Unicorn companies are crucial drivers of innovation, economic growth, and technological progress in Europe. Often, they introduce groundbreaking technologies, creating new industries or transforming existing ones. Their presence signals a mature and investable tech landscape. By generating significant revenues, these companies contribute to national GDPs, tax bases, and regional economies.

Unicorns emerge from a strong startup ecosystem and, in turn, support it by fostering innovation and enabling global market access. They also drive knowledge spillover, talent circulation, and shared infrastructure, creating a continuous cycle of growth and entrepreneurship.

In 2024, the European tech ecosystem collected €74.4 billion over more than 3.700 deals. Excluding debt funding rounds, 91 companies (2.4 percent of all companies) closed deals worth over €100 million (each). They collected around €21.7 billion (around 29 percent of the total raised amount).

In 2024, the European tech ecosystem collected €74.4 billion over more than 3.700 deals. Excluding debt funding rounds, 91 companies (2.4 percent of all companies) closed deals worth over €100 million (each). They collected around €21.7 billion (around 29 percent of the total raised amount).

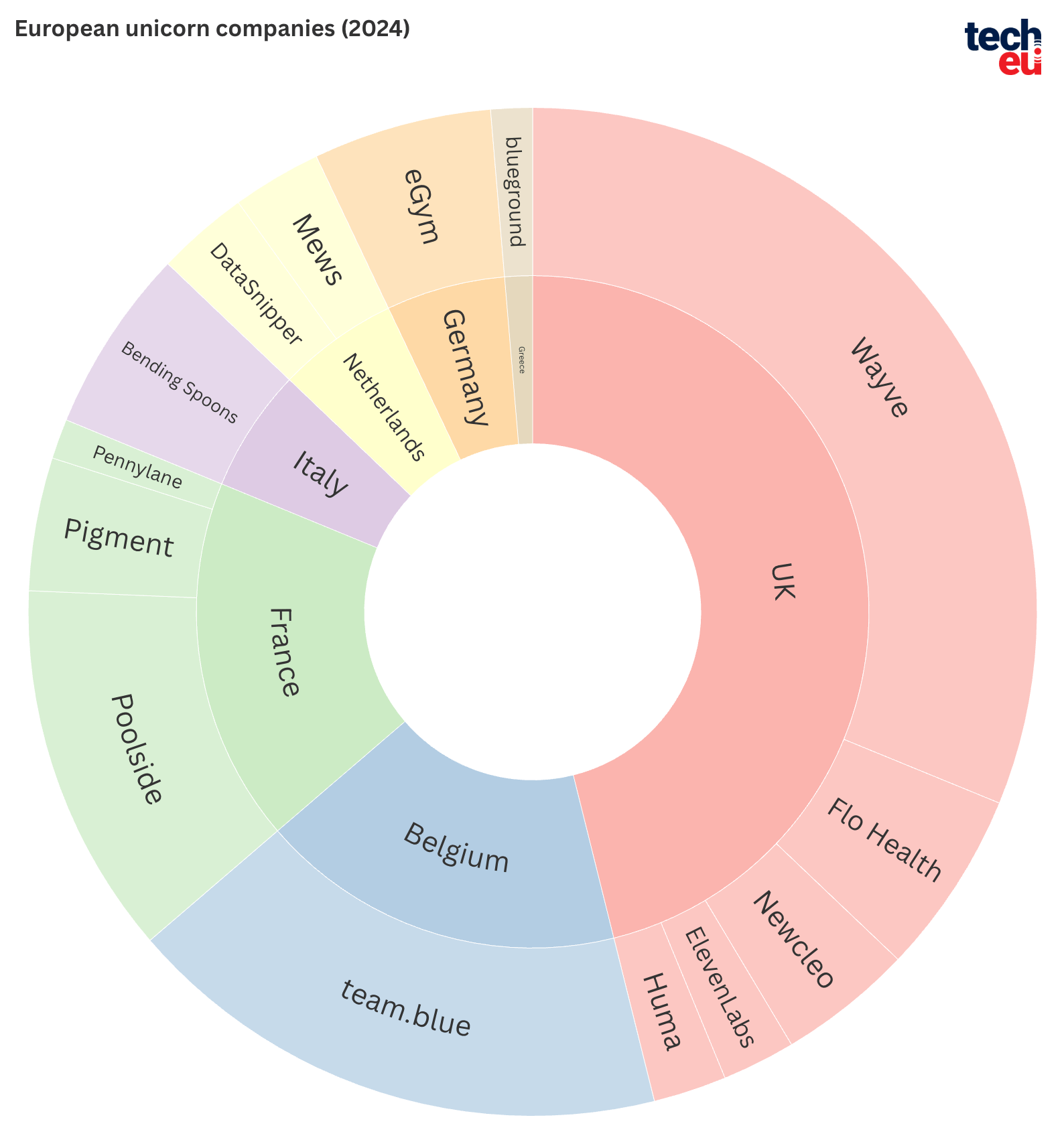

Europe welcomed 14 new unicorn companies, collectively raising approximately €3.2 billion, representing 4.2 percent of the total capital raised. The UK led with five new unicorns, followed by France with three, the Netherlands with two, and Belgium, Germany, Italy, and Greece, each adding one new unicorn to the ecosystem.

Unicorn companies are essential engines of innovation, investment, and economic growth. However, their success is deeply tied to the broader startup ecosystem. While they benefit from smaller startups as sources of talent and technology, they also contribute to creating an environment where new businesses can thrive.

1. Wayve (UK)

1. Wayve (UK)

Amount raised in 2024: $1.05B

Wayve is an AI-driven autonomous driving company focused on developing self-driving technology using machine learning and computer vision.

By leveraging cutting-edge deep learning algorithms, Wayve aims to create a scalable, safe, and flexible approach to autonomous driving. The company emphasizes the use of data-driven systems and cloud-based models to navigate complex urban environments, working to transform transportation with the goal of making roads safer and more efficient.

The company raised $1.05 billion in a Series C funding round, led by SoftBank Group, with participation from Nvidia and Microsoft, at an undisclosed (but $1bn+) valuation.

2. team.blue (Belgium)

2. team.blue (Belgium)

Amount raised in 2024: €550M

team.blue is a global digital services provider specializing in web hosting, cloud solutions, and online marketing.

The company offers a wide range of services designed to help businesses grow their online presence, including website management, e-commerce tools, and domain registration. With a focus on reliability and customer support, team.blue aims to empower entrepreneurs and organizations to succeed in the digital world, backed by a network of trusted technologies and expertise.

In July, the company secured €550 million investment at €4.8 billion valuation.

3. Poolside (France)

3. Poolside (France)

Amount raised in 2024: $400M

Poolside.ai is an AI-driven platform focused on automating and optimizing business workflows through machine learning.

The company offers intelligent solutions that streamline operations, improve decision-making, and enhance productivity across various industries. By leveraging advanced AI models, Poolside.ai helps businesses make data-driven decisions, reduce manual work, and scale more efficiently, providing a competitive edge in today’s fast-paced market.

In July, the company achieved unicorn status after raising $400 million at a $2 billion valuation.

4. Mews (Netherlands)

4. Mews (Netherlands)

Amount raised in 2024: €191M

Mews is a cloud-based property management system (PMS) designed to simplify and optimize hotel operations.

Offering a suite of tools for booking, payment, guest management, and reporting, Mews helps hospitality businesses enhance efficiency, improve guest experiences, and drive revenue. With a focus on automation and seamless integrations, Mews empowers hotels to modernize their operations and deliver personalized, frictionless service to guests.

In March, the company had a growth round of $110 million at a $1.2 billion valuation. A few months later, the company secured an additional €90 million.

5. eGym (Germany)

5. eGym (Germany)

Amount raised in 2024: $200M

eGym is a leading provider of digital fitness solutions, offering smart equipment and software to enhance workout experiences in gyms and fitness centres.

With a focus on personalized training, performance tracking, and data-driven insights, EGYM helps fitness facilities optimize their operations and deliver tailored workout plans for their members. By combining innovative technology with a user-friendly interface, EGYM aims to make fitness more accessible, efficient, and engaging for both users and gym operators.

In September, the company achieved unicorn status following a $200 million growth capital raise, bringing its valuation to over $1 billion.

6. Flo Health (UK)

6. Flo Health (UK)

Amount raised in 2024: $200M

Flo Health is a leading women’s health platform that provides a comprehensive app for tracking menstrual cycles, fertility, and overall reproductive health. The app leverages advanced AI technology to offer personalized insights and predictions, empowering women to take control of their health. With millions of users worldwide, Flo Health combines medical expertise with user-friendly design to support women in managing their health and well-being across all stages of life.

After raising over $200 million in a Series C funding round, Flo's valuation surpassed $1 billion, making it the first purely digital women’s health app to reach unicorn status.

7. Bending Spoons (Italy)

7. Bending Spoons (Italy)

Amount raised in 2024: €144.4M

Bending Spoons is a leading mobile app development company known for creating innovative, high-quality apps that enhance user experiences.

With a focus on data-driven design and cutting-edge technology, Bending Spoons develops products across a variety of categories, including productivity, entertainment, and wellness. The company is committed to delivering apps that engage millions of users worldwide, leveraging a unique blend of creativity and technical expertise.

The company achieved unicorn status after securing €144.4 million at €2.37 billion post-money valuation.

8. Pigment (France)

8. Pigment (France)

Amount raised in 2024: $145M

Pigment is a dynamic financial planning and analysis platform designed to help businesses make data-driven decisions.

With its intuitive, collaborative interface, Pigment empowers teams to model, forecast, and visualize complex business data in real-time. By combining flexibility, ease of use, and powerful analytics, Pigment enables organizations to streamline their financial processes, optimize performance, and drive strategic growth.

Pigment closed a $145 million Series D funding round in April, at a valuation of $1+ billion.

9. Newcleo (UK)

9. Newcleo (UK)

Amount raised in 2024: €135M

Newcleo is a nuclear technology company specializing in the development of next-generation small modular lead-cooled fast reactors (LFRs).

These reactors utilize recycled nuclear fuel, addressing key industry challenges such as safety, cost, and waste management.

In 2024, the company closed a maxi round of €135 million. The same year, Newcleo relocated its headquarters from London to Paris to strengthen its European partnerships and access a broader range of European funding opportunities.

10. DataSnipper (Netherlands)

10. DataSnipper (Netherlands)

Amount raised in 2024: $100M

DataSnipper is an intelligent auditing and data analysis platform designed to automate and streamline the audit process.

By integrating with existing accounting tools, DataSnipper enhances efficiency and accuracy through advanced features like document extraction, data matching, and real-time reporting. The platform helps audit professionals save time, reduce errors, and focus on higher-value tasks, ultimately improving the quality and speed of audits.

In February, the company raised a $100 million Series B, led by Index Ventures, at a valuation of $1 billion achieving unicorn status.

11. ElevenLabs (UK)

11. ElevenLabs (UK)

Amount raised in 2024: $80M

Eleven Labs is an AI-powered platform specializing in voice synthesis and natural language processing.

The company develops cutting-edge technologies that enable the creation of lifelike, customizable speech for a variety of applications, including voiceovers, customer support, and content creation. By combining advanced machine learning models with a focus on quality and personalization, Eleven Labs aims to revolutionize how businesses and creators interact with audiences through voice.

In January, the company raised an $80 million Series B round, reaching over $1 billion valuation.

12. Huma (UK)

12. Huma (UK)

Amount raised in 2024: $80M

Huma is a digital health company focused on transforming healthcare through data-driven, remote patient monitoring solutions.

By combining wearable technology, AI, and real-time data analytics, Huma enables healthcare providers to monitor patients outside of traditional clinical settings, improving outcomes and reducing costs. Their platform empowers both patients and providers with actionable insights, enhancing personalized care and enabling proactive management of chronic conditions.

In July, the company raised $80 million in series D funding, bringing its funding to over $300 million and reaching a valuation of $1+ billion.

13. blueground (Greece)

13. blueground (Greece)

Amount raised in 2024: $45M

Blueground is a global platform offering fully furnished, flexible rental apartments for business travellers and remote workers.

The company provides stylish, turnkey accommodations in major cities around the world, with flexible lease terms ranging from a few weeks to several months. Blueground's service caters to professionals seeking hassle-free, high-quality living spaces that offer the comfort of home and the convenience of modern amenities, all while ensuring a seamless booking and move-in experience.

The Greek-founded company secured $45 million in Series D funding in March, reaching a bit over $1 billion valuation.

14. Pennylane (France)

14. Pennylane (France)

Amount raised in 2024: €40M

PennyLane is a financial management platform that simplifies accounting and business operations for small and medium-sized enterprises (SMEs).

By integrating accounting, invoicing, and payroll management, PennyLane provides a user-friendly solution that automates financial tasks and offers real-time insights into business performance. The platform empowers business owners and their accountants to make informed decisions, streamline processes, and save time, ultimately improving financial efficiency and control.

In February, the Paris-based fintech startup raised €40 million in a Series C funding round, surpassing a $1 billion valuation and achieving unicorn status.

Would you like to write the first comment?

Login to post comments