Dutch neobank Bunq is launching a consumer-facing Generative AI-powered chatbot, which will leverage the much-hyped technology to provide users with answers to questions about their financial life, such as spending habits and restaurants they frequent.

Bunq, which has over nine million users in Europe and more than €4.5bn in deposits, says the launch means it is now “the first AI-powered bank in Europe”.

The move comes as Bunq, one of Europe’s biggest challenger banks, gears up for a return to the UK market after Brexit foiled its first attempt.

Bunq founder Ali Niknam says Bunq, which has secured close to €100 million in funding this year, is like a “dog with a bone” in pursuit of relaunching in the UK.

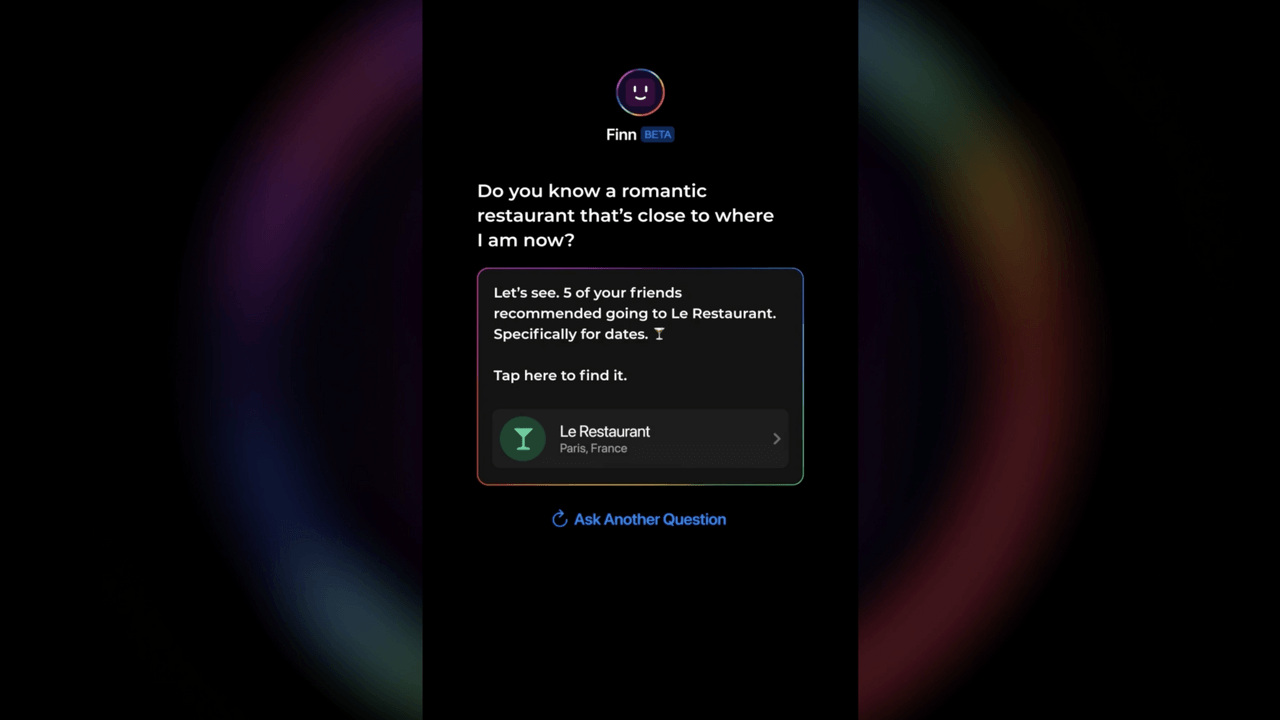

On its new chatbot, it is called Finn, which Bunq says has been created through leveraging powerful LLMs (Large Language Models). It will effectively replace the search function on the Bunq app.

Finn is a chat-style textbox, where users can ask questions, seek advice about their bank account, spending habits, savings and anything else related to money.

For example, it gives answers to advanced questions like “What is the average amount I spend on groceries per month?” or “How much did I spend on Amazon this year?“

It can also answer questions that go beyond transactions, such as “What was that Indian restaurant I went to with a friend in London?“, or “How much did I spend at the cafe near London Bridge last Saturday?”

Niknam tells Tech.eu: “Just imagine having a buddy at the tip of your finger that can answer all kinds of questions you may want to know about any aspect in life that loosely involves money. I think that is pretty magical.”

The challenger bank has been using AI in its banking systems since 2017 but Niknam says it was a difficult task building an in-house GenAI platform.

He says: “We have been deploying AI in all kinds of areas, such as balance prediction. More recently, with the gigantic Generative AI revolution last year, we have started adopting Generative AI in all kinds of areas including support, but also increasingly in behind the scenes processes such as on-boarding.”

On the potential of data leaks, Niknam said: “The most important architectural decision we made is that every user has their own shielded-off database with their own information in it.

“So the Generative AI only runs on that one database for that one user.

He added: “It is literally impossible to leak information which is one of the biggest challenges with Generative AI.”

On the likely occurrence of hallucinations, a chatbot response which is made up or wrong, Niknam admitted it would be prone to them.

He added: “It might be that the answers are incorrect, it might be that the answers are inaccurate.

“Obviously Finn will be prone to them as well. We are doing our best to minimise those but it’s just a fact of life that these will be present.

“But we do not think that it will dismiss from the magical experience and enormous power that will make your life easier.”

Meanwhile, earlier this month a report emerged in the London Evening Standard that Bunq was plotting a return to the UK market, after Brexit's regulatory requirements cut short its previous entry in 2020 when it stopped UK signups.

Bunq set up a UK subsidiary, Bunq UK Ltd in November, according to Companies House.

Niknam told Tech.eu: "We would love to be in the UK.

“We remain committed to the UK, we just need to make it work. I think we may be on a path to be able to make it work.

“We are a dog with a bone but it needs to work.

“It’s a top priority market and we are trying to think of something smart to deal with the regulatory and therefore financial overheads.”

Lead image: Bunq. Photo: uncredited.

Would you like to write the first comment?

Login to post comments