The European Investment Fund, aka EIF, has just released a super interesting working paper based on the results of its second VC Survey, which asked venture capital general managers about their state of business and market activity, as well as their general perception of the European VC market as a whole.

The EIF has helpfully summarised 10 key findings from the paper, but you might want to download the full (free) report for more detailed reading.

Not that all the responses to the EIF survey were that surprising per se.

I mean, it seems evident that VC interest in hot sectors like AI, digital health, deep tech, fintech, blockchain, cybersecurity and life sciences is going to continue to increase, and that Germany, the UK and France (in that order) are seen as promising for investments.

The three things that actually did stick out for me - and yes, I realise that I'm summarising a summary here - were how young and relatively small European VC firms actually are, and their continued strong appetite for early-stage funding.

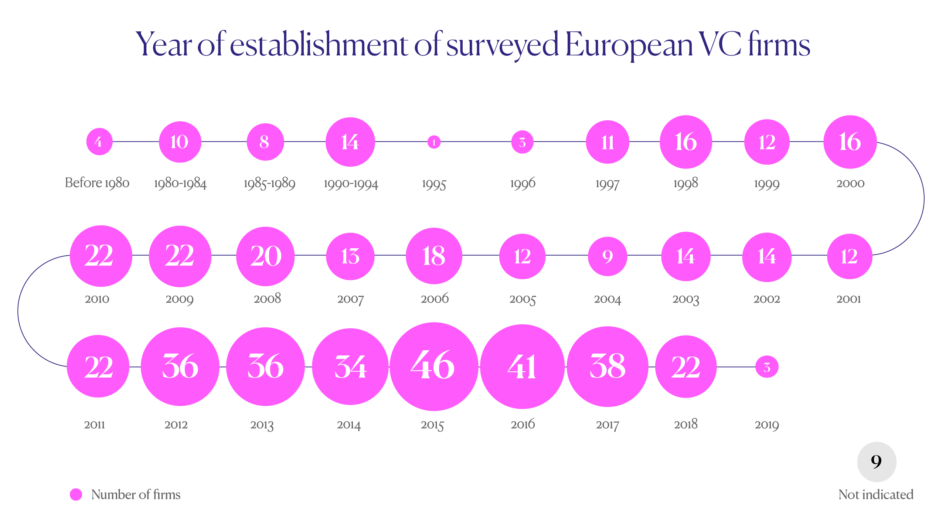

To wit, 60% of the respondents (774 from a total of 538 firms) stated that the investment firm they work for was founded within the last decade.

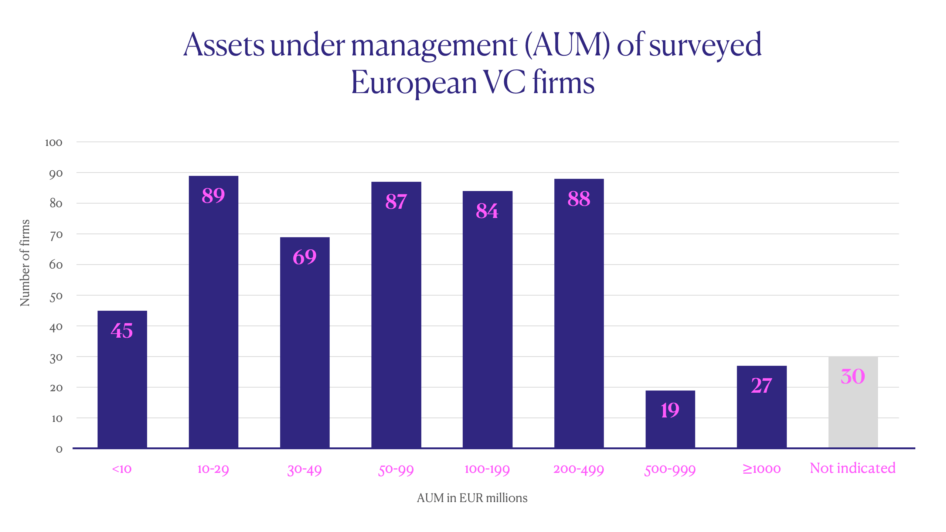

Also well worth a note: more than half of the surveyed VC firms are smaller than €100 million in size. That's an interesting statistic, given that their total value of assets under management exceeds €100 billion.

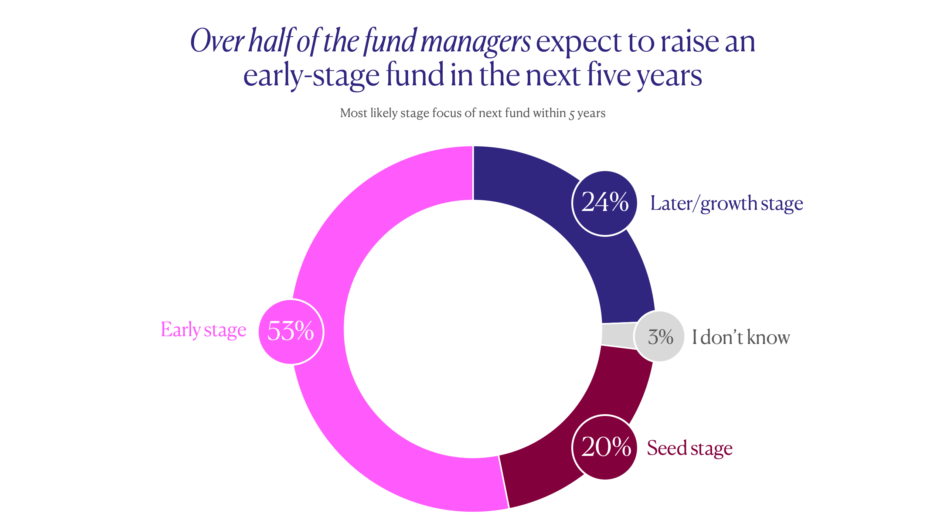

And finally, seed is still hot; over half of the surveyed fund managers expect to raise an early-stage fund in the next five years.

Also read:

Next Station: Europe – How the European tech startup ecosystems are evolving

Would you like to write the first comment?

Login to post comments