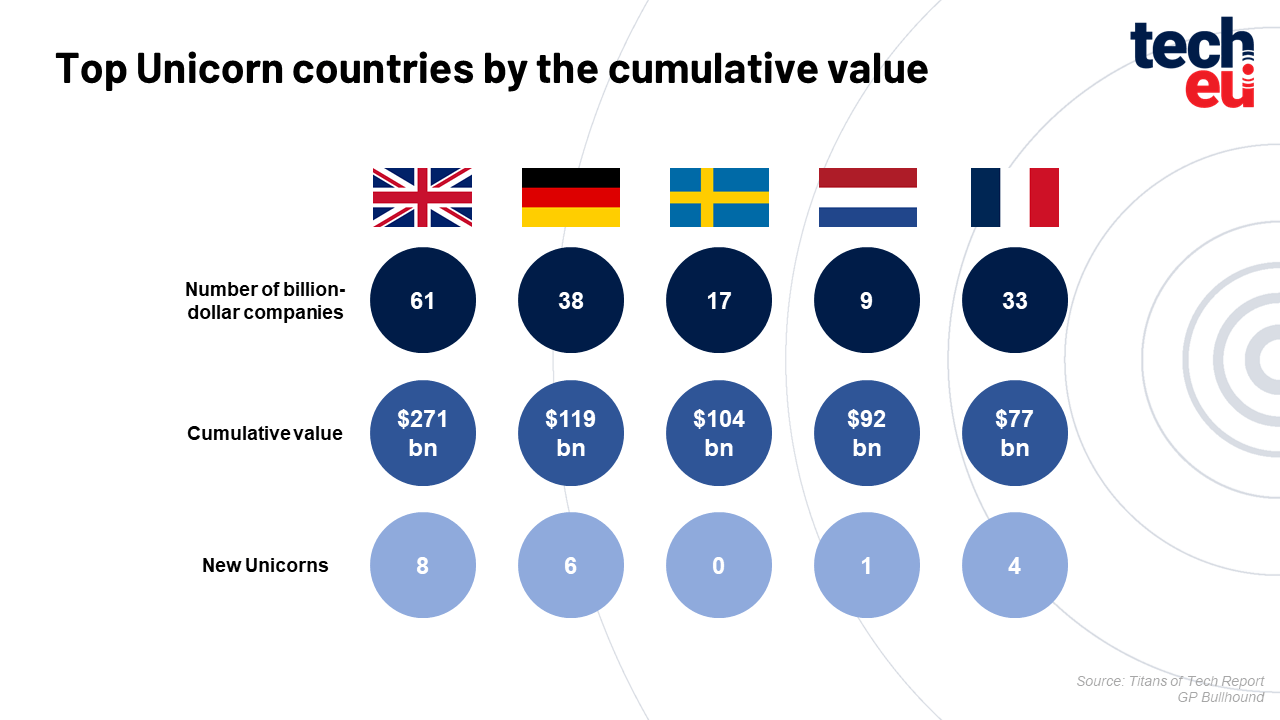

The UK is the top country regarding the number of Unicorn companies birthed over the course of GP Bullhound's survey. 8 big tech companies arose over the past year (Oyster and Sumup among them), thus increasing the cumulative value of all 61 unicorns to $217 billion.

In the number two slot is Germany, with 6 new unicorns (38 in total) and a cumulative value of $119 billion. New German Unicorns include Grover, Choco, and DeepL. It is followed by Sweden and Netherlands (with one new unicorn, Backbase) which remained strong stables by cumulative value ($104 billion in Sweden and $92 billion in the Netherlands), and France which added 4 new Unicorns (totalling 33) thus increasing the cumulative value to $77 billion. Ecovadis, was valued at over $1 billion at the time of the company's $500+ million equity funding round.

GP Bullhound's full report can be accessed here.

Would you like to write the first comment?

Login to post comments