Venture capital investment in defence startups is booming but critical funding gaps remain, according to a new report from Dealroom and Resilience Media.

The State of Defence Tech 2025 shows that while Europe is the global leader in VC investment in sectors such as quantum, it lags in space tech, as well as in AI chips and processors, two sectors identified as leading the global investment growth in security and resilience tech in recent years. AI-specialised semiconductors are vital to maintaining supply chain resilience and sovereign compute.

Some of the key findings:

Record-breaking investments

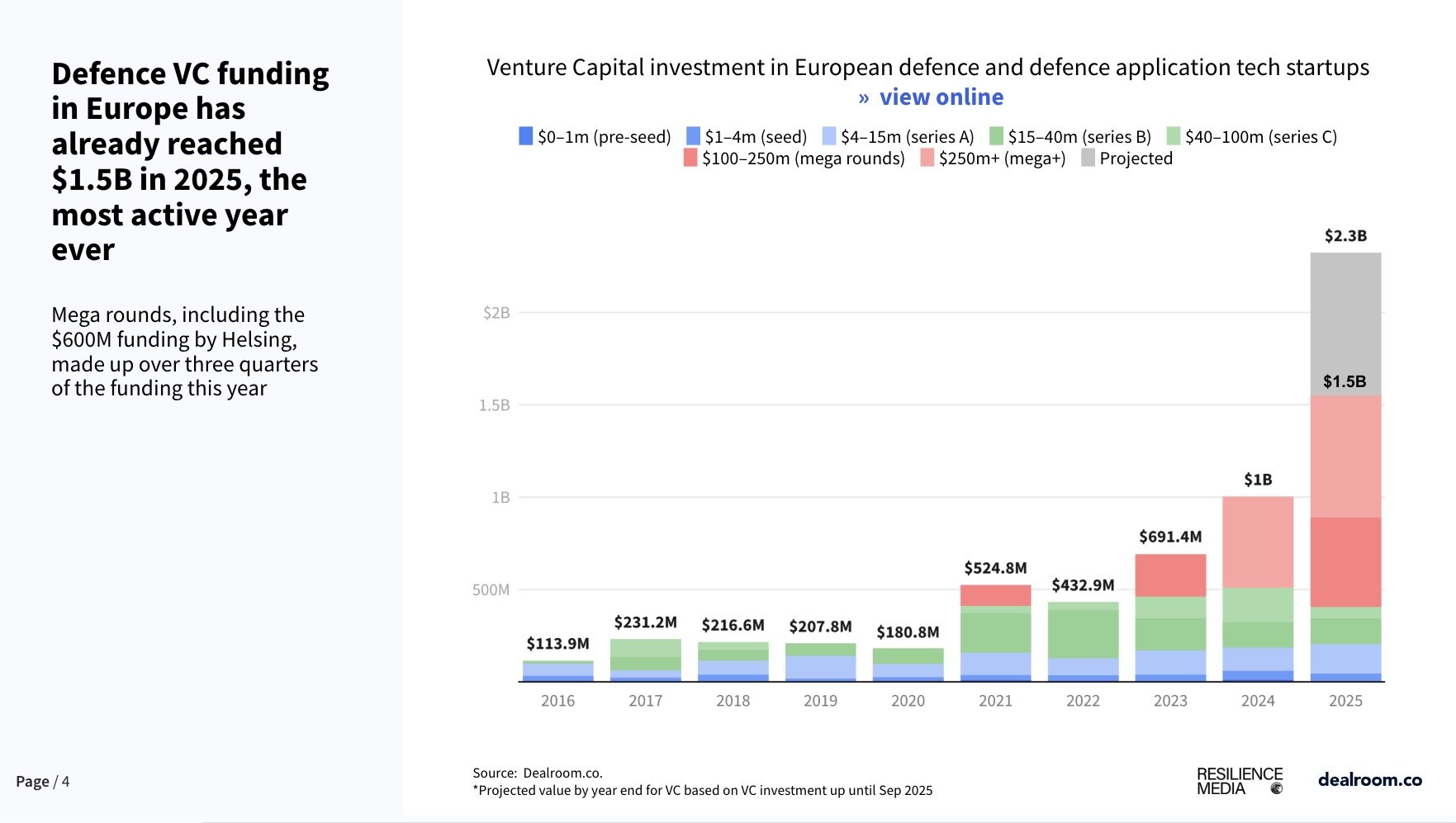

According to the report, venture capital investment in European defence tech has already reached $1.5 billion this year, making it the most active year ever for the sector, with mega rounds, including the €600 million ($698.5 million) funding raised by German defence startup Helsing in June, playing a large part in the rise.

The number of investors drawn to the sector has also increased rapidly in recent years, with the number of unique investors in European defence projected to have risen 4x since 2019 by the end of this year. In addition, the level of VC investment coming from the 27 countries of the EU has risen steadily since 2022, when Russia’s full-scale invasion of Ukraine brought intense investor focus to European and global security.

According to Artem Moroz, Head of Investor Relations at Brave1:

“As of today, the total volume of investment in Ukraine’s defence tech sector has reached at least $60 million, and we expect this figure to grow to $100 million by the end of 2025.”

Over the course of 2025, the average investment round has also tripled — from $300,000 to $1 million. He anticipates that the number and size of such deals will continue to grow in the near future.

“This trend is driven both by rising threats from Russia to EU countries, and by the battlefield-proven performance of Ukrainian products and solutions — which in many cases outperform foreign equivalents.”

Defence tech now accounts for 6.2 per cent of total European VC funding, up from less than 1 per cent before 2020. For context, overall defence expenditure is expected to reach 2.1 per cent of GDP in the EU in 2025 according to the European Defence Agency. This means it will cross the historical 2 per cent NATO target for the first time but still fall short of the new revised 3.5 per cent target.

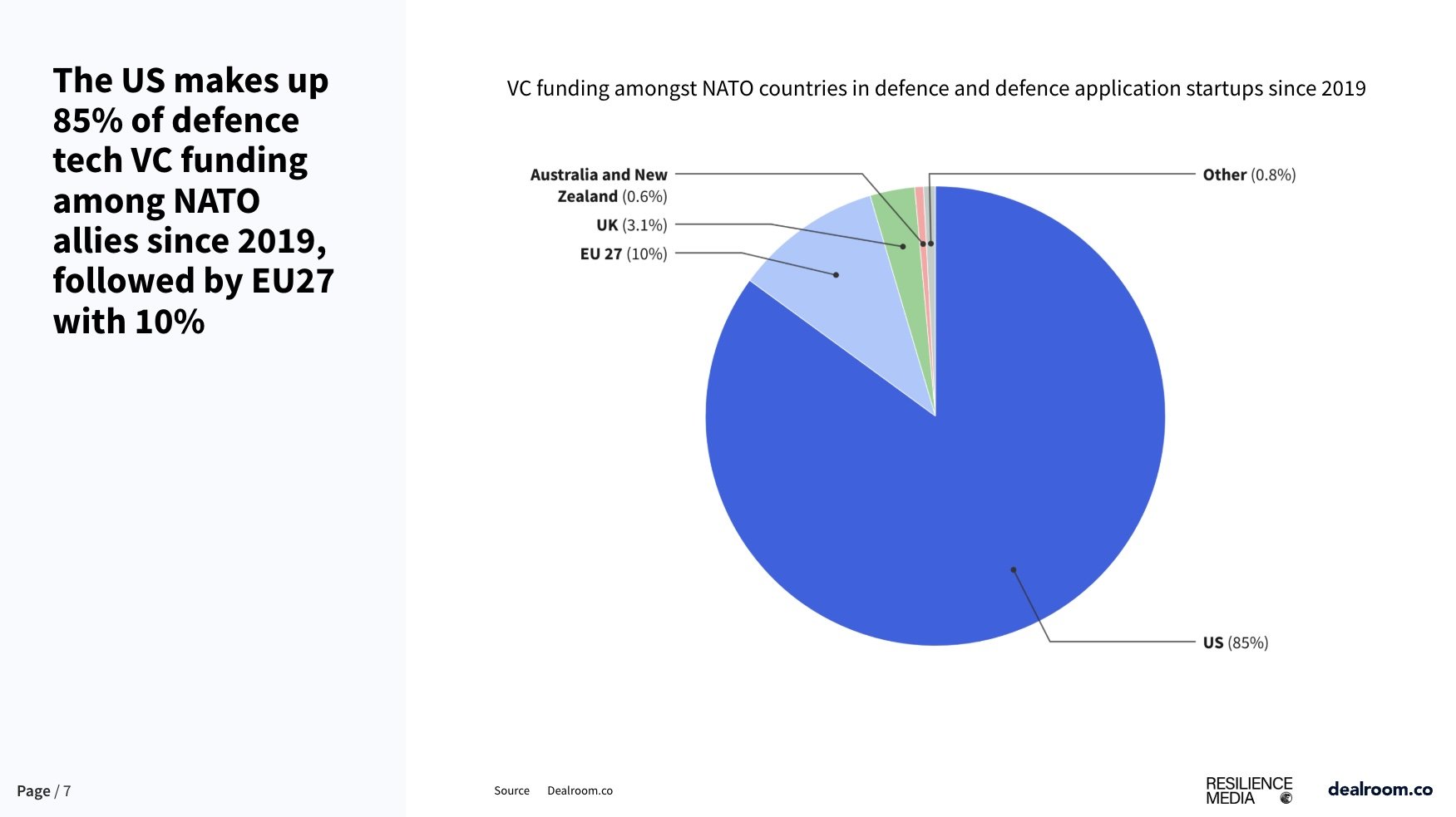

US dominates NATO defencetech investment

Predictably, the US continues to dominate defence VC funding across NATO allies. In 2025, the US contributed 85 per cent of the total VC invested in defence tech. More broadly, funding raised by NATO allies has reached $9.1 billion in 2025, already surpassing the amount raised in the whole of 2024 by more than two billion dollars.

Funding blindspots in space launch vehicles, AI chips and processors a potential vulnerability

Further, the report highlights AI in defence, robotics and autonomous systems as the main areas fuelling growth in defence tech since 2019. Despite this strong performance by the sector as a whole, critical gaps in Europe’s VC investment are identified.

Just 12 per cent of the total VC investment into space launch vehicles globally between 2022 and 2025 came from Europe, while only 6 per cent of the VC funding into AI chips and processors was from the region over this period. This has been identified by governments, including the UK and France, as a potential vulnerability and both have worked with US semiconductor giants to scale up AI infrastructure.

Furthermore, Europe provides only 25 per cent of the funding for drones, in comparison to the 53 per cent coming from the United States. In contrast, Europe provides 88 per cent of VC funding in quantum cryptography.

Europe’s hotspots

According to Khaled Helioui, partner at Plural:

“Space and applications of AI are new frontiers for defence technology that will define our sovereignty, resilience and ability to compete.

The window to act is narrow, and if we do not invest with the ambition and decisiveness that the challenges we are facing require,

Europe will remain dependent on others for the technologies that will shape the future of security and pursue its predicted obsolescence.”

Jan-Hendrik Boelens, founder and CEO, Alpine Eagle, said:

“Europe has the talent, research depth and industrial heritage to lead in the technologies that matter most for security and resilience.

However, leadership does not happen by accident; it requires a long-term commitment to both capital and execution.

Space, AI chips and advanced systems are not just future markets, they are the backbone of sovereignty. If we want Europe to be secure and competitive, we must turn today’s momentum in defence tech into sustained leadership across the entire innovation chain.”

Munich leads growing defencetech clusters

While the data shows growing VC investment in Europe, the figures reflect a handful of outsized raises, most notably Helsing’s $600 million round in Germany, as well as major raises for Multiverse Computing, Quantum Systems, Cambridge Aerospace, STARK and ARX Robotics.

Germany leads Europe both in absolute terms and relative to total VC activity, thanks largely to Helsing, which helps propel Munich to the top spot among European cities.

London and Paris follow behind, with four of the top ten hubs located in the UK - showing the country’s breadth of activity without a single dominant city. But there are also growing defence tech clusters across the rest of the continent, such as Lisbon and Madrid, which are also attracting increasing investment.

Europe’s defencetech has a military backbone

According to the report, 1 in 7 defence tech founders bring experience from the armed forces or Ministry of Defence, with the UK leading the field at 30 founders.

That influence carries through to the boardroom, with over 12 per cent of C-level executives in European defence startups having military or MoD backgrounds, most often as CSIOs and CSOs. Once again, the UK dominates, with 41 such leaders, more than twice as many as France, the next most represented nation.

Tobias Stone, co-founder of Resilience Media, emphasised the need for private capital to flow into defence and security, sharing:

“Investing in defence is unique because it is both a commercial opportunity and a moral imperative in an era where our democracies are directly under threat.”

Investors expect "rapid validation and quick deployment"

Further, according to Svitlana Braslavska, CMO, COO, and Co-founder of Falcons, for defencetech startups, traditional metrics like revenue or market share don’t always reflect readiness.

“Instead, they must prove reliability in battlefield conditions, compliance with NATO standards, and a scalable business model under high-risk wartime environments — often with clear dual-use potential.

Typically, a funding round may take 6–12 months, but for Ukrainian defence startups wartime urgency compresses this timeline, as investors expect both rapid validation and quick deployment.”

The report is launched at the Resilience Conference in London, which brings together key figures from the defence tech sector to focus on the future of the battlefield, autonomy, VC investment in kinetic weapons, post-quantum cryptography, supply chains and manufacturing.

The conference is a unique gathering of leaders from across NATO and Ukraine, representing the military, venture capital, and startup sectors working in defencetech.

Would you like to write the first comment?

Login to post comments