Dutch challenger bank Bunq is launching what it’s calling the 0.2 version of Finn, its AI chatbot assistant, which it says now has beefed up conversational powers.

The move comes as the neobank confirms it will be reapplying for a US banking licence, following its withdrawal from the process earlier this year.

Bunq, which has over 11 million users in Europe and more than €7bn in deposits, launched the first iteration of Finn at the end of last year.

Bunq says the chatbot leverages generative AI, providing users with answers to questions about their financial life, such as spending habits and restaurants they frequent.

The new version of Finn, which has hitherto answered over 100,00 customer questions, can now answer back-to-back questions and provide deeper insights into users’ finances at twice the speed, Bunq says.

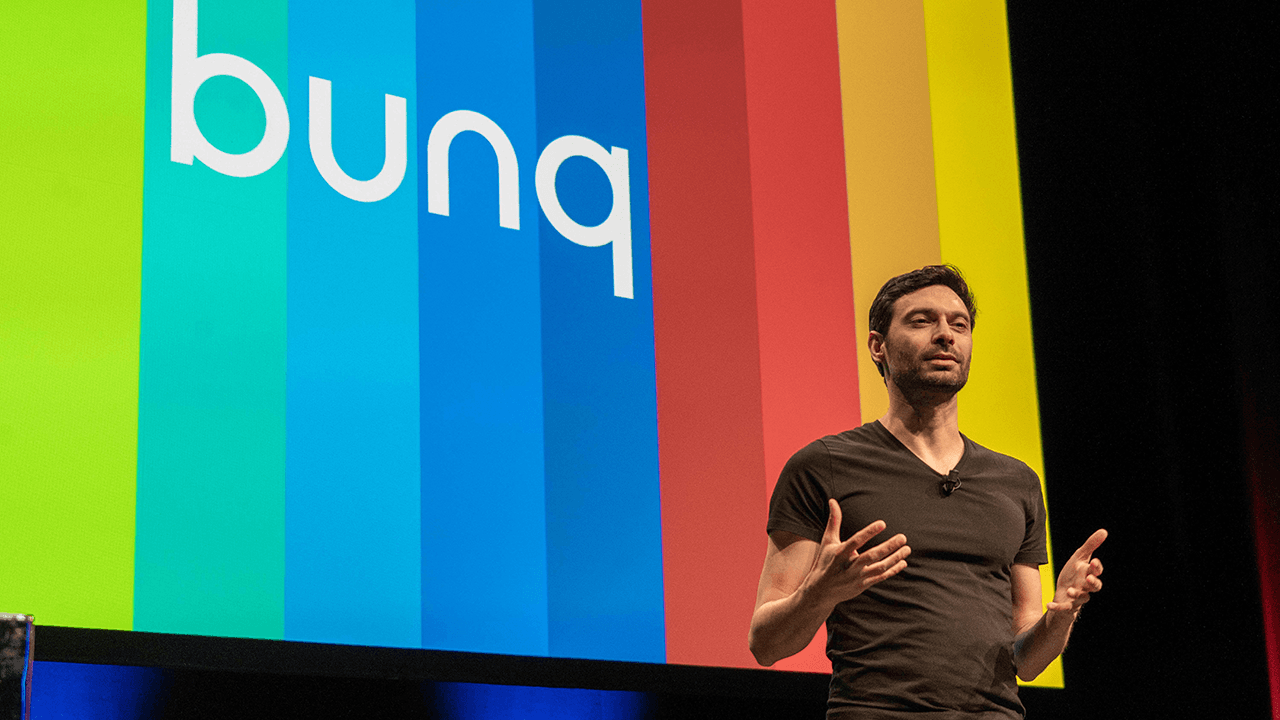

Bunq CEO and founder Ali Niknam says the new version's ability to answer questions has massively "improved” and “it can consider way more data” and the chatbot's speed has also "massively improved”.

That said, the chatbot is “still not near where we would like it to be”, Nknam says.

Niknam says he asked the chabot if he had paid his own taxes and says he was surprised that it was able to identify he was referring to his municipality taxes, understood he was based in Amsterdam, and located the tax payments.

“It is almost like speaking to a human being,” he said.

Another Bunq Al tool is solving up to 40% of user support questions, says Bunq, but Niknam says it’s hard to pinpoint how many human jobs the AI tool is replacing, given Bunq’s headcount is growing.

Meanwhile, the Dutch neobank its expanding its offering to include travel insurance, by way of a partnership with Belgium insurtech Qover, as it looks to become a full-service neobank for digital nomads.

Niknam says: “Digital nomads tend to travel a lot. This is one I am looking forward to personally because I tend to travel a lot."

On why Bunq, which is currently in over 30 markets across Europe, is launching a travel insurance product now, Niknam says "we tend to jump into insights we get from our users".

Bunq is also preparing for a crack at the US market and a second attempt to crack the UK market.

It has applied for an EMI (Electronic Money Institution) licence in the UK and Niknam is hopeful Bunq will hear positive news on its license this year.

On the UK, he said: “We have made a number of hires there, the team is expanding, and the conversations with the regulators are great. Things are looking good from my perspective."

Meanwhile, in the US, earlier this year Bunq withdrew its application for a US banking licence citing problems between its Dutch regulator, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp.

Niknam did not divulge specific details but admitted "that was a mistake on our end”.

He said Bunq was "definitely" reapplying for a US banking licence this year.

He explained the difference between applying for a banking licence in the US and Europe.

He said: "In the Netherlands, you apply, then obviously the regulator will have some feedback, that is the normal part of the process.

"And then the clock stops and then you get the opportunity to update your policies and processes. Or to explain why certain things that you have done actually do comply. And then that process resumes.

“In the US, it is slightly different. You apply and they do not have the opportunity to pause the clock. So, you withdraw and then reapply when you have fixed the things.”

Would you like to write the first comment?

Login to post comments