2023 was the year of AI. It captured the attention of the masses with platforms like ChatGPT — who reached 100 million users just two months after its launch — and Bard. The interfaces were simple enough that even your grandmother could use them.

Lawmakers and politicians discussed regulations and ethics, and investors were all in. For me, every day included pitches from startups using AI as part of their product offerings.

These included spatial planning in interior design, digital storyboarding and post-production editing in filmmaking, legal summation and analysis in law, and image editing in graphic design, as well as verticals like agritech, cybersecurity and coding.

In November, the Cambridge Dictionary named hallucinate as the word of 2023, amending the term to include

'When an artificial intelligence (= a computer system that has some of the qualities that the human brain has, such as the ability to produce language in a way that seems human) hallucinates, it produces false information.'

As Peter Sarlin, CEO and co-founder of Silo AI, shared with us:

“This year we saw the chat GPT moment as not a scientific breakthrough, but a user experience breakthrough.

But it also triggered a significant investment wave, with most of the development around engineering, leading to our ability to benefit from the science. And, I think, that is going to continue to evolve.”

As our 2023 report revealed, Germany led the AI funding race, raking in €845.3 million in 2023, a figure more than double that of the UK’s at €411.2 million and half of the total raised amount in the industry.

Thanks in part to Mistral AI’s last-minute entry, France claimed the number two spot in the funding race at €554.1 million. Regarding the number of AI-centric deals, the UK retains its top slot with 42 transactions, followed by Germany with 21. These two countries account for half of all European AI investments in 2023.

What does this all mean for 2024? Well, a heck of a lot. Here's some of what we can expect:

The cost of training models, and infrastructure, and hardware shortages becomes top of mind

Lawrence Lundy, Partner at Lunar Ventures, predicts that in 2024, it will become apparent that the costs of training frontier models are unsustainable.

"The most powerful models can cost upwards of tens of millions to train. Hyper scalers like Microsoft and Google are spending $10 billion to build the infrastructure to serve customers."

Image: Zibra ai

Oleksandr Puchka, Technical Director at Zibra AI, agrees:

"Data for training is the new oil. For companies that do not have enough data to create production-ready technology, the only way to proceed is to develop a working model, collaborate with companies with data, and release this technology. And this, of course, is not for free."

According to Puchka,

“The world has become divided between GPU-rich and GPU-poor companies and countries. We observe a similar situation to the Blockchain mining boom, causing GPU prices to skyrocket.”

This creates an imbalance of hardware availability for other industries and excessive investments in the semiconductor industry. Industry forecasts indicate that memory, NAND, and chip prices will rise.

Lundy predicts that semiconductor supply chain shortages will persist in 2024 as the semiconductor supply chain struggles to make enough chips.

As a result, “vital components like memory are sold out until 2025, and manufacturers claim they have no more capacity. The supply chain tightness will also force up costs.

"Eventually, someone will need to pay for this infrastructure.”

Petrenko sees this directly impacting startups:

“Those who have secured enough hardware supply can grow, create new tools, and monetize themselves. Others will lag in their ability to sustain their needs.”

The issue of "open" in open source grows as a pain point

In July, Meta made an open source commercial version of its large language model (LLM), Llama 2, available free of charge for research and commercial use.

However, the issue of how startups can use open source software is significant, as it greatly impacts startups who utilise these models to create competitive business offerings.

Sarlin asserts the importance of base and foundation models as open source infrastructure that allows European companies to innovate, sharing:

“It requires decisive actions during this year and years to come to ensure that European companies are part of building this AI infrastructure, building these models and being part of the value creation.

If you expect companies actually to build their strategy on top of these models, they need to get certainty around what they can rely on in the future.”

It's a challenge that extends to AI regulation. In December, the European Union reached a provisional deal on the world's first comprehensive laws regulating the use of AI.

Differing levels of openness have varying commercial impacts and community benefits.

According to Amanda Brock, CEO of OpenUK, clarity around “free and open-source” in the regulations is necessary.

She asserts that the Cyberresilience Act in its latest form, ignores the accepted definition of open source software and the long-established free software definition. This wording also fails to align with the definitions used previously by the Commission.

She notes that the text, however, does have a further stage to go through - a review by 'lawyer linguists'.

“It may be that the open source communities find it worthwhile to have a final push in the campaign against the CRA to encourage the Commission to use a corrected and established definition.“

Promised guidance on the scope of the regulation as it applies to free and open source software will be provided along with over 40 standards.

AI converges with nascent and more established tech, leading to partnerships and further accelerating innovation

AI’s power lies in its ability to join forces to supercharge existing tech or create something new altogether with speeds and capabilities never imagined by previous generations.

As Puchka shared:

"It's hard to imagine 3D graphics without AI upscalers. Photo and video processing have also used AI for a long time."

Alongside this, IoT (or indeed AIoT) has gained its rightful position in the energy sector. Cryptography and machine learning are creating new cybersecurity protection. AI and raw ingredients are accelerating the creation of new novel materials, and AI and quantum computing are a match made in heaven, to name just a few use cases.

While many startups add AI to their name, perhaps to woo investors and us journos, the role of the other tech deserves equal attention as the sum is greater than the parts.

Puchka agrees, asserting that “Generative AI is still the least part of the AI technology stack.”

In a related vein of joining forces, Dr Andre Retterath from Earlybird Venture Capital contends that partnerships will be crucial in 2024.:

"We can expect closed and open-source LLM advancements from big tech hyperscalers and startups.

However, LLMs alone will not be sufficient to create a business as they’ll converge in performance sooner.

Differentiation will be driven by access to proprietary data and domain expertise for deep product integrations. This is where partnerships become indispensable.

This is easier for big tech than for startups, as they already have the products and distribution on the application layer."

Funding becomes more considered and conservative

Roosh Ventures' Co-founder and General Partner, Den Dmytrenko shared that contrary to expectations, funding in 2023 experienced a decline, with AI merely slowing the overall downward trend, being a hot, investable topic.

“European companies faced a notable reduction, raising only half the capital compared to the previous year.

Looking ahead to the next year amidst a backdrop of two geopolitical wars, rising interest rates from the FED, other macroeconomic uncertainties, and the hype cooling down, I don't anticipate significant shifts in funding.

Let's observe whether there are any "reversal signals" that could decrease capital costs and reduce uncertainty in the macroeconomic landscape.”

Dr Retterath predicts 2024 to include more conservatism in investment:

"Investors without deep expertise who jumped on the train too late will learn their lesson, and we’ll see less dump money chasing AI startups.

Therefore, I expect more concentrated bigger funding rounds and less spray and pray in the earlier stages of AI startups.”

As part of this shift, "cohorts of well-funded AI companies, specifically in the application layer, will be wiped out by OpenAI and other fullstack providers."

Matthew Chagan, Partner at PATRIZIA’s VC fund Sustainable Future Ventures, believes that Europe and the UK could potentially struggle more than the US weathering a stormy 2024:

“I think the bar will remain very high for follow-on funding.

However, markets will be less crowded and noisy going forward, which will benefit the companies that survive.”

He sees an inevitability in acquisitions from Fortune 1000 companies in energy, chemical and material sectors needing startup’s AI solutions

“These companies also have very strong balance sheets, and they will use this to make acquisitions and position themselves for the next generation of businesses. “

However, he cautions: “We need to grow our portfolios of startups into businesses that have €50M+ in revenues, and then we’ll start to see some large exits.”

Lundy believes growth investors are looking to back category winners soon:

“I expect emergent winners in generative images, audio, video, and coding to raise huge rounds and eye-watering valuations.

But the wrinkle will likely come from new dedicated GPU debt vehicles. For many companies that need capital to buy GPUs, using debt instead of equity will be cheaper.

Many of these larger rounds might look like hybrid debt/equity rounds.

This might dampen the amount of VC deployed into the sector, but we should still expect the AI category to grow.”

AI startups to watch in 2024

CAST AI (US/Lithuania)

Running applications in the cloud is complex and expensive. As legacy applications are modernised and migrated to the cloud, and new use cases emerge —like companies that have started running and training AI models that demand specialised GPUs and require billions of computations per second and petabytes of data costs rise.

For enterprises training and running their own large language models, the resulting cloud bill can cost as much as $700,000 a day, as is the case for OpenAI’s infrastructure cost on Azure.

CAST AI has developed a Kubernetes cost optimisation platform that utilises advanced machine learning algorithms and heuristics to analyse and automatically optimise clusters.

This saves customers 50 percent or more on their cloud spend, improving performance and reliability and boosting DevOps and engineering productivity.

Delvitech (Switzerland)

Delvitech has developed machines that use advanced AI algorithms to inspect printed circuit boards (PCBs) found in every modern electronic device.

This ensures unmatched precision and flawless assembly. Delvitech's AI not only spots faults but also predicts errors and adapts through continuous learning. This results in more reliable electronic devices and transforms the electronics landscape.

Kuano (UK)

UK startup Kuano combines quantum mechanics with AI to design the next generation of medicines, focusing on seeing and modelling enzymes.

Kuano’s quantum simulation platform enables scientists to see and model enzymes in their dynamic state, opening new possibilities for more effective drug design.

Combining these unique enzyme profiles with its suite of AI tools, Kuano predicts the best structures with which to target them. Drug candidates designed this way are more likely to be more potent with fewer side effects.

Suzan AI (France)

Suzan is an AI governance tool offering a zero-trust,data loss prevention solution that secures the usage of generative AI services such as ChatGPT. It prevents data leaks and non-compliant behaviours by detecting and blocking inappropriate or illegal requests in real-time.

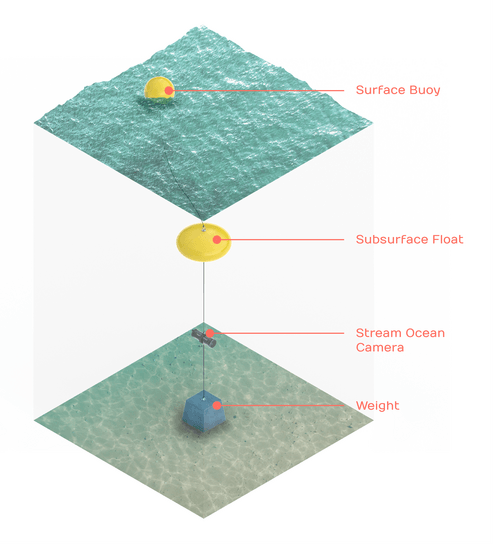

Steam Ocean (Zurich)

Oceans cover over 70 percent of the Earth's surface with approximately 360 million square kilometres, and are deeper in some places than Mount Everest is high. They constitute the largest ecosystem on our planet.

While more than 80 percent of the waters remain unexplored, oceans are at risk due to rising temperatures, fishing practices, plastic waste, and climate change.

Steam Ocean is creating an AI-powered end-to-end solution for real-time marine life monitoring: a relatively easy-to-install system consisting of three underwater cameras and data analytics supported by artificial intelligence.

Live-streamed video and sensor data from the seafloor is captured, evaluated in real-time, and displayed on a dashboard 24/7. This benefits projects that respond to the loss of biodiversity, including companies, research institutions, non-governmental organisations, and governments, particularly in measures to restore coral reefs.

Lumai (UK)

Lumai is a deep-tech company creating optical computing technology that refines the boundaries of what will be possible, with computing speeds up to 1000 times greater than today.

Even more surprising, its energy consumption is 1/100th of today, a critical need given worldwide energy use by global data centres is already 2 percent of the world’s energy.

Lumai focuses on the AI accelerator market in global data centres, where the highest compute speed is needed.

Rigpa AI (UK)

Rigpa is a fabless chip design startup focusing on the next-generation neuromorphic AI chips to accelerate future AI applications at 10x faster speed with a fraction of the power.

Use cases include autonomous vehicles, VR, and robotics.

Lead image based on the work of Marius Masalar.

Would you like to write the first comment?

Login to post comments