A new report lays bare the scale of financial exclusion facing people with learning disabilities. It found that more than a third require ongoing support to manage day-to-day spending, while nearly one in three do not even hold a bank account in their own name. Behind these numbers are systemic barriers — from complex sign-up processes and inaccessible digital tools to a lack of personalised support — that leave many excluded and vulnerable.

In response, CI&T has launched Nemo, Art of the Possible – a groundbreaking prototype of a financial app created in collaboration with Project Nemo, a grassroots initiative driving to improve disability inclusion in the Fintech and FS industries.

I spoke to Hannah Darley, Senior Strategy Director at CI&T, to learn more, and gained a wealth of information about how tech companies can embed inclusive practices into their design processes.

The Nemo prototype is devised for adults with learning disabilities to manage finances independently and safely. It not only creates a workable product but offers a wealth of information on how startups can create user-centric tech that epitomises inclusive design.

It was built in only six weeks, with CI&T’s teams engaging with individuals with lived experience to design an app that directly addresses the challenges they face with banking.

Turning inclusive banking challenges into a broad blueprint for action

The app is part of a broader strategy which began with a roundtable at Nationwide to discuss the state of banking for people with learning disabilities. Out of that came four workstreams:

- A major research project funded by Nationwide and carried out by Firefish, examining the banking experience for people with learning disabilities.

- A regulatory review by Fox Williams, looking at current frameworks like the Mental Capacity Act — what’s clear, what isn’t.

- A solutions review, almost like a Dragons’ Den, scanning for existing and emerging tools.

And finally, “The Art of the Possible”, which is where CI&T partnered.

True user-centric design from the get-go

In developing the app, the team deliberately started with a blank sheet. In parallel with the research workstream, it brought in people with lived experience — individuals with learning disabilities and their carers — throughout the process.

This is critical. I’ve previously met a startup who designed smart home tech for the visually impaired who never tested it with their intended audience until it went to market — and yes, it failed. Then there was the company creating autonomous wheelchairs, who had only tested them on research participants without mobility challenges.

According to Darley:

“We had a kickoff workshop with Project Nemo volunteers (many have family members with learning disabilities), industry experts, people with lived experience, and carers. That involvement continued across the project.”

“But, here, people with lived experience were embedded throughout.

What we heard repeatedly was: ‘This is the first time we’re really being heard.’

People said too often decisions are made about them, not with them. That ongoing involvement was hugely valuable.”

Understand the biggest challenges faced by your users

Project Nemo did so many things right. Darley recounts:

"In terms of working with people with learning disabilities and carers compared to other user research, the difference wasn’t in who was in the room, but in how often."

For the team working on Nemo, understanding the specific needs of users with disabilities was critical. These include:

- Opening an account: Documentation requirements can make it difficult.

- Ongoing money management: About a third of people regularly need support.

- Unsafe workarounds: Many share cards or passwords with carers, which is risky.

- Fraud and exploitation: They’re often targeted, or signed up for things in the street that they don’t fully understand.

- Banking apps: Remembering PINs, navigating apps, or handling declined transactions causes stress.

Further, existing “parent-child” financial tools often feel patronising to adults with learning disabilities

Create rapid user-focused design that adapts as you build

While Joanne Dewar, Founder of Project Nemo, had offers from various financial institutions, she didn’t want to be shaped by their technology priorities. Instead, she wanted a neutral partner who could go back to user needs without constraints, and in doing so created a blueprint that any bank or fintech worldwide could take and adapt.

The process started broadly — identifying functional, emotional, and physical needs for a money management app. Then it honed in on one persona: Emily, part of Project Nemo, and her daughter Ellie, who has Down syndrome.

From that, the team built a high-fidelity prototype and a technical proof of concept in just six weeks, showing that 86 per cent of the features could be delivered with existing technology.

In doing so, it created a live, working prototype, shaped by lived experience. It demonstrates how inclusive design can yield practical, scalable solutions that the Finance sector can implement immediately. According to Darley:

“The prototype made it real — proof that if we could do this in six weeks, with 86 per cent of features possible today, then other teams could do even more. It was about showing what’s possible, not just imagining it."

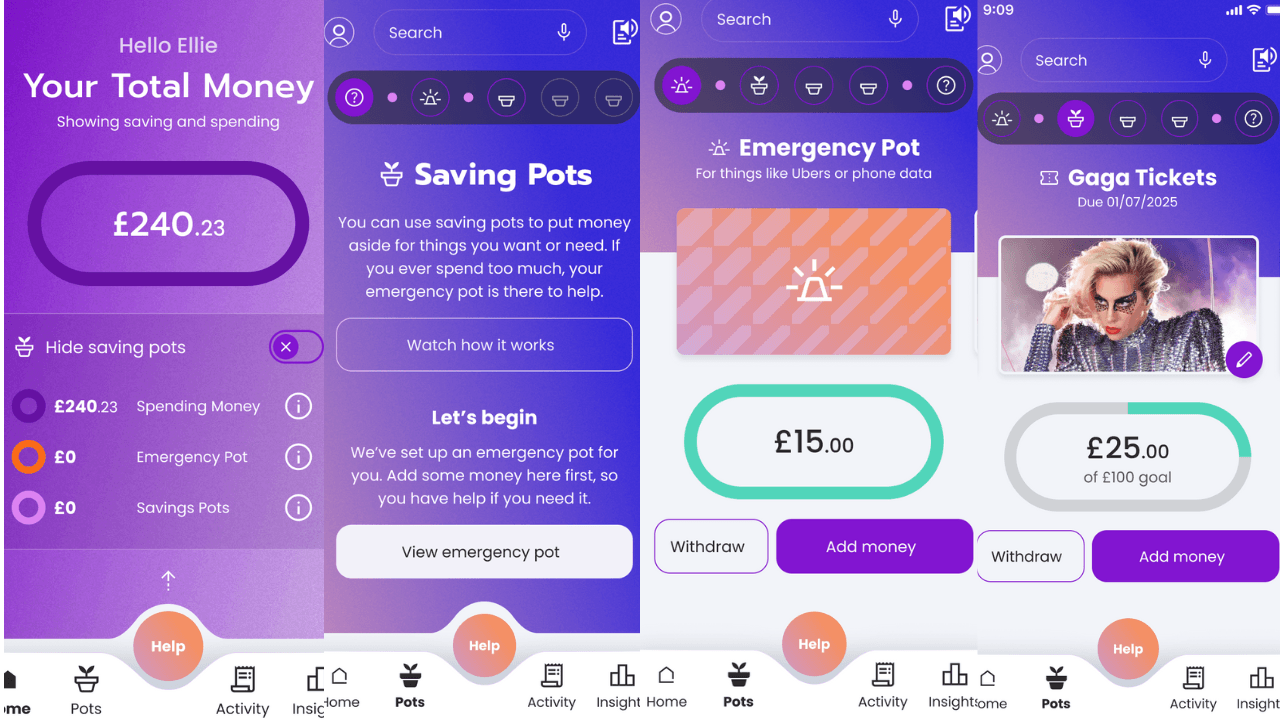

A prototype that redefines financial access

Built with accessibility and ease of use as core principles, Nemo is a highly adaptive, inclusive digital product that empowers users to take control of their financial lives, while still allowing for trusted support where needed.

While primarily designed for adults with learning disabilities, its advanced features and versatile configurability also significantly benefit neurodiverse individuals and anyone seeking greater confidence and support in managing their finances. Nemo’s key features include:

- Two views: The main app belongs to the user. They’re in control. There’s also a supporter view, but supporters can only see or nudge — never control money. Users choose who can see what.

- Onboarding: After asking users about habits like ATM use, accessibility needs, and money management styles, the app then adapts — e.g. dyslexic-friendly mode, dark mode, bottom navigation for mobility needs.

- Personalisation: Icons, layouts, and modes can be customised. According to Darley, “Abilities change over time, and the app adapts.”

- Balanced input: The app aims to capture perspectives from both users and carers. “For example, Ellie might say she can climb ladders, but her mum knows it’s unsafe. That balance shaped features,” shared Darley.

- Calm Mode: For moments of stress (like declined payments). It guides breathing exercises, strips back the interface, and helps users re-engage with money without panicking. Later, features can be reintroduced gradually.

- Representation: Some of the individuals with firsthand experience who collaborated on the prototype’s development included Kris Foster, Co-Founder of Project Nemo and George Webster, a BAFTA-winning actor and presenter known from CBeebies and Mencap who has Down syndrome.

Webster is featured in the prototype and presents in-app video explanations, such as for Terms and Conditions, to make them easier to understand.

Darley shared, “Seeing someone relatable makes information more accessible."

Accessible design isn’t optional: four lessons for startups

Regulations may be nudging companies toward accessibility, but Darley argues startups should go further — embedding lived experience, embracing diversity, and rethinking what “innovation” really means. Her advice for startups looking to implement accessible design:

- Bring users in, and pay them. People with lived experience are consultants, not charity cases.

- Diversity matters. Disabilities affect around 20 per cent of the population — these aren’t “edge cases.”

- Be careful with constant updates. Frequent redesigns disorient users and hurt trust. Darley recounts, “One person was distressed when a bank changed the grocery icon in its app.”

- Question innovation. As one workshop participant said:

“Are you really innovating if you’re leaving people behind?”

Overall, Darley contends:

“For me, the key lessons are: make sure lived experience is always in the room, push for diverse teams, and use AI in ways that help us be more human, not less."

Critically, the app is not only a practical tool, but also a statement of intent. It demonstrates how the financial sector can and should evolve to serve everyone, not just those who fit the standard mould. It also shows that inclusive innovation doesn’t require compromise, only the will to involve those most affected from the start.

This launch represents a pivotal moment in advancing financial accessibility — transforming research into actionable solutions for a community that has been underserved for far too long.

Through this initiative, CI&T and Project Nemo are building pathways to a more equitable financial future, where true independence and inclusion become realities rather than something aspirational.

Would you like to write the first comment?

Login to post comments