UK payments startup yetipay today announced that it has raised £3.5 million.

yetipay is a London-based payments company providing fast, low-cost terminals and processing for the hospitality, retail, and service sectors. The yetipay platform simplifies payments for businesses, offering reliable tools that make paying quick and simple for customers while also saving businesses time and money, allowing them to focus on their core work.

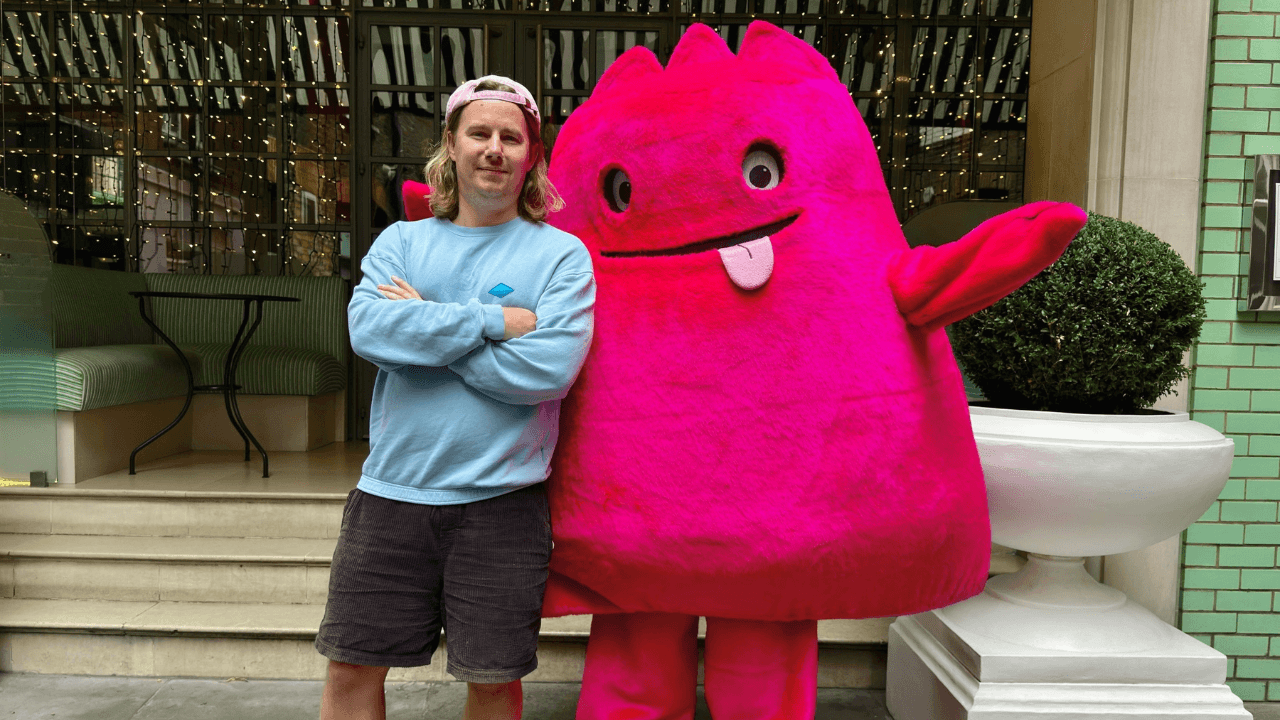

Founded in 2017 by CEO Oliver Pugh, the company has raised over £6 million in funding and operates across the UK, Italy, and Spain, with expansion planned for the US, Australia, and New Zealand.

yetipay has agreed a debt facility up to £1.75 million with re:cap, the Berlin-based fintech behind the Capital Operating System (Capital OS) – becoming the first UK business to benefit from re:cap’s €125M credit facility provided by HSBC Innovation Banking and Avellinia Capital, launched last week.

yetipay has concurrently raised £1.7 million equity from super angel investors. The company’s high-profile angel backers include Paul Statham (Condeco, Thoma Bravo), Mark Blandford (Blandford Family Office), Ben Whitaker (Masabi), Lloyd Amsdon (Watchfinder), Christian Riener (PCP Capital) and Simon Squibb (HelpBnk).

“We focused on raising the minimum amount required and selecting investors that bring valuable deep payments industry experience, combined with innovative non-dilutive funding from re:cap,” said *Oliver Pugh, Founder of yetipay.

“We are in a David vs Goliath battle with our larger competitors, where their massive OPEX commitments present a significant opportunity for our nimble, innovative and customer-centric approach.

We’ve stayed lean, raised capital in a sustainable non-dilutive way, and delivered products that offer real benefits – there’s more to come in 2025.”

“We’re thrilled to back yetipay as our first customer in the UK,” says Christian Luecke, Chief Commercial Officer at re:cap.

“Their ability to generate significant traction with a lean, focused team – while delivering a very sticky product to a clearly defined market – makes them an exceptional partner and an exciting company to work with.”

The funds will be used to continue the expansion of yetipay’s all-in-one payments platform and introduce new products to its growing base of independent and enterprise hospitality and retail customers, including Brewdog, Pho, Grasso Soho, Kütchenhaus and Zenith.

Would you like to write the first comment?

Login to post comments