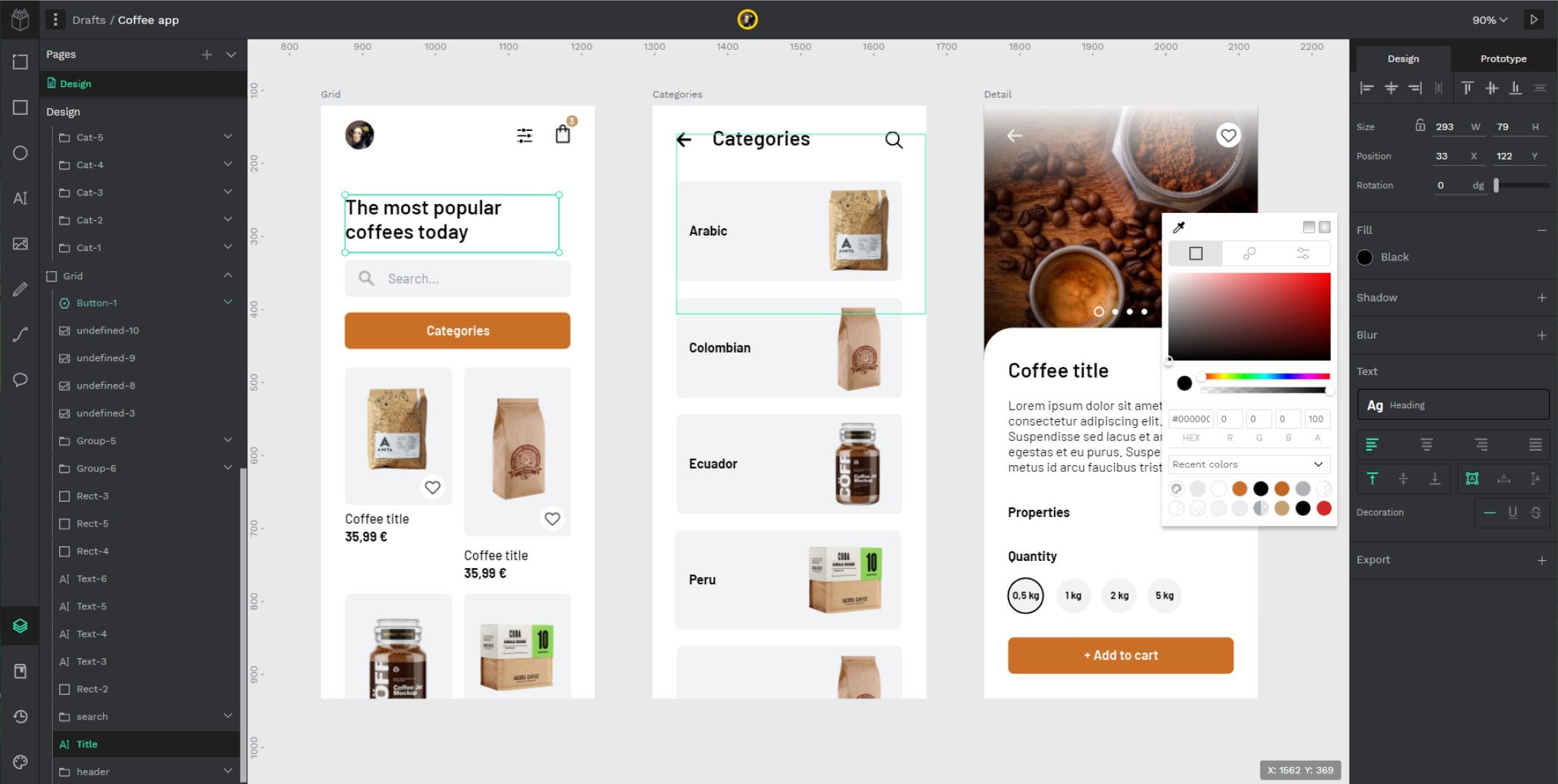

Everyone in tech uses Open Source Software, either in their products or as supporting tools at various stages during the development of their products.

But today's companies are working to balance their collaborative roots and the push for product domination. Even worse, funding has declined. But there are novel ways for companies to measure their success.

Follow the money: a pivot from open source roots

Last week saw yet another company, Hashicorp, "cash in" its open source credibility as it announced a change in model from open source to a source available business source licence.

It joins some of the grandparents of the open source movement, including Companies such as Couchbase, Cockroach Labs, Sentry, Elastic, Confluent, Redis Labs, MongoDB, Elastic, and Redis Labs who've previously made the pivot from open source after building their products off the backs of their developer communities.

Under the license, as explained by The Register, the software's source code remains freely available, with "the right to copy, modify, create derivative works, redistribute, and make non-production use." But note the restriction about use in production.

Further, "you may make production use of the licensed work, provided such use does not include offering the licensed work to third parties on a hosted or embedded basis which is competitive with HashiCorp's products."

It goes against the spirit of the open source movement — but it might offer an opportunity for Europe's startups.

Roman Khavronenko is the co-founder of VictoriaMetrics, a scaleup leader in the open source time series database monitoring space. The company was founded in Kyiv, Ukraine, and is now globally led and headquartered in the US.

He sees this as an opportunity for companies that remain open source:

Other companies that leave the open source community to increase profits are only expanding the market for those that stay open source.

Open source helps products gain popularity without huge investments in marketing. However, when the product becomes popular, a source-available licence doesn't protect it from, for example, Amazon making an API-compatible clone.

Changing the licence hurts popularity for the product. However, it extends market share for the products like ours with an open source licence.Ultimately once the source code has been published in any form there's little a company can do to prevent competitors building clones of their products, especially if you're selling solutions for their platform i.e. Amazon or Microsoft.

That's where customer service and support sets you apart from large corporations who can't and don't want to give that same level of support."

Exceptional customer service not only cultivates customer traction but also emerges as a prized asset for companies in pursuit of investment.

While securing funding might present challenges, it is by no means an insurmountable feat. Here are noteworthy funding announcements from this year:

Open source software companies successfully fundraising during an economic downturn

Open source has always been global and you can see from this great open source repository of open source software investors. While investment is down, here are some notables from 2023:

February:

Penpot (Spain) raised $12 million in Series A funding

March:

Mindee (France) raised $7 million in Series A funding

Seldon (UK) raised $20 million in March series B

April:

Cerbos (UK) raised $7.5 million in seed funding

Weaviate (The Netherlands) raised $50 million in series B funding

Timefold (Brussels) raised €2 million in seed funding.

SimpleXChat raised 350k in seed funding

Qdrant (Germany) raised $7.5 million in seed funding

May:

Anoma (Switzerland) raised $25 million in Series C funding.

June:

Odoo (Belgium) raised €150 million in a private equity round

Filigran (France) raised €5 million in seed funding.

Agenta (Germany) raised €170,000 in pre-seed funding.

Hopsworks raised $6.5 million in Series B funding

July:

ChipFlow (UK) raised £1.2 million in pre-seed funding

Unstructured media (UK) raised $6.5 million in pre-seed funding

Show me the numbers: how do you show customer retention and growth to investors?

Companies can enhance their appeal to investors right from their inception, with a particular emphasis on cultivating a vibrant user community as well as valuable customer insights.

I recently spoke to Avi Press, Founder and CEO of Scarf. Scarf builds advanced user and customer intelligence for open source software projects. It helps open source developers understand how their projects are being used.

He asserts that we're seeing a professionalisation of open source software companies across the ecosystem.

"Back in the early days, it was kind of a hacker and hobbyist affair. And now things need to be done in a very data-driven fashion; you need to make decisions that you can, you know, justify and defend after the fact to investors or a board of directors."

Scarf is monitoring downloads for over 2500 open source software projects. These projects are backed by highly credible organisations worldwide, including the CNCF, Apache Foundation, and Linux Foundation.

The company recently presented its data on downloads and – more importantly – production use, which indicates how projects are used and that there is a significant enough market to invest in.

A comparison between Q4 2022 and Q1 2023 revealed a 60% surge in overall downloads, a trend that maintained its momentum with a 61% increase between Q1 and Q2 2023. This past quarter alone witnessed over 340 million downloads from over three million unique global sources (end-points).

Press explained:

"For many companies building open source, what we're trying to measure is quite challenging.

What's most compelling to the investors we talk to is seeing really high-quality companies that are using open source, and their usage grows over time, like it's sticky. The data is the leading indicator for selling additional services and products on top of that stuff.

Knowing which companies use your products and how is critical to know how to support your (and their) community better and help target those who would most benefit from your commercial products. For example, what size is the pool of users?

How many production users do you have? What value are they getting from your products?

What are the usage patterns? Are people sticking around? What is the growth rate? How many unique users within an organisation? How do you see these actions convert into churn or increasing adoption?"

Your GitHub repos are a rich source of customer engagement

Another way investors can measure the efficacy of open source startups and scaleups is through their GitHub repos.

Runa Capital is a Luxembourg-based global venture capital firm, focusing on enterprise software, deep tech and fintech startups.

The Runa Open Source Startup (ROSS) Index collects data on all repos with 1,000+ GitHub stars.

It publishes the fastest-growing open source startups affiliated with these repos quarterly, highlighting new, trending open source startups, using a simple and transparent base.

Of the Top 10 in Q2 2023, Four are European/UK:

Windmill is a developer platform for building production-grade multi-step automation and internal apps. The company was founded in 2021 in Paris and raised $0.5M from Y Combinator.

Bloop has created Bloop.ai is an extension for a code editor that surfaces code examples from each library's official documentation. Founded in 2021 in London and raised $0.13M from Matilde Giglio, Y Combinator.

Qdrant is an open source vector similarity search engine founded in 2021 in Berlin.

Terramate adds powerful capabilities such as code generation, stacks, orchestration, change detection, data sharing and more to Terraform. It was founded in 2021 in Berlin.

Compared with Q2 2022, the number of European companies is unchanged in the top 10 but has fallen by 58 percent across the top 20.

Further, fundraising by European companies has fallen by 93 percent in the top 10 and 98% in the top 20.

It's notable that compared to Q1 2023, the number of European companies has fallen by: 25 percent in the top 10 and 50 percent across the top 20.

Further, fundraising by European companies has fallen by 89 percent in the top 10, and 94 percent in the top 20.

The days of companies fundraising series A or B without a commercial products or customer traction are undoubtedly over. Investors are looking for strong customer traction —especially in large enterprises, production users, and active communities.

Open source has its foundation in a various arms of tech innovation such as hardware, robotics, healthcare and agtech.

I'm particularly excited by projects that open source drug discovery, such as Open Source Drug Discovery, Open PHACTS, and Open Lab Foundation.

I anticipate a future where more major players pivot towards business licenses; however, startups and scaleups that adeptly employ metrics to quantify the "elusive" like community engagement are positioning themselves for enduring relevance in the evolving ecosystem.

Would you like to write the first comment?

Login to post comments