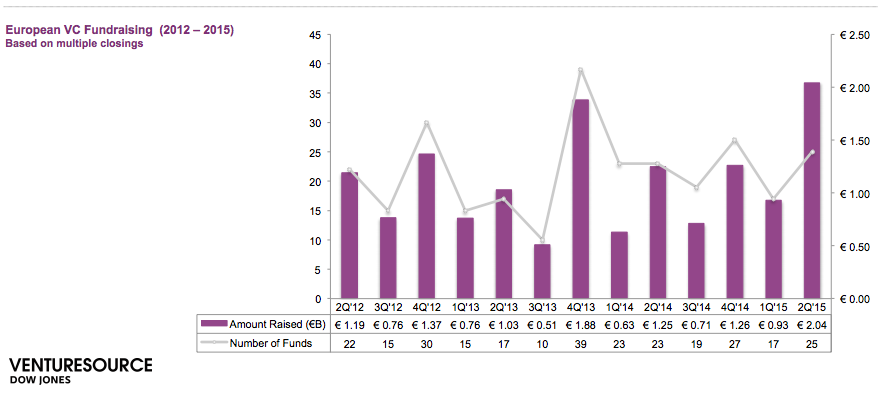

According to data from Dow Jones VentureSource, European VC firms have raised a total of 2 billion euros (approximately $2.2 billion) in the second quarter of this year, which is twice more than in Q1 2015, and up 30% compared to the same period last year.

Largely responsible for the increase is the influx of new venture capital firms setting up shop in Europe (but mostly in London), the Wall Street Journal correctly points out (see links below).

**Update:** now with added graphs:

More interesting reading on this subject:

European private equity investment (including VC) ballooned 14% to €41.5 billion in 2014: EVCA report

These were the 20 biggest funding rounds in European tech in the first half of 2015

Earlybird VC Ciarán O’Leary: “European investors need to up their game.” (video interview)

An interview with Mike Chalfen of Mosaic Ventures, a $140m VC fund with its sightsset on the Nordics

New London VC Felix Capital gets $120m to back ‘digital lifestyle’ startups

Harry Briggs leaves Balderton Capital after 6 years to join a new VC fund launching in September

Would you like to write the first comment?

Login to post comments