In a seed round led by Accelerated Digital Ventures (ADV), London-based VertoFX has raised $2.1 million to build tech enabled FX and international payments solutions for businesses in emerging markets. The startup was part of the latest YCombinator cohort (winter 2019).

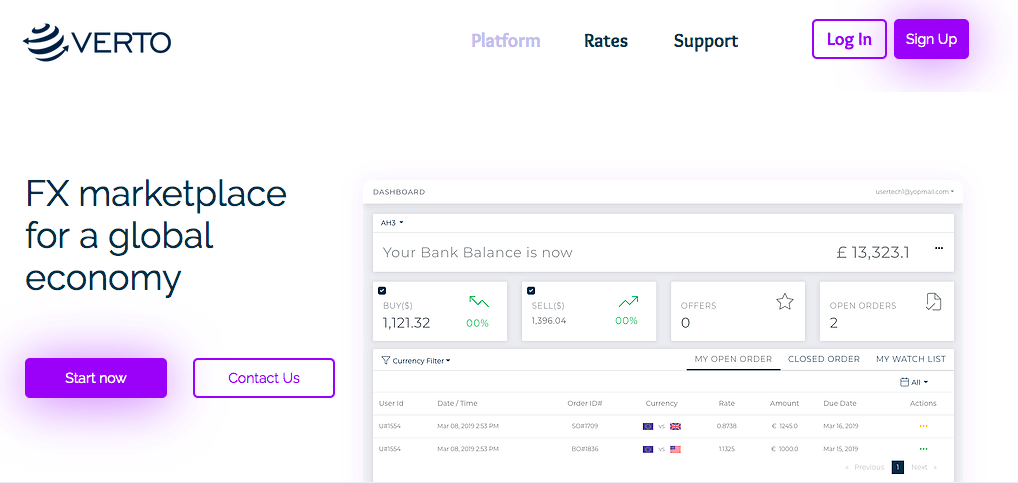

Founded in 2017 by Nigerian-born, British ex-bankers Anthony Oduwole and Ola Oyetayo, VertoFX is a B2B currency exchange marketplace that focuses on emerging markets and their cross-border payments struggles. Since its launch, the company has gained approval from the Financial Conduct Authority (FCA), opened accounts in 19 currencies, and is currently processing millions of dollars in monthly transaction volumes for businesses with a steady month-on-month growth at 20 percent. By utilising a peer-to-peer model where businesses with foreign currency needs are matched with each other via algorithms on a regulated and secure platform, VertoFx claims to enable them to access currencies cheaper, faster and more securely.

The capital from the recent seed round will be used mainly to scale technology and expand VertoFX operations to additional emerging markets followed by an increased number of currencies available on the platform. The company also plans to increase its banking network and partnerships to further enable access to the currently under-served trade corridors.

Would you like to write the first comment?

Login to post comments