London-based VC firm Northzone has published a new report "Measuring what matters: Northzone ESG Annual Report (2022)" in which they break down the numbers behind their overall portfolio impact and the wider framework of ESG performance.

In so much, they're offering portfolio companies the ability to see their own performance in relation to overall Northzone numbers as well as benchmarks from other companies at different stages.

Overall, by holding itself and those it's invested in accountable, Northzone's aim is to encourage a transparent and comprehensive dataset that can help the entire ecosystem make the right decisions at the right time(s).

Some key findings:

The potential of positive impact in relation to ESG

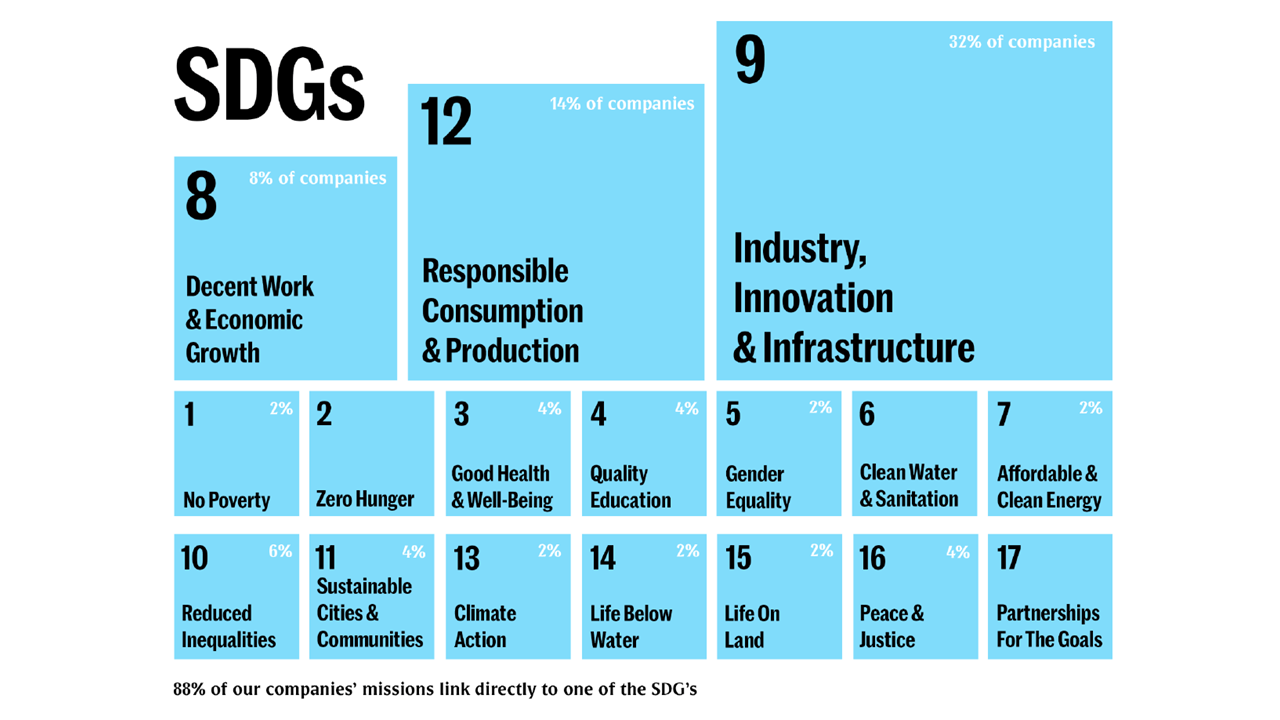

A key topic that arises when talking ESG often centres around the positive impact(s) that companies are making. Are portfolio companies simply talking the talk, or are they actually walking the walk? Do mission statements and business models directly align with any of the 17 Sustainable Development Goals (SDGs)?

According to Northzone's 2022 figures, approximately 90% of their portfolio companies had a direct correlation with at least one SDG (based on the number of companies but also based on the volume of the invested capital).

The most significant potential positive impact of Northzone portfolio companies was in SDG 9 – Industry, Innovation & Infrastructure (32% of companies), and in SDG 12 – Responsible Consumption & Production (14% of companies).

This leads us to some conclusions:

- The positive sign is the fact that most of the companies include activities on shaping a more sustainable future into their company mission, and they want to be an active part of the solution already from the start.

- Even the alignment with the SDGs provides a promising indication, as 88% of companies have SDG aligned mission statements, it's not a sufficient indication of actual impact.

However, there are other factors and inputs that offer important guidance and supplementary criteria for the SDGs' impact. One such is the Global Impact Investment Network (GIIN) which positions impact not as a "benefit" but on the same level playing field as financial return. To confirm this approach, GIIN defines impact investments as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial”.

Additionally, the EU Sustainable Finance Disclosure Regulation (SFDR) definition defines a “sustainable investment” as an investment into an economic activity that either demonstrates a contribution to an environmental or social objective or contributes towards an economic activity identified within the EU Taxonomy while doing no significant harm and promotes good governance (SFDR 2019/2088 Article 2.17).

Financial vs. Impact materiality

Using portfolio materiality as a benchmark, the Northzone report provides a weighted compilation of the most important ESG areas in the invested industries. In doing so, the firm aims to maintain that metrics remain pertinent to the portfolio.

According to the research, in 2022, Northzone portfolio companies' most pivotal ESG topics were Responsible Product Design, Employee Health & Wellbeing, Data Privacy & Security, and Diversity & Inclusion.

As a confirmation that the companies are starting to measure what matters, the data shows that over 70% of portfolio companies implemented initiatives that were focused on critical areas such as employee wellbeing (72%), data management (74%), and anti-discrimination measures (70%).

Given Northzone's investment stage focus, it should come as no surprise that the majority of portfolio companies do not feature a dedicated individual leading the charge when it comes to ESG policies, the firm says that they've seen the rapid adoption of ESG leads as well as environmental and social topics being incorporated into management roles.

Additionally, most portfolio companies have some environmental initiatives already in place quite early on, with the most common being the Virtual meet policy (50%) and Waste recycling (48%).

Improvements in gender diversity and reducing the gender pay gap

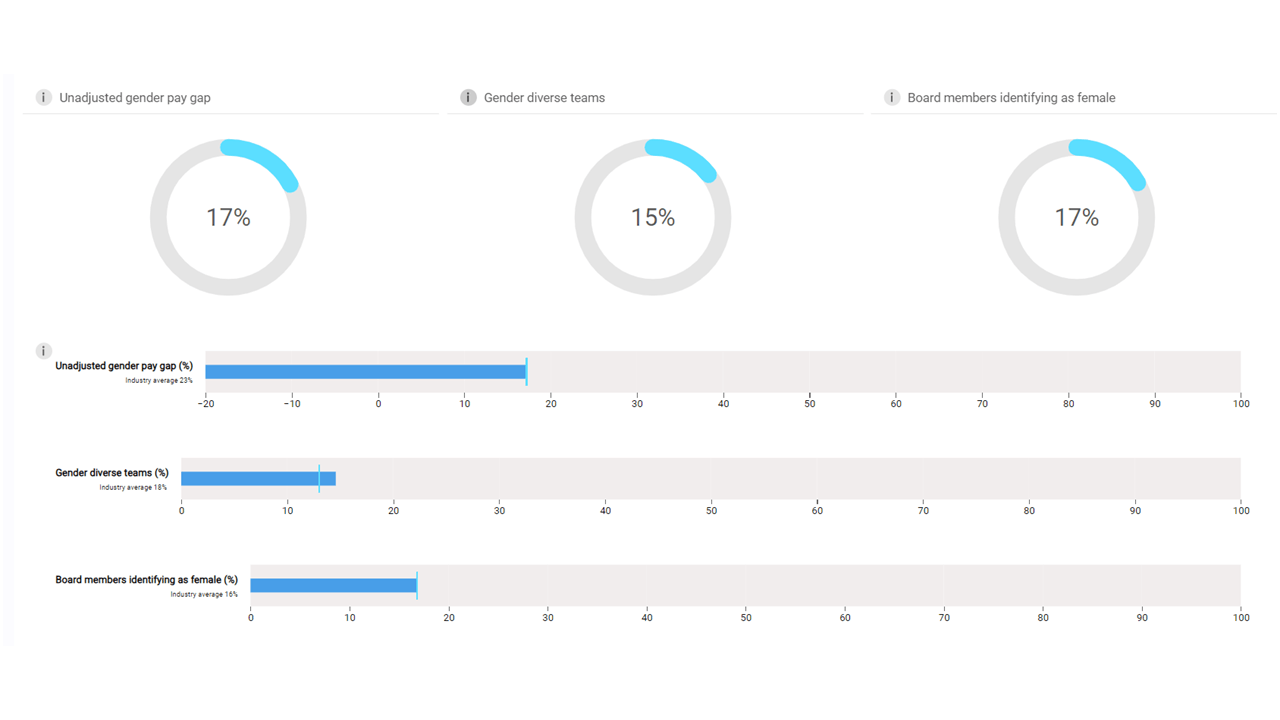

Building a gender-diverse team not only makes sense, but it's essential to future-proofing company success. According to the research, there is encouraging growth in gender diversity among companies: 15% of founding teams, 17% of board members, and 19% of senior management are identified as female.

Another metric that Northzone honed in on was the Unadjusted Pay Gap. The findings show that employees identifying as male earn 17% more than women, regardless of role or seniority. While unjust for a wide variety of reasons, it is noteworthy that the industry average when it comes to the pay gap is 6% higher at 23%.

In line with the underlying premise of the review, Northzone's findings help portfolio companies not only do the right thing but also comply with regulatory frameworks. A prime example would the the EU's Pay Transparency Directive, which states that companies with more than 250 employees will be required to share information about how much they pay women and men for work of equal value and take action if their gender pay gap exceeds 5%.

Reducing the carbon footprint

Last but certainly not least, Northzone looked into the carbon footprint of its portfolio companies. According to the research, 35% of companies calculate their carbon footprint, a figure that the firm intends to extend to 100% over time in order to achieve maximum long-term CO2 reduction.

Moving beyond the "carbon neutral" approach, Northzone is specifically interested in promoting reduction pathways, providing support, and tracking the results of catalytic research in new reduction and removal techniques, actions they say have an immediate impact on reducing portfolio companies' carbon footprint.

If you'd like to dive even deeper into Northzone's ESG Annual Report (2022) head on over here.

Would you like to write the first comment?

Login to post comments