In April 2025, the European tech ecosystem saw a significant 42 per cent drop in total capital raised month-over-month, falling to €3.3 billion from €5.7 billion in March.

Despite the sharp decline in funding volume, deal activity increased, with 311 deals recorded in April versus 297 in March, suggesting that while fewer large-scale deals were closed, investor interest remained strong, shifting instead toward a higher number of smaller investments.

A key driver of this trend appears to be a change in sector focus. Whereas March was dominated by large funding rounds in the gaming industry, April saw investor attention pivot toward fintech—an area typically characterised by earlier-stage or mid-sized investments.

Thomas Cuvelier, Partner, US & Europe at RTP Global, commented on the April numbers within the European tech investment landscape in our April Tech.eu Pulse, a compact version of the monthly report:

At RTP Global, we were built to help founders navigate the complexity of an increasingly interlinked global economy - whether you are starting up in the UK, India or the US.

With teams on the ground in New York, Bangalore, Dubai, London, and Paris, we bring a global perspective and operational support for founders building for a single market or thinking globally from day one.

Our network, experience, and footprint enable companies to move faster, access new markets, and scale smarter when the time is right.

European founders must take note. In today’s volatile environment, local excellence matters - but the ability to move across borders, as soon as opportunity strikes, matters even more. At RTP Global, we help founders turn ambition into action.

For his more detailed review and more in-depth analyses of the European tech ecosystem, including industry and country performance, exit activities, and more, check out our April report.

Here are the 10 largest tech deals in Europe from April, accounting for approximately 33 per cent of the month’s total funding.

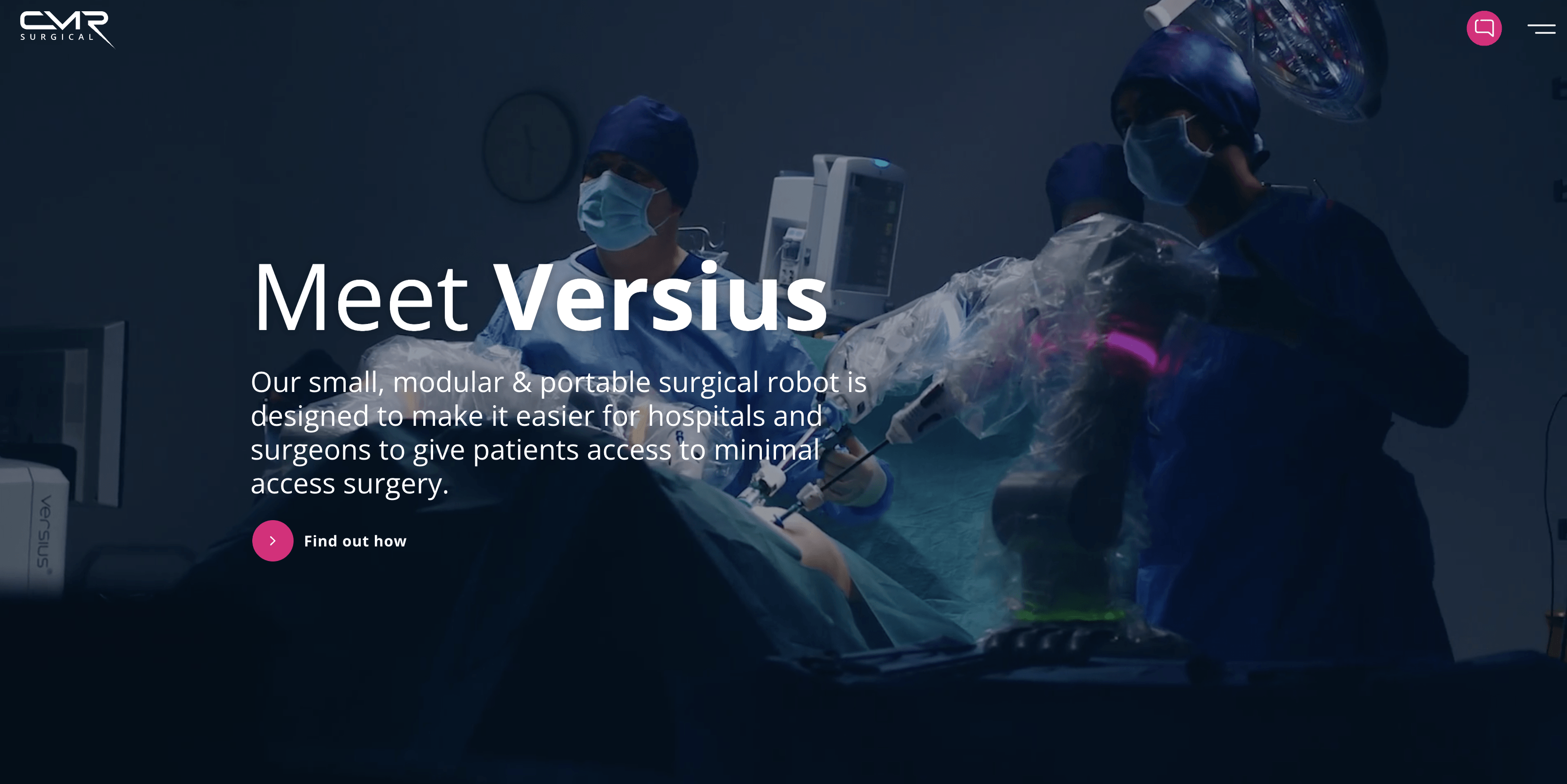

CMR Surgical (UK)

Amount raised: $200M

CMR Surgical is a UK-based medical robotics company transforming surgery with Versius, its next-generation robotic system.

Designed to make minimal access surgery more accessible and affordable, Versius combines precision, flexibility, and data-driven insights to improve patient outcomes and support surgical teams worldwide.

The company raised over $200 million, which will be used to drive global adoption of the Versius system, while advancing innovation with the new Versius Plus.

Zepz (UK)

Amount raised: $165M

Zepz is a global digital payments platform powering inclusive cross-border money transfers through its brands, WorldRemit and Sendwave.

With a mission to create fairer, faster, and more affordable financial services, Zepz serves millions of users worldwide, helping people send money securely and seamlessly across borders.

In their last round, Zepz has secured a new $165 million debt finance package.

Lhyfe (France)

Amount raised: €149M

Lhyfe is a pioneer in the production of green hydrogen from renewable energy sources.

With a focus on sustainability and innovation, Lhyfe develops and operates facilities that supply clean hydrogen for mobility and industry, supporting the global transition to carbon-free energy.

This month, Lhyfe received a €149 million grant for its future green hydrogen production plant.

Enpal (Germany)

Amount raised: €110M

Enpal is a German clean energy company revolutionising solar power by offering solar panel systems, batteries, and EV chargers through affordable rental models.

With a mission to make green energy accessible to everyone, Enpal enables homeowners to switch to solar with zero upfront costs and seamless digital services.

Recently, Enpal secured a €110 million investment.

Cast AI (Lithuania)

Amount raised: $108M

CAST AI is a cloud optimisation platform that automates cost reduction, performance scaling, and security for Kubernetes workloads.

By enabling real-time cost savings and intelligent resource management, CAST AI helps companies maximise cloud efficiency across major providers like AWS, Google Cloud, and Azure.

The company secured a $108 million Series C round to boost R&D efforts and scale operations in key markets, including the US and beyond.

Flowdesk (France)

Amount raised: $102M

Flowdesk is a digital asset trading infrastructure provider that offers market-making and liquidity solutions for cryptocurrency projects.

By combining advanced trading technology with regulatory compliance, Flowdesk empowers Web3 companies to manage and scale their token ecosystems efficiently and transparently.

Flowdesk raised $102 million to fuel its global expansion and meet rising demand for liquidity provision and OTC trading services.

Job&Talent (Spain)

Amount raised: €92M

Job&Talent is a global digital staffing platform that connects workers with temporary job opportunities through its AI-driven technology.

By streamlining hiring, onboarding, and workforce management, Job&Talent helps companies fill roles quickly while offering workers flexible, reliable employment.

The company raised €92 million in Series F to expand its workforce management platform.

Xayn (Germany)

Amount raised: €80.7M

Xayn is a privacy-focused AI company offering secure, on-device search and recommendation solutions.

Combining user-centric design with cutting-edge machine learning, Xayn empowers businesses to deliver personalized digital experiences without compromising data privacy.

Xayn secured €80 million to build Europe’s privacy-first legal AI.

Marshmallow (UK)

Amount raised: £68M

Marshmallow is a UK-based digital insurance provider using technology and data to offer fair, affordable car insurance—especially for people overlooked by traditional insurers.

With a mission to make insurance more inclusive, Marshmallow delivers fast, flexible coverage through an easy-to-use digital platform.

Their recent $68 million round will be used to expand the InsurTech business’s product offerings and advance plans for international growth.

Pennylane (France)

Amount raised: €75M

Pennylane is a French fintech company offering a comprehensive financial management platform designed for small and medium-sized enterprises (SMEs) and accounting firms.

The company provides an integrated solution that combines invoicing, expense tracking, real-time cash flow monitoring, and accounting services into a single platform.

Pennylane secured €75 million in funding, which will be used for European expansion.

Would you like to write the first comment?

Login to post comments