Isn't that a million-euro question right there?

To wit, there are also a million ways to try and answer that question, and - spoiler alert - none of them are perfect.

That said, there's lenses one can use to look at the available data and information and extract answers based on certain criteria. And that's exactly what NGP Capital (née Nokia Growth Partners) have done for its latest report, which we're delighted to share with Tech.eu subscribers exclusively.

But burying what you probably came here for is not delightful at all, so here you go; the three best places to start business in Europe are:

1) Israel (yes, not in Europe)

2) United Kingdom (yes, not in the EU)

3) Ireland (yes, a surprise)

So where does the ranking come from? Let's dive in.

Alternatively, you can listen to our latest podcast episode, in which we interviewed NGP Capital partner Bo Ilsoe and the firm's Atte Honkasalo about the main findings of this report:

NGP's Take

The lens used by NGP Capital is that of available venture funding (per capita), and the ability for startups in a given country to raise more follow-on funding as they grow. That is to say the availability of venture capital across stages, and how local companies are able to convert seed rounds into subsequent financing rounds.

And that's where Israel, the UK, Ireland but also countries like Switzerland, Sweden, Finland and Denmark shine, at least for the measured period of time highlighted in the NGP report (which is roughly three full years, starting from Q1 2019).

And sure, Israel isn't technically part of Europe, but we covered it as part of the European tech ecosystem for long enough to understand the reasoning behind including it. For what it's worth, NGP Capital actively invests in Israel and has quality data on the ecosystems there.

Looking at total funding, in absolute terms, the UK's lead is highlighted again in the data analysed for this report. Germany and France follow, above the rest of the pack, but Israel and Sweden are surprisingly close.

The top 10 countries to start a business in Europe, at least from the perspective of VC availability, is rounded out by mostly small countries such as the Netherlands, Denmark and Switzerland. Relative to the size of their economies, Spain, Italy and Turkey display lacklustre performance on this level, dragging the average down.

Finally, NGP Capital also analysed the conversion rates from seed rounds to Series A by analysing companies that raised seed funding in 2019 as a cohort (more than 4,500 companies in total, of which 731 'graduated' to Series A level).

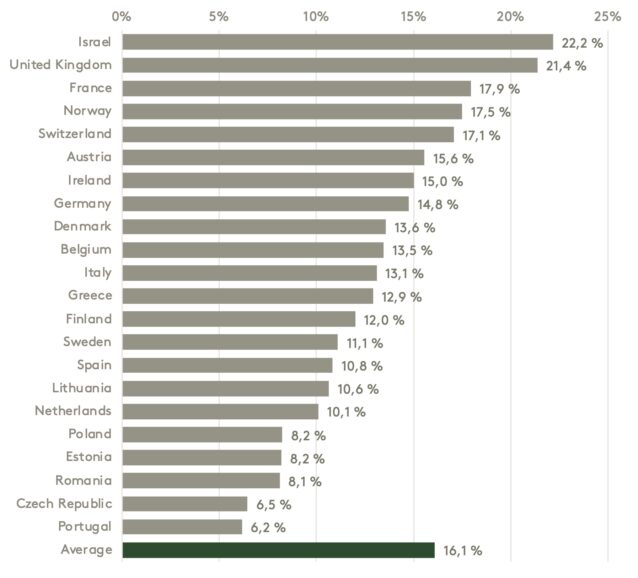

Here, the top 4 countries in terms of seed funding per capita (Israel, Ireland, UK, Switzerland) all perform at or above average in moving companies forward to Series A. French companies seem to convert better than average at 17,9% conversion rate, whereas German ones are behind at 14,8%.

According to the research, Portugal and Czech Republic are the weakest at seed-to-Series A conversion.

And for the money shot, here's the list of the best places in Europe (including Israel and Turkey) to start a business, based on the availability of funding per capita:

You can download the full report here.

Would you like to write the first comment?

Login to post comments