London-founded derivative analytics startup OpenGamma has landed a $10 million funding round led by Dawn, with participation from Accel, CME Ventures, and ex-SunGuard CEO Cristóbal Conde.

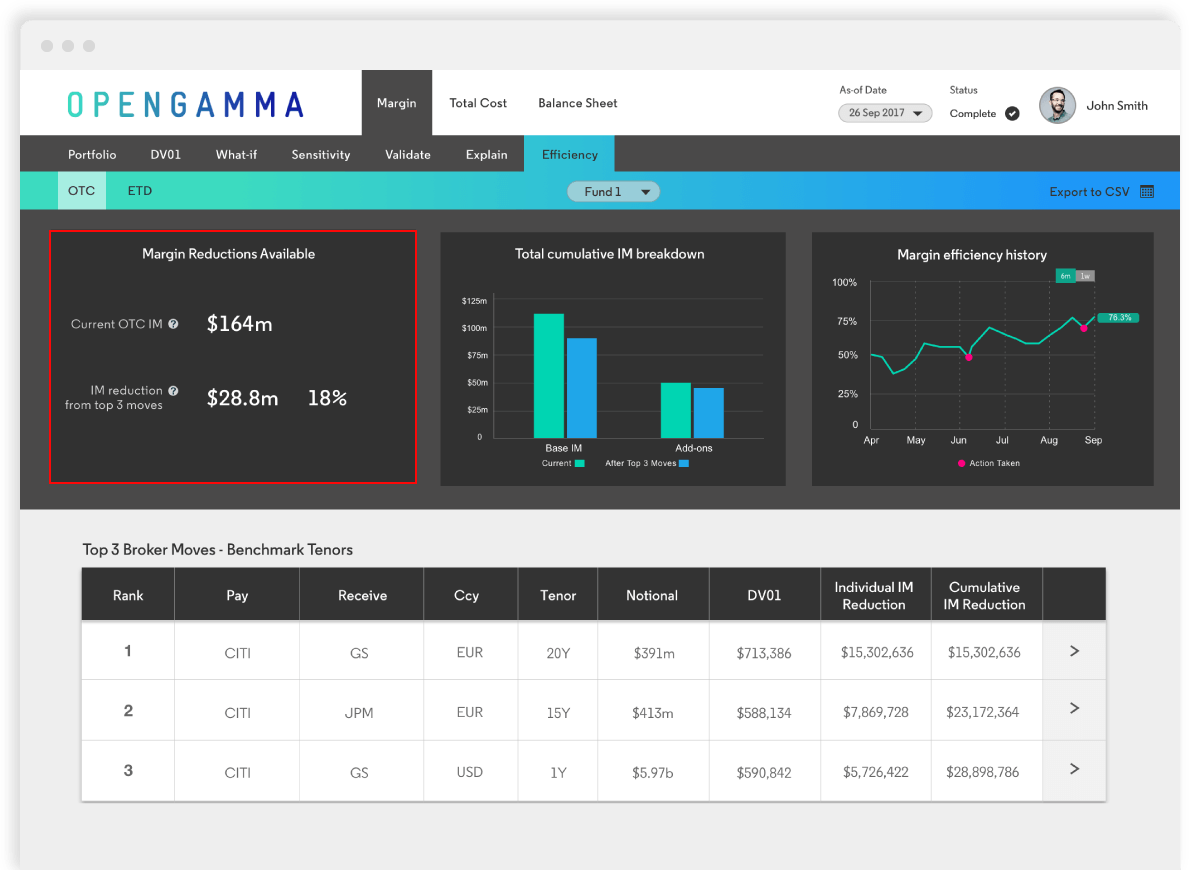

OpenGamma claims that its solution allows “the world’s banks, hedge funds and asset managers to dramatically reduce the cost of trading derivatives.” The startup stated that it's seen a 300 percent increase in recurring revenues over the past 12 months and has doubled the customer base and team.

“Regulation has created new opportunities for firms like OpenGamma,” said Peter Rippon, the startup's CEO. “We work with key market infrastructure providers, including CME Group, Eurex, JSCC as well as top tier banks, to ensure we have access to the models needed to solve a key industry problem: the rising cost of trading derivatives.”

Would you like to write the first comment?

Login to post comments