Europe’s quantum tech industry is steadily evolving from a research-led domain into a more commercial ecosystem. Activity spans the full stack, from quantum computing hardware and photonic components to software, algorithms, sensing, security, and test infrastructure, with both specialised deeptech startups and platform-oriented players attracting capital.

In H1 2025, hardware development remained a central focus, including fault-tolerant quantum processors, trapped-ion and CMOS-based architectures, as well as single-photon sources and detectors that underpin quantum communication and networking.

At the same time, quantum-inspired and quantum-native software, sensing technologies, and post-quantum security tools gained momentum, reflecting growing demand for practical, application-driven value.

The following are the ten largest funding rounds in the European quantum tech industry during the first half of 2025.

Multiverse Computing (Spain)

Amount raised in H1 2025: €256M

Multiverse Computing is a company specialising in quantum and quantum-inspired software for solving complex industrial challenges.

Founded in 2019, the company develops platforms such as Singularity and CompactifAI, which apply quantum, tensor-network and advanced AI techniques to optimise processes, enhance forecasting, and accelerate modelling across sectors including finance, energy, manufacturing, mobility, and defence.

Multiverse Computing enables enterprises to unlock high-value insights and performance gains without requiring quantum hardware.

Multiverse Computing has raised €256 million across two funding rounds to speed up the adoption of LLMs by reducing the high costs that currently limit their deployment.

Alice & Bob (France)

Amount raised in H1 2025: €100M

Alice & Bob (A&B) is a deeptech quantum computing company, founded in 2020, with headquarters in Paris and a presence in Boston.

The company is developing a universal, fault-tolerant quantum computer based on its proprietary cat-qubit architecture, a new type of qubit that significantly reduces error rates and hardware requirements for large-scale quantum systems.

Alice & Bob serve both hardware and software markets, offering its quantum technology via cloud services and targeting applications across industries where exponential computing power will drive innovation.

In January, Alice & Bob raised €100 million in a Series B round to accelerate its progress toward building the world’s first practical quantum computer by 2030.

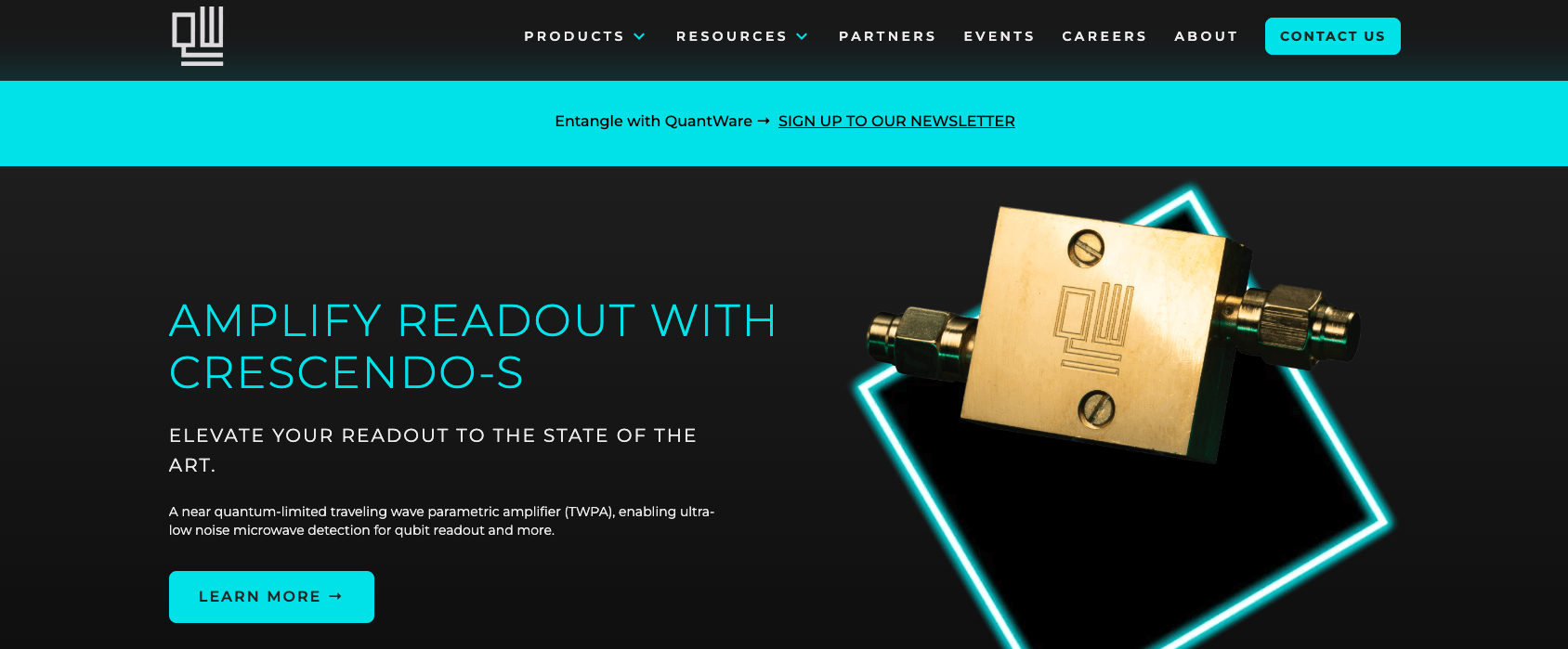

QuantWare (Netherlands)

Amount raised in H1 2025: $27M

QuantWare is a quantum hardware company that designs, develops and manufactures superconducting quantum processors and related components.

Spun out of TU Delft / QuTech and based in Delft, the company offers off-the-shelf and custom quantum processing units and amplifiers, giving labs and system builders affordable access to high-quality quantum chips.

QuantWare’s goal is to “become the Intel of quantum,” enabling scalable, useful quantum computers by making powerful quantum hardware broadly available.

In March, QuantWare secured $27 million Series A (over two rounds, in April and June) to help develop large-scale quantum processors.

Sparrow Quantum (Denmark)

Amount raised in H1 2025: €21.5M

Sparrow Quantum is a deeptech company spun out of Niels Bohr Institute (University of Copenhagen) that specialises in photonic quantum chip technology.

Its core offering is deterministic single-photon sources on silicon, emitting long strings of photons with world-leading purity, indistinguishability and efficiency, aimed at enabling scalable quantum communication, quantum computing and quantum internet infrastructure.

In June, Sparrow Quantum raised €21.5 million in a Series A round to support growth across several key areas.

OrangeQS (Netherlands)

Amount raised in H1 2025: €12M

Orange QS is a company that specialises in automated testing equipment and software for quantum chips.

Founded in 2020 as a spin-off from QuTech, the company offers industrial-scale solutions such as the “OrangeQS MAX” and “OrangeQS FLEX” systems, designed to speed up the testing, benchmarking and qualification of quantum devices with high throughput and lower cost per qubit.

By targeting the critical bottleneck of quantum-chip validation, OrangeQS supports both commercial quantum-chip manufacturers and research labs, helping to bridge the gap between prototype qubit systems and scalable production.

OrangeQS raised €12 million in June in an oversubscribed seed funding round.

zerothird (Austria)

Amount raised in H1 2025: $10M

zerothird (formerly Quantum Industries) is a quantum security company that protects critical infrastructure and enterprise networks with entanglement-based cryptography designed to resist both classical and quantum attacks.

Its product portfolio spans Key-as-a-Service, entanglement-based quantum key distribution systems, and quantum lab equipment, all built on high-efficiency entangled photon sources and detectors.

In March, the company raised $10 million in seed funding.

QT Sense (Netherlands)

Amount raised in H1 2025: €6M

QT Sense is a company that applies quantum sensing using nanodiamond technology to detect free-radical activity inside live cells in real time.

Its platform, Quantum Nuova, delivers sub-cellular resolution insights into oxidative stress, enabling new capabilities in drug discovery, early-stage disease diagnostics and personalised medicine.

In February, QT Sense raised €6 million to further refine its Quantum Nuova product.

ZuriQ (Switzerland)

Amount raised in H1 2025: $4.2M

ZuriQ is a Swiss quantum computing startup developing a scalable 3D trapped-ion architecture designed to overcome the key hardware bottlenecks of today’s quantum systems.

Using micro-fabricated Penning trap arrays and ultra-small trapped-ion qubits that can move and connect freely in three dimensions, ZuriQ aims to deliver high-fidelity, highly connected quantum processors compatible with industrial silicon fabrication, enabling practical applications in areas such as pharmaceuticals, chemistry and logistics.

In January, ZuriQ raised $4.2 million to break quantum computing's scaling barrier.

Pixel Photonics (Germany)

Amount raised in H1 2025: €1M

Pixel Photonics is a start-up that specialises in scalable superconducting nanowire single-photon detectors (SNSPDs) integrated on photonic waveguides.

Their systems deliver ultra-high performance, including broadband operation, high count rates and rapid timing resolution, for applications in quantum computing, secure communications, LiDAR, and advanced imaging.

In February, Pixel Photonics received a €1 million grant from the German Federal Agency for Breakthrough Innovation (SPRIND) to advance the development of its waveguide-integrated superconducting nanowire single-photon detectors (WI-SNSPDs) for multi-mode detection.

QSENSATO (Italy)

Amount raised in H1 2025: €500K

QSensato is developing atomic-photonic chips and integrated vapour cells for next-generation quantum sensors.

Using innovative laser-written vapour cell technology, the company builds compact, ultra-precise devices capable of detecting tiny variations in electric and magnetic fields.

Its solutions target applications in medical diagnostics, lab-on-chip systems, space and defence, environmental monitoring, and other sectors that require robust, high-sensitivity measurement tools.

In May, Qsensato raised €500,000 in pre-seed funding to support R&D on new prototypes, accelerate the commercialisation of its current solutions, and expand its operations across Europe and the United States.

Would you like to write the first comment?

Login to post comments