Oslo-based residential solar and battery installations marketplace Otovo has raised €40 million in a private shares placement. The new capital is aimed at providing Otovo with a path to profitability by growing sales volume, optimising operational costs, and monetising subscription assets

Shares were allocated to existing shareholders Axel Johnson Group through its solar energy-focused investment arm AxSol, the Norwegian state climate fund Nysnø, Norwegian housing developer Obos, and Å Energi, a Nordic energy group created by the merger of Vest Agder, Aust Agder, and Statkraft Holding AS in 2022, provided more than half of the issue.

According to the company, in conjunction with the new equity raise, it has decided to carry out a repair issue of up to 17.4 million shares at the same price and will conduct a restructuring of its options programme for key employees.

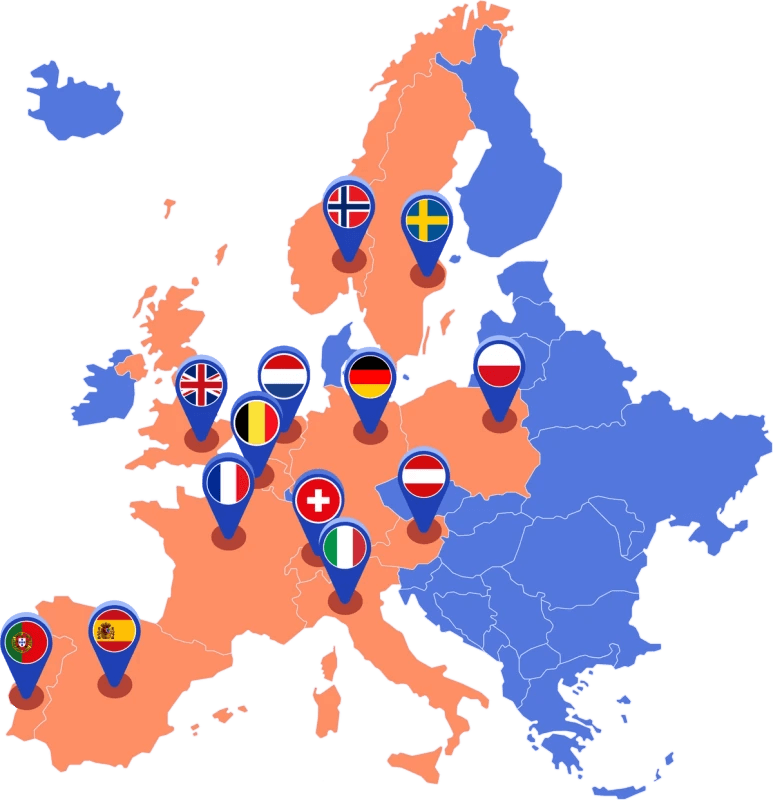

Founded in Oslo in 2016, Otovo has sold and completed over 20,000 solar energy projects across Europe and is active in 13 markets. Slightly different from the growing list of startups that offer a hassle-free way for consumers to become less reliant on skyrocketing energy costs, Otovo uses proprietary technology to analyse a home and then finds the best price and installer for the job, all based on an automatic bidding process.

Founded in Oslo in 2016, Otovo has sold and completed over 20,000 solar energy projects across Europe and is active in 13 markets. Slightly different from the growing list of startups that offer a hassle-free way for consumers to become less reliant on skyrocketing energy costs, Otovo uses proprietary technology to analyse a home and then finds the best price and installer for the job, all based on an automatic bidding process.

Otovo CEO Andreas Thorsheim shared:

“The equity raise allows Otovo to aggressively pursue the opportunities given by an energy market in which the cost of building new solar energy is at an all-time low, traditional energy prices are rising and consumers are looking for ways to cut their expenses.”

Lead image via Otovo.

Would you like to write the first comment?

Login to post comments