A new 2025 Globalscape report from Accel, published today, finds that AI models and AI-native applications are driving record funding in 2025, with total investment projected to reach $184 billion, nearly 80 per cent higher year over year.

The report finds that AI is fueling record activity in public and private markets despite geopolitical and macroeconomic uncertainty. It also highlights the rise of a $5 trillion market leader and a concentrated group of large-cap technology firms that together represent roughly half of the Nasdaq Composite Index. Their combined operating cash flow, estimated at about $0.6 trillion in 2024, positions them to keep funding the substantial investments needed to stay competitive in AI.

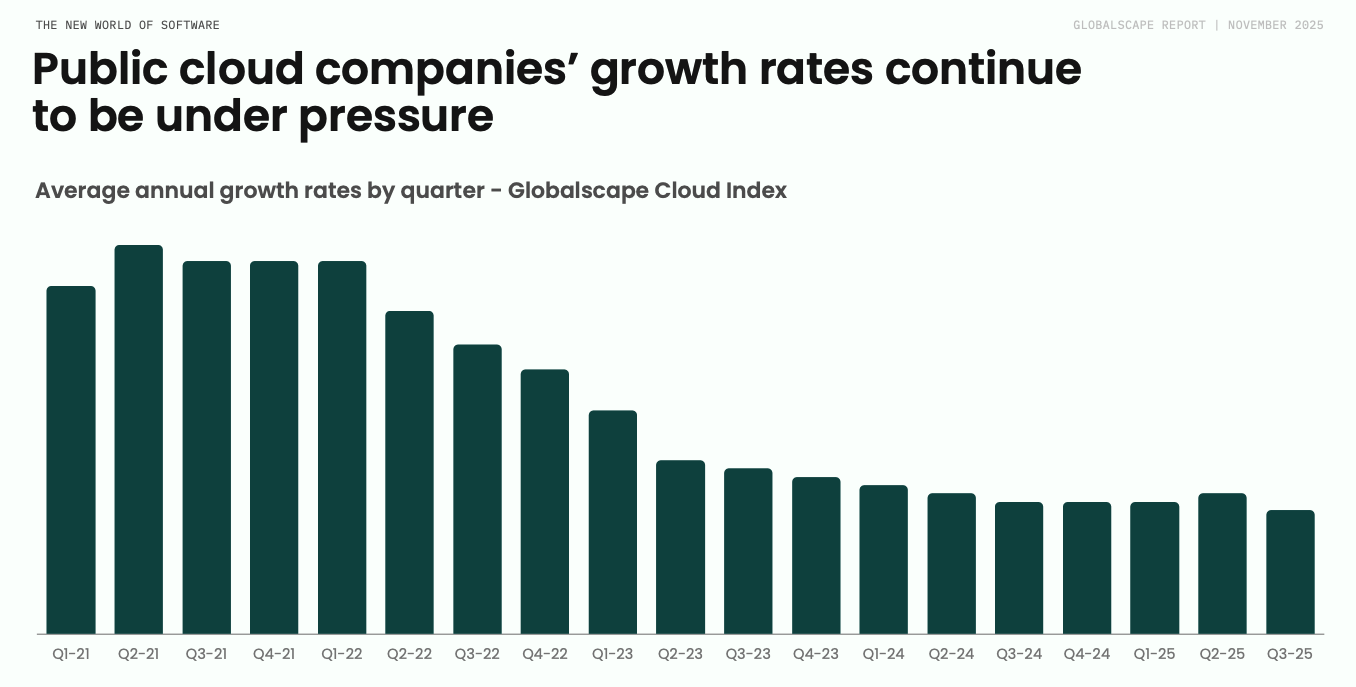

Beyond models and infrastructure, performance among $100+ billion cloud companies is mixed. Several large providers are beginning to see AI-related gains, while others remain more dependent on broader enterprise adoption of agentic automation.

Overall, the outlook for software remains constructive. Accel’s Globalscape Public Cloud Index is up 25 per cent year over year, and the tech IPO market has begun to reopen. As agentic adoption approaches the S-curve inflexion point in the coming years, larger cloud providers may regain momentum by using existing platforms to deploy and orchestrate new agentic workflows, the report says.

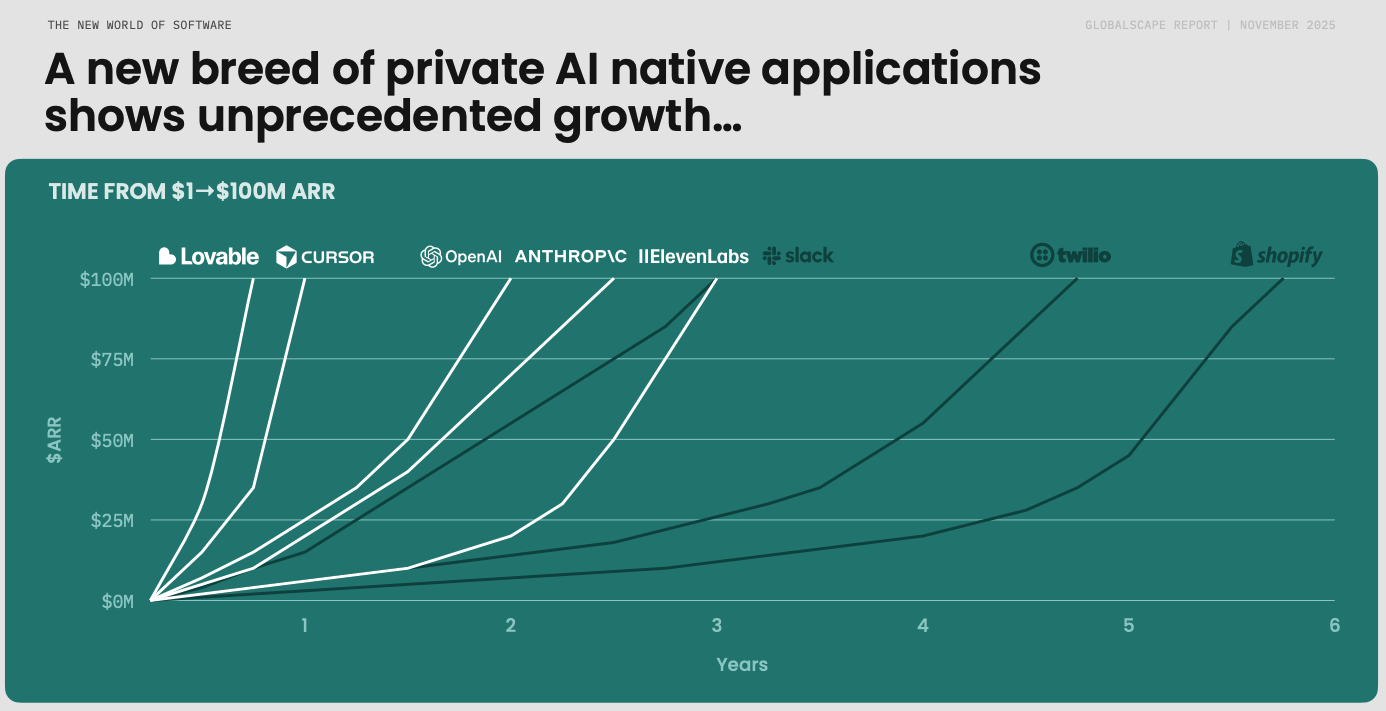

AI-native applications are accelerating investment

As established vendors invest in agentic capabilities, a new cohort of AI-native applications is scaling rapidly. Combined financing for these apps and for AI models is pushing venture investment in cloud and AI across the US, Europe, and Israel to record levels. In 2025, funding in these regions is projected to reach $184 billion (nearly 80 per cent higher than in 2024).

European application companies are raising rounds comparable to US peers, with notable examples including ElevenLabs (London), Helsing (Munich), Lovable (Stockholm), n8n (Berlin), and Synthesia (London).

The race for compute

The rapid expansion of AI-native applications, alongside expected growth in enterprise agentic deployment, is accelerating demand for AI infrastructure. Current estimates indicate that roughly 117 GW of additional AI data-centre capacity will be needed by 2030, comparable to the combined power use of the UK, Italy, and Spain, and could require about $4 trillion in capital expenditures over the next five years.

Commenting on the report, Philippe Botteri, Partner at Accel, said AI is driving a profound global transformation marked by an unprecedented pace of innovation and scale. He added that meeting this shift will require significant investment, around $4 trillion over the next five years, to build accelerated-computing data centres to power the next generation of AI-native applications and agentic workflows.

For more detailed insights and data, the full Accel 2025 Globalscape Report: Race for Compute is available for download here.

Would you like to write the first comment?

Login to post comments