Sometimes the most compelling startup ideas are born from simple, everyday problems that demand a tech-first fix. Take two UK founders who bootstrapped through COVID and are now the global leader in the highly competitive space of luggage storage. UK startup Stasher.

During COVID, they built systems that now onboard hundreds of locations monthly without meetings. They've expanded from 1,000 to over 8,000 locations across more than 1,000 cities and 80 countries, and hit profitability during the summer and 100 per cent YoY growth, while their US competitors (like Bounce, backed by a16z) burn through much more cash. I

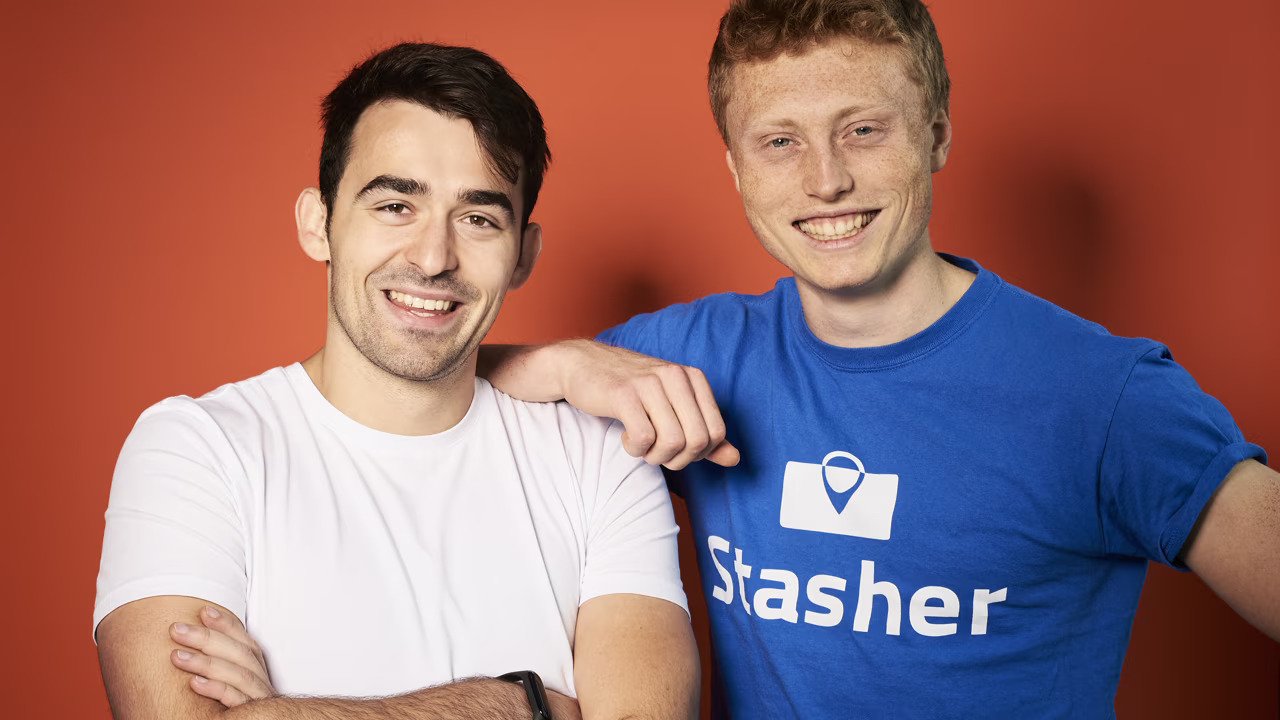

I spoke with founders Jacob Wedderburn-Day and Anthony Collias to learn how they did it, and ultimately how UK founders can still build category leaders without following the Silicon Valley playbook.

From student flat to global platform

The business started when students kept knocking on the co-founder's King's Cross door, asking to store bags for the summer holidays.

According to Collias, after uni, he was living between Euston and King’s Cross, and Wedderburn-Day was still at UCL, which had a startup programme.

They’d both realised they didn’t really want to go into corporate graduate schemes — Wedderburn-Day had done a stint with the government and had a job offer from the Bank of England.

Collias recalled:

“I’d done an investment-banking internship and hated it — long hours, smart people doing boring work. At the time, I was living with my brother, who was at City University.

Between us and our friends, people were always asking, ‘Can I leave my stuff at yours for a couple of weeks?’ You know, getting kicked out of student halls, going travelling, that sort of thing. Jake would often leave his bag with me, too.”

The duo decided to put the idea in the UCL’s Hatchery startup incubator program.

Refining the model: from homes to hotels

The duo took some time refining their idea.

Wedderburn-Day shared:

“At the beginning, it was kind of 'Airbnb for storage.’ You could store your stuff in someone’s house for a day, a week, or a month. But we soon realised that was a bad idea — too much friction for what you could charge.

We also realised everyone was using it as left luggage, not self-storage. They just wanted to leave their bags for a few hours or a day, not months. We didn’t know how to price one day versus one month — they were completely different things.”

So they narrowed it down to same-day storage, and saw it made more sense to work with local businesses.

According to Wedderburn-Day, “they were already open, had spare space, and liked having people come in. “That’s how the business model evolved — from 'store anything anywhere' to a clear left-luggage service run through shops and hotels.”

Scaling through marketing and digital infrastructure

Left-luggage offerings are nothing new - walk through any tourist precinct and you’ll see stores offering left luggage services.

But according to Collias, “a lot of those standalone locker stores — especially in places like Barcelona or Madrid — are becoming oversaturated."

"Ten or twenty years ago, if you opened the first few, you made a killing. But now, in some cities, there are 40 or 50 of them, and the economics don’t add up.

Most of those operators aren’t experts in online marketing, and it’s not worth running ads for just one or two locations."

Stasher has developed a platform that connects travellers with trusted storage spots — including hotels, shops, and lockers — across cities worldwide, allowing them to drop off their luggage for a few hours or several days. One thing they discovered is that 90 per cent of luggage storage is booked on the same day, making it on-demand urban logistics rather than planned infrastructure.

With Stasher, users can easily search, book, and pay online for a convenient storage location for specific dates and times through the website. Once booked, travellers simply “stash” their bags at the chosen location and collect them later.

In addition to short-term storage, Stasher also offers a luggage shipping service, enabling users to send their bags directly to their next destination. Collias contendst:

“We can solve a lot of the problems those small storage shops face. They have the physical presence; we have the digital infrastructure. Combine the two and you get real synergy.”

Further, he asserts that platforms like Slasher have the advantage because we can spread the marketing costs across hundreds of sites. For customers, that means more choice — they can compare all the nearby options instead of relying on chance.”

Winning in a crowded market

Wedderburn-Day shared that to win in a crowded market, “You have to nail three things: product, price, and distribution.”

“Product is tricky because you’re working with fragmented partners — shops, hotels, different setups — but smart lockers are helping with consistency.

We also like hotels because they’re used to handling guests’ belongings professionally. Our pricing strategy aims to be the best-value option.

Lockers have to maximise revenue per square metre, but we can offer lower prices and still profit thanks to scale.”

Data-driven expansion

Stasher is now active in about a thousand towns across cities globally. Early on, it picked places based on search volumes, tourism, and common sense — “like, obviously, downtown New York will have demand.” But another metric is Airbnb density.

According to Wedderburn-Day, numerous short-term rentals result in a large number of bags. With its own data, the team can now base expansion on where people are searching. He shared:

“We get thousands of bookings and tens of thousands of search queries a day, so we can see demand patterns in real time.

If a location has lots of searches but few conversions, we know we need more or better supply there. It gives us a really rich picture of global demand, and helps us grow intelligently rather than guessing.”

In terms of customer acquisition, Stasher’s biggest channels are partnerships and search.

According to Collias, partnerships make perfect sense because travel is time-specific.

“Think Airbnb hosts whose guests need storage before or after check-in. They already have the customers who need us.” Search – a mix of organic and paid — is the other big one. And when people search “luggage storage,”

It’s a location-based query, so Maps is crucial too. In terms of revenue, hosts charge a fixed fee per bag per day. It varies by geography and partnership type, but for most major partners, it’s roughly a 50/50 revenue share. Wedderburn-Day asserts that the economics are solid:

“We’ve been profitable for the last few months. We do have seasonal fluctuations — summer is strong, winter is slower — but the team's global reach means it's always summer somewhere, and overall, the business is safe and cash-flow positive.

The unit economics are very healthy. Growth just depends on how aggressively we choose to reinvest.”

Flywheel style growth

In terms of growth, Wedderburn-Day muses that “People assume you just pour money into ads, but that’s not how it works."

Our growth is more like a flywheel: A bit more demand lets us add more supply; more supply attracts more demand. Hosts generate visibility — more pins on Google Maps, more signage, more reviews — which boosts traffic.

That improves our economics, so we can invest more in marketing. It’s a conventional marketplace loop: demand → supply → demand.

The bigger you get, the better your product and conversion, so you can scale without burning cash.”

From startup to scaleup

Now Stasher is at a turning point — shifting from startup to established company. Collias asserts, “When we talk about raising money now, it’s not about survival; it’s about how we can use capital to grow intelligently. There’s still huge room for expansion.”

Once you know where it makes sense to invest, you can shift from a variable-cost to a fixed-cost model in key areas, which is a powerful way to scale a marketplace sustainably.

Significantly, Stasher achieved its goals with less than £5 million in funding — partly by learning how to do "more with less". The duo cold-emailed their way from there to their first investor (Big Yellow Storage CEO), securing their first game-changing partnership with Premier Inn shortly after.

“Too many founders build to exit”

Ultimately, Collias believes that Europe needs to stop selling itself short.

“Too many founders build to exit. We need bigger swings and the patience to stick around.”

Wedderburn-Day asserts that US companies have easier access to capital and higher valuations, this makes it easier for them to acquire European startups.

“Take Airbnb. One of the teams they acquired in Europe had incredibly capable founders. One of them stayed on as Head of Growth for years.

Clearly, he could’ve built something great independently. But the ecosystem didn’t make it worthwhile to stay independent.”

Collias believes:

“We need to make it make sense for founders to build long-term European champions, not sell early because of the system."

In many ways, Stasher’s journey offers an example to many startups. With £5 million in total funding, the company built a profitable, global business in a fiercely competitive market — not by outspending rivals, but by outthinking them. It’s proof that capital efficiency can outperform capital abundance, and make it possible to turn a simple student idea into a worldwide category leader.

Lead image: Stasher co-founders Anthony Collias and Jacob Wedderburn-Day. Photo: uncredited.

Would you like to write the first comment?

Login to post comments